This article was originally published by Tyler Durden at ZeroHedge.

Hong Kong markets and Chinese stocks listed in the US surged in premarket trading as Chinese government health experts made an unscheduled overnight announcement in which they not only vowed to speed up Covid shots for the elderly but to avoid excessive restrictions, fueling a new round of bets that Beijing is bending to the pressure of an economic reopening.

“The vaccination rate of the first dose of the vaccine for people over 60 years old has exceeded 90%, but it is still necessary to continue to do a good job of full vaccination and to strengthen immunization for people aged 60-79, especially those over 80 years old,” the National Health Commission wrote in a statement. An official told reporters that vaccination is the best way to prevent severe illness and death, and the elderly benefit the most. The low elderly vaccination rate was viewed as a significant roadblock in reopening the economy, like the rest of the world.

The Hang Seng China Enterprises Index soared over 6% because as Bloomberg’s Sofia Horta e Costa put it, we got “plenty of signaling” on the road to reopening, to wit:

- Vaccinations: There was a focus on the vaccination of the elderly. This may seem obvious but it’s one of the major obstacles to China’s reopening. While there was nothing about a vaccine mandate, we heard strong words urging older residents to take responsibility for their own health.

- Virulence: One spokesperson detailed the science showing omicron and its sub-variants aren’t as dangerous. Lowering the population’s fear of the virus is an important step toward a panic-free reopening. There was also a bit of self-congratulatory talk around China’s low death rate — claiming victory over the pandemic also plays into how Beijing will clear the path to move on.

- Inconvenience: Health officials said it was paramount to minimize the impact caused by the Covid outbreak. This is somewhat of a reiteration but to investors, it suggests the government is concerned about the anxiety caused by its pandemic response.

- Excessive measures: The spokespeople said some local governments are taking lockdowns too far, imposing measures without prior approval from the central government. Restrictions should be limited in scale and length, and local authorities must respond quickly to “reasonable” requests from residents. If not they will be named and shamed.

As Horta e Costa put it, “the key to tracking shifts in China’s Covid Zero policy will come from official tone, language and signaling — reading the tea leaves might be a high-risk bet but investors seem happy with what they got today.”

What could come next is further details on China’s reopening plans, but officials fell short of announcing those steps as the economy is stuck in a perpetual state of harsh zero Covid curbs. The pledge to bolster vaccination is seen as a step towards reopening. This all comes after unrest erupted over the weekend across cities from Beijing to Shanghai and Chengdu. People are frustrated with zero Covid policies that have disrupted business activity and slowed economic growth.

“We do not expect China policy to publicly shift away from the Zero Covid stance, however, we could see some easing of the policy privately and in localized areas,” Jefferies analyst Mohit Kumar told clients in a note.

Market sentiment has been whipsawed since Monday’s setbacks when investors dumped Chinese stocks as lockdown protests worsened. Sentiment has done a complete 180 degrees. Kumar said, “markets are in a happy state and are comforted by the expected reduction in the pace of rate hikes from central banks.”

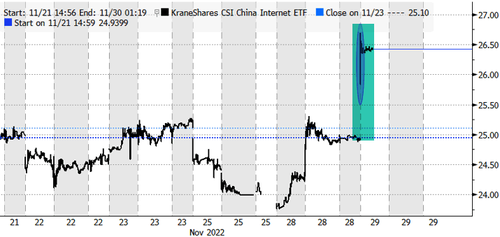

The exchange-traded KraneShares CSI China Internet Fund, which holds about 40 Chinese stocks, jumped 6% in premarket trading.

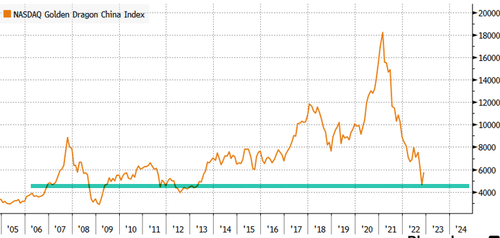

Today’s gains in US-listed Chinese stocks will add to the Nasdaq Golden Dragon China Index’s 23% advance this month, heading for the largest monthly gain on record, even if there is still a long way to go to recover recent losses as chart below shows. The gains started with a social media rumor about Beijing moving towards a zero Covid exit early this month.

Shares in mainland China and Hong Kong rebounded. Hong Kong’s Hang Seng Index closed up 5.24%, and mainland China’s CSI 300 was up 3%.

0 Comments