Editor’s Note: Did you know the Great Depression wasn’t triggered by a U.S. stock market crash? Most of that history has been lost to mainstream talking points over the last 80 years, but in reality, as Martin Armstrong has noted, the catalyst was a collapse in Europe. This information is important as you read the following report from ZeroHedge.com below, because at this very moment China is entering a massive credit crisis and according to Kyle Bass, the man who not only predicted the crash of 2008 but profited handsomely from it, all hell is about to break loose. With China being one of the largest economies in the world, there is a real possibility that the contagion may soon spread to Western markets, which may explain why corporate insiders are unloading their stocks like there’s no tomorrow.

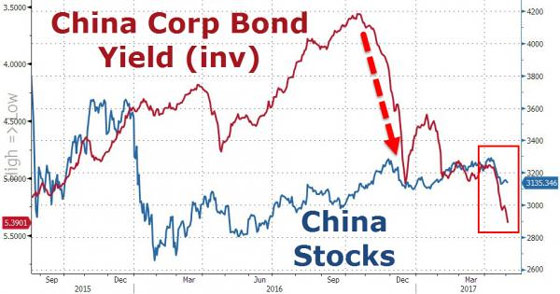

China’s credit system expanded “too recklessly and too quickly,” and “it’s beginning to unravel,” warns Hayman Capital’s Kyle Bass.

Crucially, Bass notes that ballooning assets in Chinese wealth management products are another sign of a looming credit crisis in the nation.

“Some of the longer-term assets aren’t doing very well,” Bass said on Bloomberg TV from the annual Milken Institute Global Conference in Beverly Hills, California. “As soon as liabilities have problems – meaning the depositors decide to not roll their holdings – all hell breaks loose.”

The wealth management products, or WMPs, have swelled to $4 trillion in assets in the last few years, he said., on a $34 trillion banking system…

“think about this – in the US, our asset-liability mismatch at the peak of our subprime greatness was around 2%! … China’s mismatch is more than 10% of the system.”

Must Watch simplification of the next stage of the credit cycle in China…

“Some of the longer-term assets aren’t doing very well,” Bass said on Bloomberg TV from the annual Milken Institute Global Conference in Beverly Hills, California. “As soon as liabilities have problems – meaning the depositors decide to not roll their holdings – all hell breaks loose.”

The wealth management products, or WMPs, have swelled to $4 trillion in assets in the last few years, he said., on a $34 trillion banking system…

“think about this – in the US, our asset-liability mismatch at the peak of our subprime greatness was around 2%! … China’s mismatch is more than 10% of the system.”

Must Watch simplification of the next stage of the credit cycle in China…

Via: Zero Hedge

0 Comments