This article was originally published by Charles Hugh Smith at Of Two Minds Blog.

The lifestyle you ordered in the euphoria will be out of stock in the panic.

Humans running Wetware 1.0 (which is all of us) love to gamble, and we are entranced by the thrill of victory and the agony of defeat. When there’s a market for speculation, these wild swings of emotion manifest as euphoria (I’m winning!) and fear (I’m losing).

Thus the soaring price of goats due to speculation in 1740 B.C. Babylon so vexed Hammurabi that he ordered the execution of those he deemed responsible for profiteering off their clever speculative manipulation.

Speaking of goats, let’s ask a GOAT (greatest of all time) question: what’s the greatest bubble of all time (GBOAT)? The easiest way to measure speculative bubbles is the starting price and the peak price, but that may not do justice to the question. Perhaps the number of people drawn into the speculative frenzy is a better measure of GBOAT: after all, if only a handful of speculators lose their shirts, how that can be the greatest bubble of all time?

To even qualify, a bubble must draw the masses into the euphoria and then slaughter them as mercilessly as Hammurabi massacred the goat profiteers.

Another qualifying factor is the scale of disconnect from reality. Even if you overpaid for a goat in a speculative mania, at least you can still milk the goat and make cheese. But tulips, which drove the remarkably excessive speculative Tulip Mania in 1636 Holland, are not even edible.

At least tulips offer a bit of beauty in a world besmirched by speculative ugliness, but the shares of the South Seas Company that sucked in the best and brightest in 1720 Britain and proceeded to lay waste to their wealth did not even have that saving grace.

Another qualifying factor is the power of the delusion driving the bubble. To qualify as a contender for GBOAT, the mania has to be utterly convincing and persuasive to everyone involved. In other words, it isn’t even speculation to invest all your money in the bubble, it’s simply common sense due to the dead certainty of the proposition fueling the mania.

The 1999-2000 Dot-Com Bubble is a good example of the universality of belief in the obviousness of the gains to be reaped: the Internet was changing the world and would expand for decades, so obviously the companies involved would grow for decades, too, as would their profits (obviously!).

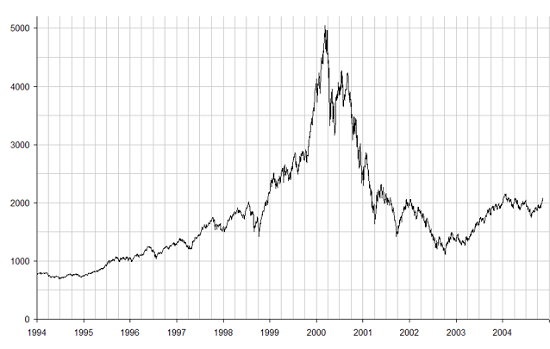

The chart of the dot-com bubble offers a textbook example of how a bubble gathers momentum, spikes to insane heights, falters as the smart money exits but soars to a lower high as true believers buy the dip. Once the buying is exhausted, the bubble collapses back to its starting level.

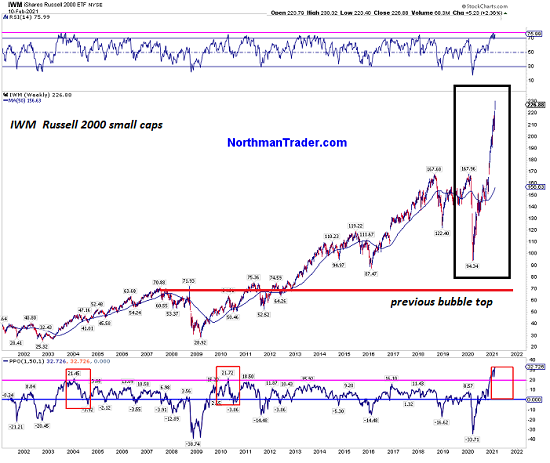

But not all bubbles follow this trajectory. Here is a current chart of IWM, the Russell 2000 index, courtesy of NorthmanTrader.com. (I added the black box and the red line in the center panel to indicate the previous bubble top.) The violence and amplitude of this speculative mania over the past year makes the dot-com bubble appear quaintly staid in comparison.

So let’s make the case that we’re experiencing the greatest bubble of all time in real-time. The magnitude of the price movement is extreme: check. The number of people sucked into the mania is extreme: check. The power of the delusion is extreme: check. (The Fed will print trillions forever, the federal government will borrow and blow trillions forever, the world is about to enter the Roaring 20s, technology is changing the world, etc. etc. etc.) The gains to be reaped are extremely obvious: check.

History leaves no doubt that all speculative bubbles pop, and much sooner and more violently than the euphoric participants believe possible. Before Hammurabi shut down the mania in goats, a rare goat with distinctive markings could be traded for an entire house. After the bubble popped, it was just another goat.

The lifestyle you ordered in the euphoria will be out of stock in the panic. Everyone running Wetware 1.0 is prone to getting caught up in a mania in which a tulip or goat can be traded for a house. But then euphoria flips to fear and after the mania fades and the losses have crushed spirits, hopes, and dreams, a tulip is once again just a tulip and a goat is once again just a goat.

NOTE: I made up the story about the bubble in goats and Hammurabi. That is fiction, not history.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

I posted one comment this morning and was warned I am posting comments to quickly?

A certain someone whom talks to hear themselves speak, is ruining it for everyone else. Moderator, requesting a comment up and down vote so we can somehow make these rants invisible, only available click to view / read more? I’ve heard of disturbing paranoid psychosis but come on…

You know what they say; Price is not the same as value.

Neither is word volume any more meaningful than concerted carefully crafted speech in many scenarios.

Big shot money managers have a myopia to themselves. Without the leveraging of other peoples labor and efforts, there could be no bubble in the first place. Wealth comes from the land, from our families, from our hearts. True wealth can not be counted in hand. It is a dangerous game they play with far reaching consequences, leveraging other peoples monies and labors. Investing is not some benign action with limiting reach, even if it may seem that way to those only counting beans from the bean charts. Investing and promoting leveraging of other peoples efforts is just as potentially dangerous as managing a standing army. There is in fact, an army’s worth of labor behind those pie in the sky numbers. We continue to call foul on the notion that publicly traded companies do anyone any good when all is said and done. Brand loyalty is for the birds.

The upvote/downvote was tried on here a number of years ago. Didn’t work out too well. Certain posters kept logging in to downvote everybody until most posts disappeared.

That was the end of that…

Charles Hugh Smith, thanks for the awesome teachable moment. Many concepts & ideas fail to be conveyed to the masses. I hope many folks enjoy your analysis, and learn the important lessons therein. History can save lots of future pain, or can illustrate what we (humans) are prone to repeat. The goat story & Hammurabi tell the tale, thanks for the enjoyable read.

Yeah, but what is the net effect of such activity on society at large? The stock market is like a golden calf, worshipers idolizing at it’s feet.

Being the winner of the game does not excuse the lack of ethical principals which led to over leveraging, market manipulations, or even the mismanagement or greed which led to a public offering in the first place. People whom love their own companies and appreciate the fact they are providing gainful employment rarely offer them up for investor control. The very act of going public is the act of promoting a caste system, because inevitably the people at the bottom experience diminished human value and reduced gains from their own labors. Imagine if all the human man hours put into ‘the stock markets’ and instruments like them, were instead applied to quality of living considerations. Imagine a persons fruits of labor being their own. We could shed the out of control ultra rich, and get back to a life of liberty where all men have value and adherence to such equitable principals would be woven into society. But I digress, it’s not the past, it’s today. And today it’s more important to count your own wealth than to consider if there was fair distribution to others.

When I hear the word goat, all I can think about is the 360 game, Goat Simulator. It’s super fun, and easy for the whole family to play. My daughter loves the rocket and gun mods. I’m partial to the funny glasses and nutty airborne activites. The only game where the goal is to glitch it out so hard, you have to reset the console. It’s the only way to win.

Mr. Yesterday, I also have misgivings about our stock & commodities markets. I believe they are manipulated for the benefit of the gazillionaires. Where we might disagree relates to the same outcome (compensation) for all as in the communist ideal. Communists sell the idea but it NEVER happens. If we had real MARKET CAPITALISM, those that worked harder and developed the most important capabilities would realize the greatest benefits. I like to ask my liberal friends: “Who would you prefer to do your brain surgery? The BRIGHTEST person that worked the hardest in school & developed the best skills, or the dumbest? Your call.”