This article was contributed by James Davis at Future Money Trends.

I’ve been publishing economic and financial commentary for years and consider TODAY’S LETTER to be one of my top 10 most important alerts EVER.

The coronavirus has made it ABUNDANTLY CLEAR that the federal government in D.C. and the Federal Reserve are never going to allow the U.S. economy to suffer through a dollar deflation event if they can help it.

They will walk over HOT COALS and will BEND every rule in the book in order to put money in the pockets of the SYSTEMATICALLY-important institutions and there’s no greater example of it than the chart below.

America is a DUALITY and two conflicting forces create the drama of the free markets.

On one hand, America’s economy is built on CONSUMPTION. About 70% of its GDP is determined by the average American’s shopping habits.

That’s not what creates job growth, though… the innovation and power of the individual to launch a small business and hire employees does.

More than 50% of S&P 500 companies’ earnings are foreign-sourced.

Therefore, the powers-that-be aren’t about to let corporations run low on liquidity. When they see the bids drying up, they will swoop in like a HUMPBACK WHALE:

Courtesy: Zerohedge.com

When the bond bubble burst into OBLIVION, the Federal Reserve started buying. The following day, all of the short positions disappeared.

Our markets are free, but only to an extent; it’s not PURE CAPITALISM anymore. When your competitor is having a heart attack, the U.S. Government and its tentacles will not let you dance on their hospital bed and capitalize.

“DON’T FIGHT THE FED” is the mantra of the 21st century. More importantly, don’t DARE to fight Washington.

This isn’t to be construed as standing down and bowing to tyranny, but rather refers to the INVESTMENT world. Neel Kashkari, president of the Minneapolis branch of the central bank, told us time and again that they’re not going to err on the side of caution this time.

The U.S. Government is also not HOLDING BACK while entering the most important two-week period of the COVID-19 “stay at home” medical policy. We are looking at stimulus packages of UNPRECEDENTED proportions.

Courtesy: Zerohedge.com

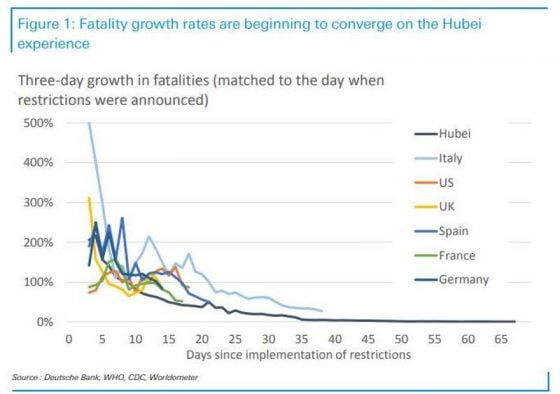

The world’s largest economies are currently successful at DEFEATING both the panic and the curve of new infections, which means that by the end of April, guidelines might begin to relax. This is combined with the hotter weather of spring, which will help stop the infection before the 2nd wave of October re-emerges.

By then, thanks to the work of medical device companies, we will have probably tested most of the population.

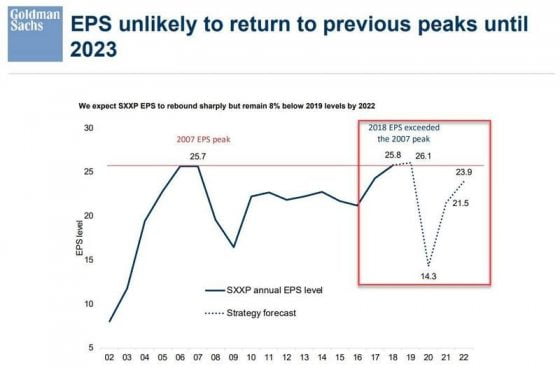

Still, the impact of this sustained period of QUARANTINES is certainly not quick to pass. Therefore, we will have a few years of less than STELLAR earnings, which is always one of the CRUCIAL catalysts of great returns for gold stocks.

Since markets are forward-looking, I give us a maximum of 24 months before the clear trend emerges.

Courtesy: Zerohedge.com

Not until 2023 will earnings per share go back to 2020 levels, and that’s OUR WINDOW of capitalization on gold and on mining, in general.

During this period, we expect roughly $1.8 trillion TO FLOW into gold, which will take its price to an estimated $3,400/ounce, conservatively.

All else being equal, I’m going to invest in best-of-class gold companies, which ought to deliver SPECTACULAR returns, but the 1,000% gainers are the ones that will either make discoveries or meaningfully de-risk their development-stage assets.

Of course, the crown jewels will be the companies that are BOUGHT OUT!

The most important obstacle is to break gold’s previous all-time high in dollars terms. That will spark the MANIA.

0 Comments