Actor and soccer superstar Eric Cantona says that we can change the way the entire system works, but we have to bring it down in order to rebuild.

A manufactured collapse, if you will.

Instead of protests and riots in the streets, the solution is much easier, according to Cantona:

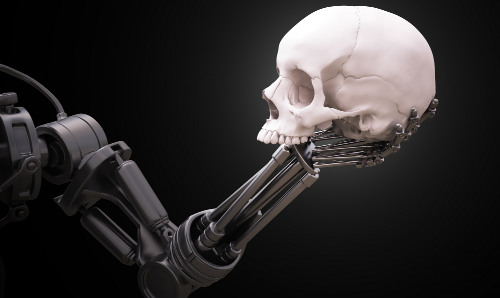

What is the system? The system revolves around the banks. It’s based on the power of the banks. So it must be destroyed starting with the banks.

…

3 million, 10 million people and the banks collapse and there is no real threat, a real revolution. In this case there would be a real revolution. It’s not complicated. Instead of going on the streets and driving kilometers by car, you simply go to the bank in your country and withdraw your money. And if there are a lot of people withdrawing their money, the system collapses. No weapon, no blood or anything like that.

(Video below)

Cantona’s strategy, a concept that is spreading like wildfire across Europe, is one that can be quite effective in bringing down the corrupt banking system of the world. By eliminating the ability for banks to make loans (because they can’t fractionally create fake money out of nothing due to lack of deposits) the entire system comes to a halt. And the dominoes will fall.

It is similar in scope to Max Keiser‘s movement for bringing down JP Morgan Chase and others who try to manipulate the precious metals markets by keeping prices depressed through the use of paper derivatives and other machinations. Keiser’s idea is simple:

All you need to do is buy one silver coin, maybe two silver coins. Demand physical delivery of that silver, thus forcing JP Morgan and these other financial terrorists to have to cover their negative bets and put a company like JP Morgan, basically forcing them into bankruptcy. Because, there is no way they can cover their liabilities if we all buy one silver coin and demand physical delivery.

(Video below)

These are just two ideas – two ways to effect real change in the system. It may not be pretty, because in Cantona’s case the entire banking system would collapse, and likely lead to governmental instability as well. But, the alternative is likely much, much worse.

Of course, if you’re with the mainstream media, you might be opposed to such an idea, like Andrew Clark with The Guardian Observer, who writes:

Cantona’s campaign will probably flop. Let’s hope so, because it’s not very wise. There are plenty of reasons to be angry at the way in which banks are run: they took reckless risks in the run-up to the financial crisis, developed ever more opaque derivatives, and senior executives paid themselves far too much. The people of Ireland went on the march yesterday to protest at an economic crisis sparked, to a large extent, by banks feasting on an unsustainable property binge.

But destroying these institutions in one fell swoop would serve nobody. It’s impossible for everybody to withdraw their savings on the same day, because bank branches and cash machines would quickly run out of cash and close. Even if such a campaign were to succeed, it would simply prompt governments to spend billions more bailing out the banks, forcing them to implement even tighter austerity measures. If they didn’t, then anybody who hadn’t heeded Cantona’s call to withdraw their savings would lose all their money.

Perhaps this would further the cause of anarchy. But it’s not very well thought through. There’s nothing evil about the concept of banks – they exist to look after our savings and to provide investment for businesses. Let’s tame them, not destroy them.

What Mr. Clark doesn’t understand is that these very institutions – the world’s banks, and subsequently the governments funded by them – are leading us down the road of tyranny. No one (well, maybe some) is advocating pure anarchy as Mr. Clark suggests, but rather, a movement towards liberty. Sometimes this gets confused with anarchy, but this would suggest that we eliminate the rule of law, which is simply not the case. The banks cannot be tamed, because they do not fall under the general rule of law that the rest of us do. Thus, the solutions put forth by Keiser, Cantona and others advocate first collapsing those corrupt institutions and then building a new financial system from the ashes – one in which all parties, not just the proles in the streets, are subject to the rules of society.

These ideas may not be perfect, but they may be a much better course of action than bloody revolution, or perhaps worse – global war.

Eric Cantona – Kill The Banks:

Max Keiser – Bring Down JP Morgan:

0 Comments