The expression, “gold bug,†has two meanings. In politics, a gold bug is someone who favors the gold standard. The phrase was first used in the election of 1896 to indicate the supporters of William McKinley, who favored the gold standard, as opposed to the supporters of William Jennings Bryan, who favored adding silver to the system to increase the money supply. On July 9, 1896, Bryan gave a famous speech at the Democratic convention in Chicago in which he said:

“You shall not crucify mankind upon a cross of gold.â€

Then he went down to flaming defeat, not once but three times.

In the 1960s, the phrase “gold bug†acquired a meaning in the speculative markets. It referred to a speculator who believed that the price of gold was going up. In this sense, James Dines was “the original gold bug.†As it happened, most gold bugs in the speculative sense were also gold bugs in the political sense, but it is important to distinguish between the two meanings.

Readers of the articles in this web site are gold bugs in the speculative sense; however, we are about to enter a new period in American history where the two meanings become intertwined, and this is extremely important for anyone who wants to understand the financial markets. The decisive event occurred on November 17, 2010 when the Wall Street Journal ran an editorial entitled, “Ron Paul’s Golden Opportunity.†(WSJ, 11-17-10, p. A-19.)

Now you all know what has been going on in the markets over the past few weeks. The Fed has begun another program of the massive printing of money, this one labeled QE2 and estimated to amount to $600 billion (although larger numbers are mentioned). If we consider the (more than) doubling of the U.S. money supply which has occurred between mid-2008 and November 2010, then QE2 will bring the total increase in money up to approximately a triple. And this leads me to expect an increase in consumer prices (from current levels) to approximately triple over the next 3 years. First, commodity prices will rise. Second, producer prices will rise. And finally, consumer prices will rise. The first phase of this has already started.

As we all know, Bernanke’s QE2 has provoked a world-wide protest. Central bank heads and prominent (establishment) economists around the world have condemned it. There has been talk (in the Financial Times) of restoring the role of gold in the world monetary system. Most important, the Wall Street Journal has taken a number of pro-gold positions, the most important of which is the Nov. 17 article, mentioned above.

The economic environment over the coming 3 years will be in turmoil. The rise in prices will create great public dissent. I can remember the rise in prices of 1979 (13.3%) and the public outrage it occasioned. As a result of that outrage, the Democrats were defeated in 1980, and the nation entered (what is called) a conservative era. Unfortunately, the conservative movement, which had based itself on the balanced budget, was betrayed by Ronald Reagan, who instituted massive government deficits, doubled the U.S. money supply and violated his promise to adhere to Milton Friedman’s rule (2%-6% growth in money supply per year).

Now a tripling of the money supply over 3 years computes (when the compounding factor is reversed) to about 40% increase per year. If 13% got people outraged in 1979, then we can surmise what 40% will do. The country will be up in arms, and the chances for Democratic revival, now very slim, will become non-existent. There is even a possibility that the Democratic Party will cease to exist and that the Republicans will split in two (perhaps a Tea Party Republican and an establishment Republican), thus completely changing the political landscape of America.

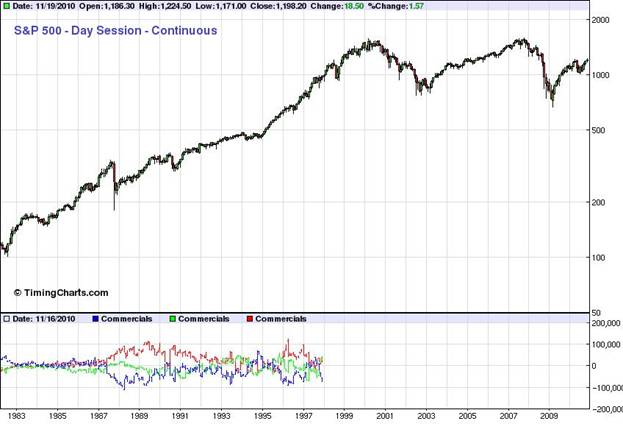

But what does this mean for speculators in the precious metals? Let us take a look at the long term chart of the S&P 500.

Here are the last almost 30 years of the advance in the S&P 500, from 100 to 1500. Note that after 18 years to the upside the S&P 500 has stalled, and there has been a small decline over the past decade (while gold has multiplied by more than a factor of 5). What is this telling us?

It is always important to keep in mind von Mises’ principle that an economic system high on paper money and easy credit is like a person high on drugs. As his body adjusts to the drug, he gets less high from the same dose. To get a bigger high he needs a much bigger dose. That is what is going on with QE2. It is the bigger dose of money and credit which is now necessary to bring increased profits to the paper aristocracy. Can it bring the U.S. stock market to new highs? Perhaps, but it is a fundamentally losing battle. The world is now against Ben Bernanke. He can fight for a limited time, but remember that the entire argument of his side of the debate is that the world is on the verge of an imminant “deflation.†As prices rise by 40% per year, this argument will become laughable. It will be cited in the economic books as the ultimate in human stupidity. Bernanke’s supporters, few now, will become non-existent. They will be seen as being like the people who were still bullish on stocks in early September 1929.

As the movement against Bernanke builds steam, it may take many forms. It is now being suggested that the Fed drop its commitment to reduce unemployment and adopt a single commitment (to reduce “inflationâ€) like the European Central Bank. As a point of information, the U.S. from 1793 to 1933 had 140 years of stable prices (WPI). For much of that time, unemployment was so low that there was no word for it. And the American economy, with no central bank for most of this period, became the greatest, not only in the world but in all human history. Indeed, it was precisely at the time that we abolished the second central bank (1836) that we started to overtake Britain for the economic leadership of the world. Both countries had a basic free economy (undercut in the U.S. by human slavery in the South), but Britain retained her central bank while the U.S. abolished hers, and that was the difference. This shows the wisdom of Thomas Jefferson in making the decision to fight the bank in 1791. Thank you Mr. Jefferson. To you America owes an important part of her greatness.

As Bernanke is forced to tighten credit, it must be kept in mind that commodities are responsive to the money creation power of the Fed while stocks are more responsive to the credit easing/tightening power of the Fed. Therefore, as Bernanke tightens, first stocks will go down, but gold and silver will continue up for some time. A good example of this is 1973-74 when gold continued higher while stocks had a serious bear market. Another example is 1979.

With the Paul family, father and son, putting pressure on the Fed to tighten, the astute speculator will be watching the Fed closely. However, do not make the mistake of anticipating the tightening. The markets are so stupid that they do not discount a Fed tightening (or easing). As a result, you don’t need to guess. You can wait for the Fed to act and still lose very little of the move. As a result, I intend to maintain a bullish position in silver and gold until the facts tell me otherwise. But at some point I expect to switch from a bullish position in the precious metals (which will probably have a blow-off top) to a bearish position on stocks.

Interestingly, stock bear markets are easy to play. Stocks round over slowly and go into a steeper and steeper decline. One simply waits until the pattern is unmistakable and then lays out one’s line. But today hardly anyone has any experience with bear markets. They just hold on tight and wish. They buy and hold for the long pull because they are idiots whose heads are screwed on backwards and who were born in 1982. Well, from 1885 (the earliest that we have real-time records) to 1933, when the U.S. left the gold standard, the DJI was flat (usually moving back and forth between 40 and 100). There is no long term uptrend in stock prices. When the Fed was given the money printing power in 1933, this allowed it to steal from bondholders and give to stockholders. It is this power which puts stocks up. Since most people who buy stocks also buy bonds, the Fed is taking money out of their back pocket and putting it into their front pocket. And they are too stupid to figure this out.

A Fed tightening raises interest rates. Since the earnings yield on stocks is competitive with the interest rate on bonds, this earnings yield must go up, which means that P:E ratios must go down. Woops. This is the explanation for the low P:E ratio on the DJI in 1982.

The Fed tries like the dickens to steal from bondholders and give to stockholders, and this is what gives the appearance of a long term uptrend in stock prices. But since the great majority of stockholders consider it responsible to “balance†their portfolios with bonds, they are simply treading water. They are victims of the paper money illusion, and they think they are getting richer while they are getting poorer. The recent depreciation of the Zimbabwe currency is a case in point. Prices went up by over a trillion times. The unemployment rate rose to 90%. Starvation swept the country, and the expected lifespan fell from 60 years to 40 years over a decade. The system finally collapsed when doctors and nurses quit their jobs (because they were not being paid in money of any value) and a cholera epidemic swept the country. This finally got people mad enough to stop the paper money. If this happens in the U.S., I am sure Bernanke will call it “economic growth.†(Notice the complete blackout on this in the U.S. media. This is because it is information the paper aristocracy does not want you to know.)

So over the next few years the speculative gold bugs have to pay close attention to the political gold bugs and chart their successes and failures. If the political gold bugs can force Bernanke into a tightening, then the whole ball game will change, and at some point a bearish position on stocks may be even better than a bullish position on gold or silver. (In our example above, early 1973 was such a time.)

A word to those who think that it is the job of the Fed or the Government to make the stock market go up. This is a widespread view, and Fed chairmen are rated according to whether the market went up on their watch. As above, during the period when the country was on a gold standard and had real time stock market indexes the market was flat. That is, if a given company made an extra profit, it did so by superior productive achievement. Customers switched over to the successful company and away from its competitor. Thus one stock would go up and the other down. This is why after almost 50 years on a gold standard (1885-1933) stock prices (the DJI and its predecessors) were unchanged. But as soon as we abandoned gold, stocks began an incredible advance. Thus, F.D.R. instituted a policy of robbing from the American working man and giving his wealth to the big corporations; however, the nation’s media lied to the people and told them the exact opposite. The media are still lying, but judging by the results of the Nov. 2 election the people seem to be waking up.

In these exciting markets, one must think quickly and accurately and move with decision. To guide you through these unprecedented markets, I publish the One-handed Economist, a fortnightly newsletter predicting the various financial markets (stock, bond and commodity with special emphasis on gold and silver). You may subscribe by visiting my web site, www.thegoldspeculator.com and pressing the Pay Pal button ($300) or by sending $290 ($10 cash discount) to The One-handed Economist, 614 Nashua St. #122, Milford, N.H. 03055.

Thank you for your interest.

# # #

0 Comments