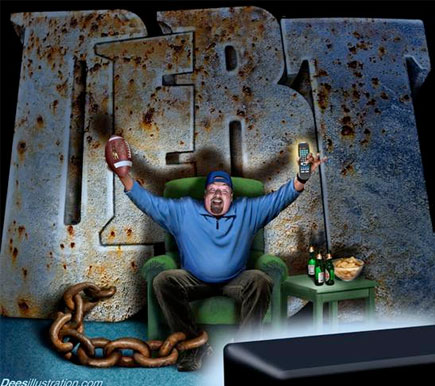

Illustration by David Dees. http://www.deesillustration.com/

Individuals are following in the bloated government’s footsteps. During an “economic boom,” Americans now have a record of $14 trillion in personal debt.

Household debt shot up 0.7% during the third quarter, the New York Federal Reserve said on Wednesday. This is a continuation of a five-year climb in debt, and the “experts” say it’s encouraged by low unemployment, strong consumer confidence, and cheap borrowing costs. However, as we previously reported, consumer confidence is failing while Americans take on the burden of more debt and increase their consumption.

Consumer debt is now a whopping $1.3 trillion higher than the previous peak set in 2008, although these figures are not adjusted for inflation nor the larger size of today’s economy, reported CNN. Household debt has climbed about 25% from the post-recession low of $12.7 trillion.

Mortgages remain the largest chunk of individual debt, but all other forms of debt are on the rise too. Student loans climbed by 1.4% to $1.5 trillion, while credit card balances rose $13 billion during the third quarter.

Federal Reserve Chairman Jerome Powell doesn’t care that Americans are increasingly becoming debt slaves. He did warn on Wednesday that business debt is “historically high,” but has also maintained that he’s not particularly concerned about consumer borrowing.

All of the increases in borrowing, particularly credit cards and mortgages, support consumer spending which the biggest part of the US modern economy. But that massive debt will also become harder to repay during the next recession when unemployment rises.

Americans have short term memories. There will come a point when the American consumer is tapped out, so to speak, and will have no choice but to dramatically cut back their spending or default on these loans. For a nation whose vast majority is living paycheck to paycheck, these statistics do not bode well.

If you are struggling with debt and living paycheck to paycheck, Dave Ramsey’s The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

will help you get on track.

By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

- Design a sure-fire plan for paying off all debt—meaning cars, houses, everything

- Recognize the 10 most dangerous money myths (these will kill you)

- Secure a big, fat nest egg for emergencies and retirement!

*This article contains affiliate links.

0 Comments