“The nature of humans is to reject what is true but unpleasant, and to embrace what is obviously false but comforting.†– H.L. Mencken

Money Addicts. Stimulus packages and bailouts are implemented for one reason: to give a temporary appearance of an economic recovery during a time when the free market has decided that a recession is necessary. Because of our dependence as a society on easy credit and because of our culture of overconsumption and underproduction, most political figures get elected these days on the promise that they will not let us go through the pain of the recession that the free market is trying to enter us into. Promises that the party shall continue despite the hangover sound great to the average voter. After all, what sane person would vote for a politician who told us we had to eat less and work harder? Who wants to go through that kind of withdrawal? Just give us another shot of money now and we’ll deal with the consequences later. But if the real problem in the world economy was that there wasn’t enough money, printing more of it should solve everything. So why hasn’t it worked yet? Perhaps, as Paul Krugman says, $787 billion wasn’t enough. Maybe a cool trillion would have gotten us back on our feet instead? There’s only one way to find out. Print more money and see what happens, right? However, the proponents of the Austrian school of economics say that printing more money at a time like this does two things: it delays the inevitable while making the inevitable much much worse.

Money Addicts. Stimulus packages and bailouts are implemented for one reason: to give a temporary appearance of an economic recovery during a time when the free market has decided that a recession is necessary. Because of our dependence as a society on easy credit and because of our culture of overconsumption and underproduction, most political figures get elected these days on the promise that they will not let us go through the pain of the recession that the free market is trying to enter us into. Promises that the party shall continue despite the hangover sound great to the average voter. After all, what sane person would vote for a politician who told us we had to eat less and work harder? Who wants to go through that kind of withdrawal? Just give us another shot of money now and we’ll deal with the consequences later. But if the real problem in the world economy was that there wasn’t enough money, printing more of it should solve everything. So why hasn’t it worked yet? Perhaps, as Paul Krugman says, $787 billion wasn’t enough. Maybe a cool trillion would have gotten us back on our feet instead? There’s only one way to find out. Print more money and see what happens, right? However, the proponents of the Austrian school of economics say that printing more money at a time like this does two things: it delays the inevitable while making the inevitable much much worse.

“I’ve been drunk enough times to know that you can postpone a hangover by continuing to drink. But if you keep drinking eventually you will collapse.†– Marc Faber

New Proposed Bailouts. Despite the first round of bailouts,Fannie Mae and Freddie Mac have gotten delisted from the NYSE and are still losing a lot of money. Fannie has now asked for an additional $8 billion and Freddie has asked for an additional $10 billion. Also the PBGC (Pensions Benefit Guaranty Corporation) currently has legislation on the table to potentially receive a $165 billion bailout in order to guarantee union pensions in the future.

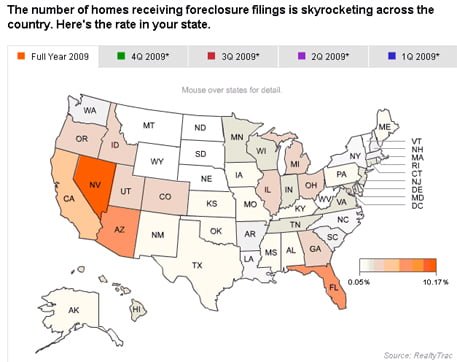

Will it Stop There? No. Back in January of 2010 Governor Schwarzenegger asked the federal government for a $6.9 billion bailout for the state of California. If they get that money the 3 other states with the highest foreclosure rates ( Arizona, Nevada and Florida) as well as many other states may soon follow suit. If one state gets a bailout every state in trouble is likely to want their piece of the stimulus pie. And as you can see below, there are a lot of states in trouble.

President Obama is now pushing for another $50 billion to help state and local governments sustain their payrolls for policemen, firefighters and teachers. This bill is expected to meet opposition by members of Congress due to what they call “spending fatigueâ€. However, I believe it will eventually be passed because of the possibility for outright revolt. The average citizen simply will not stand for big corporations getting bailed out while the government sits back and lets policemen, firefighters, and teachers lose their jobs left and right (not to say I am for the stimulus, but this is what I believe will happen).

Also, it is not on the table yet, but the FDIC for sure will be getting a bailout very soon. Lord knows how big that is going to have to be. To read more about the troubled FDIC go to my April 2010 report at https://www.shtfplan.com/schaef/schaef-report-all-tsunamis-contain-more-than-one-wave-april-2010_04282010 .

Why the First Round of Bailouts Didn’t Work

Elizabeth Warren, Chair of the Congressional Oversight Panel, discusses the success (or lack thereof) of the highly touted Troubled Asset Relief Program (TARP) which was implemented in late 2008 to supposedly not only help large entities, but small businesses as well by providing much needed capital infusions to relieve large banks of the burden of the troubled assets on their books so they can resume lending again. In her May 2010 report, she says “Let’s remember. Congress said explicitly that TARP should create jobs and promote growth. So a focus on small businesses makes sense. After all, 99% of all American businesses are small businesses, and together they employ about half of the private workforce and they create about 2 out of every 3 new jobs. America cannot have an economic recovery without small businesses.†She goes on to say that Wall Street banks, after receiving their bailout money, were never directly told they had to lend to small businesses, so, of course, they didn’t. In fact they cut back on overall lending by around 4%, but on small business in particular they cut back on lending by 9% since receiving the TARP money.

What did the big banks do with all that money if they didn’t lend it? They paid bonuses, invested in real estate and in the stock market and other things to turn a profit and stay afloat. All these things were good for the companies which received the money, but the “trickle down†effect that the government said it was hoping for clearly has not happened. Is it fair to say that the Wall Street banks don’t care about economic recovery nearly as much as they do about turning a profit? Perhaps, but the real question is, what fool would have thought otherwise? I mean, despite all the talk of socialism being on the horizon we are still a capitalistic society. The real problem with TARP is the federal government’s sheer incompetence and lack of foresight that has made the program a huge waste of taxpayer money. TARP should really be renamed to TOWP (the Transfer Of Wealth Program), because instead of creating an economic recovery all it really did was force tax payers to help big banks turn a profit that they otherwise would not have made in a recession.

“Bailouts, buyouts, resÂcue plans, stimulus packages… by whatever name, it was the greatest heist in AmeriÂcan history.†– Gerald Celente.

How will the 2 nd Round of Bailouts be Different? In some ways they won’t be different. Fannie and Freddie could very likely receive money again with no strings attached and so might state and local governments. In other ways, however, the new bailouts could be much different. The Congressional Oversight Panel has made it clear that the big banks are not cooperating in helping out small businesses get the credit TARP was designed to provide. Either the big banks will get more money with strings attached this time (with direct orders to loosen their lending standards so that the money really does go to small businesses), or Wall Street could be circumvented altogether and the money could go directly to small businesses through the small banks that typically lend to them (this program would be called the “Small Business Lending Fundâ€). A 3 rd option would be another round of Bush-style stimulus checks sent directly to citizens. Each option has different consequences for the economy as a whole because of where the money will go and the velocity at which it goes there.

Inevitable Consequences of More Economic Stimulus

I’ve talked about this many times before, but using different illustrations sometimes helps our understanding of concepts. It doesn’t take a genius to guess what is about to happen to the water level in the picture above. As you can see, our friend jumping into the water here represents stimulus money. Once he goes into the economy price levels simply have to rise. There is no other possible outcome. The only way prices wouldn’t rise is if the pool got larger on impact (that is, if the economy automatically expanded at the same time so as to completely absorb the stimulus). That would mean that production would have to increase simultaneously with the timing of the stimulus in order for prices to stay stable. However, if there was no increase in productive capacity and stimulus was simply added, you would just have more money chasing the same amount of goods and services. This is exactly what will happen. More money means higher bids. Higher bids mean higher prices. And the government doesn’t mind that happening at all.

Why Governments Love Inflation

Inflation is not something that people want, but make no mistake – the government needs it to happen. Why? Because inflation results in all kinds of things that the government can point to in order to tell us that our economy is improving when it really isn’t. In an inflationary environment, home prices go up, the stock market goes up, people eventually make more money through cost-of-living wage increases, etc. These are all things that help politicians get re-elected. But most importantly, when inflation happens it is easier for the government to pay off its debt. Think about this on a personal level for yourself. A $350,000 mortgage is hard to pay off when you are only making $40k a year, but after massive inflation happens, and wages increase, your income has now gone up while your debt has stayed the same. Therefore, your debt burden has been relieved because your payments are easier to make. Unfortunately, this takes time to play out, however, and wage increases typically lag behind the real rate of inflation.

Hence, the real problem with high inflation is that prices tend to rise much quicker than wages do. Unfortunately, this has the greatest effect on the poorest pockets of society because they have no savings to fall back on. Therefore, once again, what is in the best interest of the government is in direct contradiction with what is in best interest of the people.

How Likely is it that the Government Can Control Inflation? The government’s addiction to inflation has made it a necessary evil for them. While they believe they need a certain level of it, they also realize that too much inflation causes chaos in the economy. One thing is for sure, all this “deflation†that has been happening is not to be tolerated so they feel they must do something. The normal (or should I say “publicly acceptableâ€) rate of inflation has been roughly 3-6% per year. So until we get a healthy 3-6% rise in the Consumer Price Index ( CPI) per year, the government will continue to print money and keep interest rates at zero. But, once again, here we have the government trying to manipulate something that is very difficult to control – an entire economy! Right now our economy can be compared to a car careening off the road in an ice storm, so how likely is it that those who are behind the wheel will be able to steer it back without over-compensating? If the previous interventions of the federal reserve serve as any indication of their ability to avoid unintended consequences, we are clearly in for a major catastrophe.

Some, like Marc Faber, say hyperinflation in the US is inevitable. Others say that high, 1970s-like inflation (15-20% per year) is coming. Either way, it’s most likely going to be pretty bad.

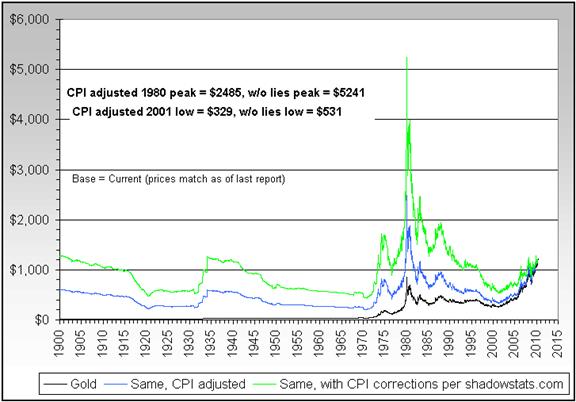

Lessons From the Past. If we can’t control what the government is doing then at the very least we can control how their actions will affect us. In order to preserve your wealth (and possibly even profit from what is about to happen), you just have to look at what precious metals did in the 1970s. The chart below has been adjusted for inflation according to the CPI (which is essentially a bogus government inflation statistic) in the blue line. When you adjust for true inflation ( the green line), gold should peak out at $5,000 an ounce at the very least once inflation kicks into high gear again:

To preserve your wealth, by gold and silver and hold them. If precious metals go down, know that it is just a short term correction and use that correction to accumulate more. Gold and silver will become a bubble one day, but as you can see in the chart above, they are not even close to that yet.

Bye for now,

Schaef

The Schaef Report is an independent newsletter contributed to SHTFplan.com by Mr. A Schaef. You can receive the Schaef Report in your inbox. It’s Free! Subscribe below by providing your name and email address and you’ll be automatically added to the monthly distribution list. The Schaef Report and SHTFplan.com take your privacy very seriously and will not distribute or share your email address with other parties.

Error: Contact form not found.

References:

http://www.marketoracle.co.uk/images/2010/Apr/gold-14_image004.jpg

http://www.washingtonpost.com/wp-dyn/content/article/2010/06/12/AR2010061204152.html

0 Comments