Fact: The Federal Reserve has screwed over the country.

Monetary policy has been the single most important factor in the economy for some time.

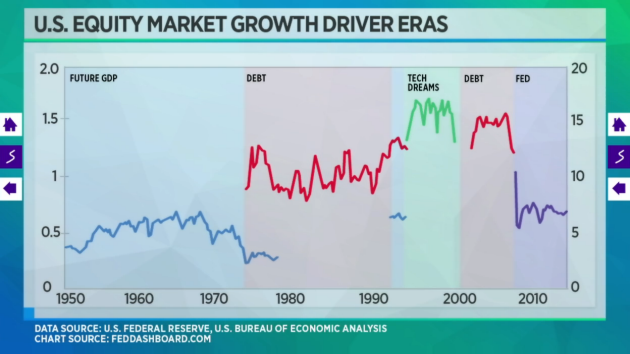

A new analysis from economist Brian Barnier shows that while future GDP, household debt from credit cards and tech accounted for past bubbles in American history, the bubble that has risen since Obama became president is due to one – and only one – factor: the Federal Reserve.

And the private banking cartel – which masquerades as a public government institution – has become plenty controversial for its ties to elite hidden agendas and its debasement of the economy.

However, few Americans realize just how huge – and detrimental – this institution has become.

In the wake of the 2008 financial crisis, the Fed, then chaired by Ben Bernanke, began an unprecedented quantitative easing (QE) program that literally changed everything.

During the last eight years, monetary policy has completely upended the economy, and concentrated wealth into fewer and fewer hands, while making it more and more difficult for ordinary people to stay afloat. This intervention has gone way, way too far and has driven up a particularly unstable bubble that is ready to burst.

Through QE and bond purchases, the Fed managed to double the S&P 500 value, while more than doubling its own balance sheet in the process.

Yahoo! Finance reported:

The factors behind that and previous bubbles can be illuminated using simple visual analysis of a chart.

The S&P 500 (^GSPC) doubled in value from November 2008 to October 2014, coinciding with the Federal Reserve Bank’s “quantitative easing” asset purchasing program. After three rounds of “QE,” where the Fed poured billions of dollars into the bond market monthly, the Fed’s balance sheet went from $2.1 trillion to $4.5 trillion.

This isn’t just a spurious correlation, according to economist Brian Barnier, principal at ValueBridge Advisors and founder of FedDashboard.com. What’s more, he says previous bull runs in the market lasting several years can also be explained by single factors each time.

[…]

As the financial crisis reached a fevered pitch in 2008, the Federal Reserve took to flooding the financial market with dollars by buying up bonds. Simultaneously, interest rates fell dramatically, as bond yields move in the opposite direction of bond prices. Barnier sees the Fed as responsible for over 93% of the market from the start of QE until today. During the first half of 2013, the Fed caused the entire market’s growth, he said.

Barnier, who compiled this data analysis, dubbed this the “Era of the Fed” – as this ill-reputed institution has been more responsible than any other factor (including the 2008 financial crisis) for how bad the economy has gotten for average Americans, college-graduates seeking careers and small businesses.

The above chart is simplified from others before it to show that the Fed was the single most important factor during the last era – overlapping Obama’s presidency – and that a staggering 93% of the economy has been dictated by the Federal Reserve. See the Yahoo! article for more data and charts.

As many analysts have discussed before, this unprecedented intervention has distorted and warped the American experience. Savers, pensioners and investors have all take harsh blows as the interest rate held at zero and even dipped into negative – forcing some customers to pay for deposits and others to take a haircut on their life savings and retirement packages!

Read More:

“Fed Risks Triggering Panic and Turmoil”: World Bank Warns Against Raising Rates

Federal Reserve About To Do “Tremendous Amount of Damage” To U.S. Dollar

Trump Accuses Fed of Not Raising Rates Because Obama “Doesn’t Want a Bubble Burst” Until He Leaves

Ron Paul: Unless the Fed is Stopped, America Will “Soon Experience Major Economic Crisis”

0 Comments