This article was originally published by Tyler Durden at ZeroHedge.

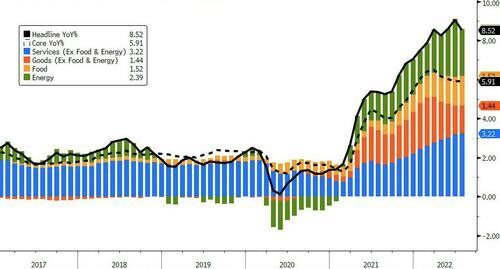

While economists expected another modest rise in inflation on a MoM basis (if far below the 1.3% surge in June), the headline US Consumer Price Inflation was expected to slow from +9.1% YoY to +8.7% YoY in July, but it actually slowed significantly more than expected to +8.5% Yoy (flat MoM), ending a 16-month streak of MoM gains.

Source: Bloomberg

Core CPI (ex food and energy) however was expected to re-accelerate (rising from +5.9% YoY to +6.1% YoY in July), but instead it too continued to decelerate to 5.9% YoY…

Source: Bloomberg

Services inflation continued to rise but Energy and Goods price growth slowed…

Source: Bloomberg

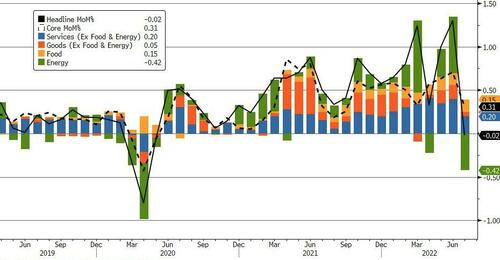

… as energy prices tumbled MoM.

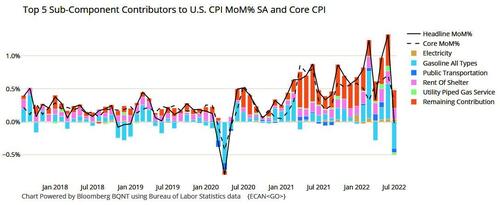

… driven by plunging gasoline prices.

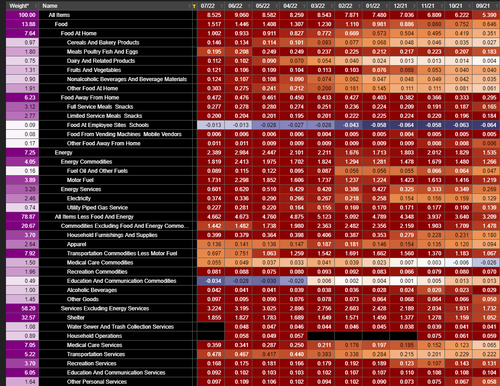

Full breakdown – Fuel Oil (-11%) and Gasoline (-7.7%) were among the biggest drivers:

…but Shelter costs continued to rise (+0.5% MoM)…

The shelter index continued to rise but did post a smaller increase than the prior month, increasing 0.5 percent in July compared to 0.6 percent in June.

The rent index rose 0.7 percent in July and the owners’ equivalent rent index rose 0.6 percent.

The index for lodging away from home continued to decline, falling 2.7 percent in July after a 2.8-percent decrease in June.

The shelter index rose 5.7 percent over the last year, accounting for about 40 percent of the total increase in all items less food and energy.

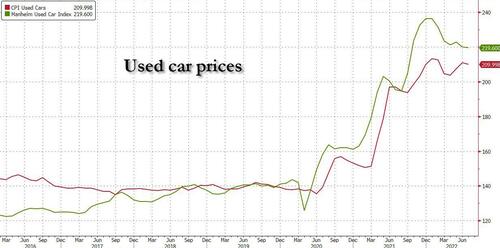

This was partially offset by a modest drop in used car prices.

Finally, and perhaps most importantly, real average weekly earnings continue to plunge, now down 16 straight months as inflation eats away at any wage gains…

Source: Bloomberg

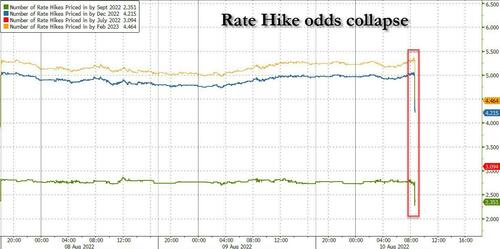

Is this drop in CPI big enough to signal a Fed pivot? One look at rate hike odds shows a collapse in tightening expectations…

… which are playing out broadly across markets, where risk assets are soaring and yields are crashing.

Why the “New World Order” Is Impossible to Implement without Creating Mass Chaos

0 Comments