Just yesterday, a few hours prior to the stock markets coming unhinged, we opined that “uncertainty” would be the critical factor that leads investors around the world to panic as a result of fearing the unknown. Twenty four hours later, we see how quickly we can go from stability to chaos. As you’ve no doubt already seen, global stock markets are getting pounded in what can only be described as a meltdown:

“People are finding it really isn’t gold. It isn’t precious metals. It’s not currencies. U.S. Treasurys are where people are flocking to at a time of extreme concern about risk, and we continue to see Treasurys continue to get bid up,” said Zane Brown, fixed income strategist at Lord Abbett.

Source: CNBC

Back in January of 2010 we put forth a scenario that almost perfectly describes what is happening around the world today as investors unload anything and everything that isn’t nailed down – for the exception of the US dollar:

For traders (not investors) looking to make short term profits, precious metals are just as dangerous as the stock market right now. If you are a long-term precious metals investor, turn off the news and stop watching daily price movement in precious metals, you should be fine when gold does finally decouple from other assets and becomes a safety asset, not because of inflationary fears, but because instability in the public (government) sector.

When this will happen is anybody’s guess, but there should be a floor for gold, because as the price collapses, it will become attractive for large buyers, especially central banks in China, India and Russia. So, there really is no need to run out and sell all your gold bullion to Cash4Gold at 60% less than it is worth. The longer trend for gold is still entact.

The dollar seems to be the beneficiary of recent market mini-panics, as evidenced by corrections in US markets last year, Dubai and now the shift in capital out of Chinese assets.

How can this be, you ask? Isn’t the dollar supposed to be on an unstoppable collapse to a value of exactly zero? Well, yes, it is on a collapse trajectory, but it is important to note that this will not happen in one fell swoop. There are gyrations in the markets, and since the US Dollar remains the world’s reserve currency, regardless of talk from Russia and China, this is where the money will go when everything else is collapsing. We strongly believe that this trend will eventually end and the ultimate safety asset class will become precious metals, but in a paper world, when the SHTF, capital flees to the safest paper around, which ironically, is the US Dollar.

Considering that the US Treasury needs to fund roughly $1.5 Trillion in new debt via Treasury sales in 2010, a global stock market collapse could be the US government’s saving grace

The majority of investors around the world operate in a world of paper assets. They don’t run their own companies, they buy stocks. They don’t store their own food, they buy commodities on the Comex. And they don’t hold real assets of value, they hold paper currencies. Thus, it makes sense that when panic hits financial markets, the only place most investors know to go is into the safety of US dollars, either directly in the form of the currency by selling their equities and commodities, or indirectly by investing in US Treasury funds.

This is what we are seeing today, but as we pointed out back in 2010, confidence will eventually be lost in the US dollar as a safe haven asset as well (that’s already happening, as evidenced by the recent US debt downgrade and rhetoric from China, but during a panic people tend to ignore events that are less than even six weeks old). Right now we’re seeing a lemming mentality, and for all we know, tomorrow will be a record breaking up day in stock markets. But one thing is for sure, if stock markets do meltdown, whether it is now or later, the lemmings will do what everyone else is doing.

First, they’ll get crushed in the stock markets, and then as price inflation on essential goods continues, their purchasing power will be destroyed by currency debasement.

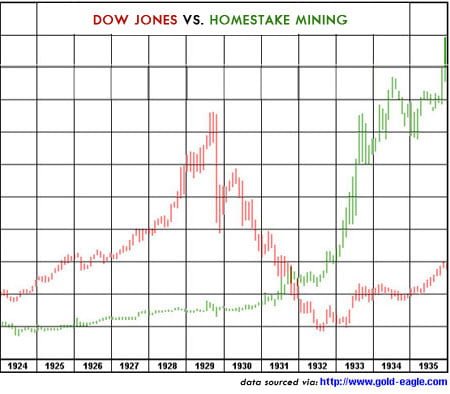

Eventually, some, but not most, will realize that paper in any form will be worthless. This is when the shift into physical precious metals will take hold. It will only take a small percentage of the population to drive this, and we believe it will start with central bank buying of gold in the BRIC and periphery countries, with a floor in the price of gold in the $1200 – $1400 area. Once central banks start buying up gold, we will likely see the long awaited decoupling, where gold separates from the broader stock and commodities indexes, much like at the tail end of 1931 and into 1932:

One item of critical importance that cannot be ignored is that at anytime the wheels could come flying off of the entire system. We really don’t know what is happening behind the scenes,what plans the elites have, and where China and the rest of our creditors stand.

In the midst of these sorts of crashes (if this is turns out to be a crash), it is important to keep your eyes and ears open, because as Troy Grice described in his book Indivisible and James Rawles in Patriots, for all we know the Chinese pulled the plug and we are seeing the beginnings of an all out system collapse. We really wouldn’t know until it was too late. Our view is that because the dollar is still rising and capital continues to flow to it for safety (similar to 2008), we are not seeing a collapse initiated by our creditors (maybe, however, it is coordinated by our own Treasury, Fed and Government-owned banking institutions as a way to fund our debt).

Whatever the case, trillions of dollars of wealth are being wiped right now, so the situation is serious and should not be underestimated.

0 Comments