Schaef Report

Issue: November 2009

“All human situations have their inconveniences. We feel those of the present but neither see nor feel those of the future; and hence we often make troublesome changes without amendment, and frequently for the worse. “ Benjamin Franklin

I love that quote by Mr. Franklin. He was wise beyond his years. He and the other founding fathers knew that putting a band aid on a problem that required open heart surgery was eventually going to make things worse in the future. So why can’t our current government recognize that? I’m not sure why, but what I do know is that we have painted ourselves into an economic corner as of late. A prefect example is what the Federal Reserve has done with rates since the bursting of the dot com bubble in 2000.

The Fed Playing God with Our Money

The Federal Reserve’s tendency to meddle in the market can be compared to the late Michael Jackson’s infatuation with his own face. Once you start to play God by tweaking things here and there you become disillusioned and think if Ijust keep changing it I can eventually make it perfect – all the while not realizing that what you are really doing is self-mutilation. Our economy has now been so disfigured by the Federal Reserve that our own founding fathers wouldn’t recognize this country anymore than Michael Jackson’s father would recognize him if he had not seen him since he was a young man.

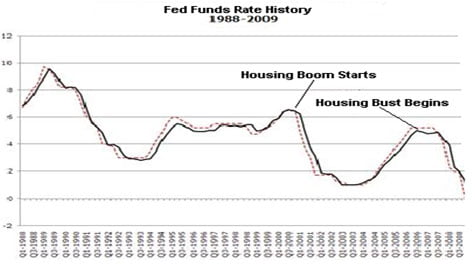

Economic Self-mutilation. In reaction to the dot com crash in early 2000, then Federal Reserve Chairman Alan Greenspan lowered the fed funds rate from 6.5% to 1.0% between the months of January 2001 and June 2003. This was done in an effort to “stimulate the economy†(or, in other words, reinflate the stock market bubble instead of letting a natural correction occur). Interest rates had not been that low since 1958. They felt this measure would “encourage spending, borrowing and investingâ€. That it did, but not just in the stock market. A combination of low interest rates and relaxed lending standards resulted in the infamous housing bubble that we are now all too familiar with. So what did the Fed do in reaction to a bubble forming in housing? In 2004 they started to aggressively raise rates. In their ignorance they thought this move would get housing “back to the normal growth rate again†of a modest 5-10% gains per year. But the damage was already done with regards to over-speculation, and when the Fed decided to raise rates investors stopped buying and decided it was time to get out. Result: CRASH!

The Rate Trap. Now that the Fed has decided it is time to lower rates again (since their last idea didn’t turn out the way they’d hoped) short term rates have essentially gone to zero. That means that the Federal Reserve is lending money to banks basically FOR FREE. The idea being that if banks are having a hard time making money through lending, the Fed figures if they lend to banks with no interest at all, any interest the banks get in return will be 100% profit. Meanwhile the Fed is deathly afraid of raising rates again because they don’t want to crash another sector of the economy. Who knows what the next sector will be to crash if they raise rates (credit cards? auto loans?), so they want to leave them at zero. But when fear keeps you from raising rates and you can’t make them any lower than zero, you are stuck in a rate trap. So, is that such a bad thing? Yes, unless you don’t mind making the dollar worthless by giving it away for free. But the Fed sees that as a necessary evil if it means that the stock market goes up, because they would love to brag about how everyone’s 401(k)s are back where they used to be.

Forced Speculation . Its one thing for the stock market to go up because of investor confidence, but it’s a completely different thing for it to go up because the Fed has forced the public to speculate on stocks. How are they doing this? Well, where else can one put his/her money right now besides the stock market? With rates so low, banks don’t even pay 1% on savings accounts. It was just a matter of time before the public realized that they cannot stay on top of inflation by keeping their cash on the sidelines in a money market account. Slowly but surely people are realizing they have no choice but to get back into the market. I believe that this manipulation from the Fed is entirely responsible for the bull run we have seen since March of this year. And, of course, the recent news of ‘ DOW 10,000’ sparks all kind of speculation that we are “on the road to recoveryâ€. However, what say we examine our definition of recovery for a minute, shall we?

DOW 10,000 – The Road to Recovery?

For those of us who hold stocks one thing is for sure; ‘ DOW 10,000’ is better than ‘ DOW 7,000’. Therefore, the general consensus is that we are on our way back to happy days again. But before we come to that conclusion a few important questions to ask are:Will we keep moving in that direction? At what point have we fully “recovered� And (perhaps most importantly) recovered from where? Recovery is a hard thing to determine, as it depends on one’s perspective. The American stock market was at a 12 year low in the first week of March 2009, and every week since then the market has been higher than that so this may be considered a “recovery†by some people. Also, some people think we are recovering now simply because stocks aren’t falling off a cliff anymore. But the DOW still isn’t as high as it was in Q3 of 2007. If we hit those highs again, we have surely recovered, right? As Lee Corso would say, “Not so fast my friend!†We’ll get to that in a minute, though. Lets stick to today’s news. As the DOW hits 10,000 again it is a very important benchmark for many economists to come out and say “We have finally turned the corner†But how big of an economic achievement is this really?

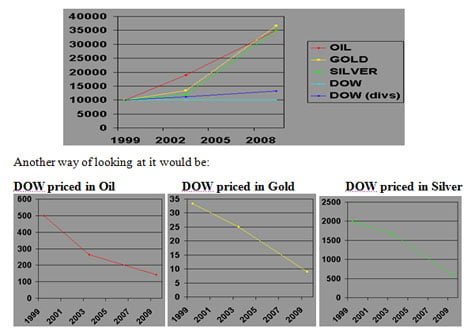

The history of DOW 10,000 . The first time the DOW ever closed at or above 10,000 was March 30, 1999. On that day if you cashed out one share of the DOW here is what you could buy:

- 500 barrels of oil at $20 a barrel… or

- 33.33 ounces of gold at $300 an ounce… or

- 2000 ounces of silver at $5 an ounce.

A year later the dot com bubble bursted, and by July of 2002 the DOW sank as low as 7,200. Then it bounced off the floor (much like it has recently) and in December of 2003 the DOW was back up to 10,000 again. Once again the “benchmark of recovery†had been reached. At that point if you cashed out one share of the DOW here is what you could buy:

- 263 barrels of oil at $38 a barrel… or

- 25 ounces of gold at $400 an ounce… or

- 1667 ounces of silver at $6 an ounce.

The DOW stayed fairly flat through 2004 & 2005, then in 2006 it started to soar and reached its lifetime pinnacle in the 3 rd quarter of 2007 when it briefly touched 14,000. I think we all know what has happened since then, so I won’t reopen that wound. So here we are, once again, finding ourselves excited that the DOW has bounced off the floor and is at the 5 figure mark again. But what could you buy if you cashed in one share of the 10,000 DOW Jones Industrial Average today?

- 142 barrels of oil at $70 a barrel… or

- 9 ounces of gold at $1,100 an ounce… or

- 573 ounces of silver at $17.45 an ounce.

So, what has really happened? Have our 401(k)s stayed flat since March of 1999? Of course not! They have gone WAY down. At the very least this market could have given us a rate of return that matched inflation, but it has not. This is the difference between NOMINAL terms and REAL terms. Whenever you watch the news they will refer to the stock market in NOMINAL terms ( DOW 10,000, or S&P 1,100, etc), but what if when you watched the news they priced your investments in REAL terms? So, the next logical question is: Where would the DOW be today in REAL terms if it had actually kept up with inflation? Remember the numbers from March 1999:

- 500 barrels of oil today would cost roughly $35,000

- 33.33 ounces of gold today would cost roughly $36,663

- 2000 ounces of silver today would cost roughly $34,900

So there you have it. The DOW would have to be around 35,000 to just break even (when priced in these 3 commodities). But you may say “What about reinvesting dividends? I made that election in my 401(k) so its not as bad as you are saying†You’re right. Its not as bad, but it still sucks. In 1999 the average dividend yield of the DOW was at about 1.5%. Today it is at 2.87%. Taking the higher of the two yields, lets make a calculation. $10,000 invested at 2.87% compounded over 10 years gives you approximately $13,270 (see the dark blue line on the chart below). Meanwhile oil, gold, and silver have more than tripled in the past 10 years. And since oil is something everyone needs and silver and gold are what our founding fathers considered to be “the only real moneyâ€, it is more than fair to use them as a measuring stick for investment performance.

Conclusion. In REAL terms stocks have been in a bear market for the past 10 years.

The Founding Fathers’ View of Money

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.” (Article I, Section 10 of the US. Constitution).

Let’s just say, for example, that our government still followed the Constitution. I know it may be a stretch, but try to use your imagination. Would our currency be falling in value? No! And I can prove it. Until 1965 the United States made its quarters with 90% pure silver (10% copper to add strength). A 1964 quarter had 6.25 grams of silver back then, and back then 25 cents would buy you about one gallon of gas. Today 6.25 grams of silver is worth $3.13. So today you could cash in a 1964 quarter at a precious metals dealer and still buy yourself about one gallon of gas. Now, that’s what I call consistency!

Today quarters are made of 91.67% copper and 8.33% nickel (to give it a silver-like finish). That’s right. They have no silver in them at all. That’s why one of them barely buys you a gumball anymore. Is it becoming clear now why our founding fathers wanted us to keep our currency denominated in precious metals? Precious metals are rare, and the founding fathers wanted our money to be just as rare. What’s happening today is counterfeiting in the literal sense of the word! But why is the government doing this?

Today quarters are made of 91.67% copper and 8.33% nickel (to give it a silver-like finish). That’s right. They have no silver in them at all. That’s why one of them barely buys you a gumball anymore. Is it becoming clear now why our founding fathers wanted us to keep our currency denominated in precious metals? Precious metals are rare, and the founding fathers wanted our money to be just as rare. What’s happening today is counterfeiting in the literal sense of the word! But why is the government doing this?

Inflation lag time. Inflation doesn’t happen over night, and the Fed is very aware of this. Since it takes time for newly printed money to bring down the value of the existing currency already in circulation, the first people to get their hands on the new money are able to use it at its highest value. In the recently passed $787 Billion Stimulus Bill, the new money will start making its way into the system by going to pay the people working on the various projects designed to stimulate the economy. Then, as the new money makes its way through the system, it slowly starts to dilute the rest of the money that is already out there. By the time it trickles down to the little guy, he needs it to pay the higher prices which have already adjusted to match the inflated money supply. So, what stimulus has really been achieved? None! It is a net zero change at best, and flat out robbery of those who hold cash at worst.

Money for gold scams. Have you noticed the commercials that have been showing up on tv more frequently in the past couple years that say “Send us your unused or unwanted jewelry, and we’ll send you cash†? Have you ever bothered to ask yourself why more and more businesses are popping up that are designed to offer you a convenient way to rid yourself of the precious metals lying around your house? These guys aren’t stupid, but they know that the general public is. They are literally paying pennies on the dollar for your gold, melting it down and cashing in big time. People who fall for this scam are actually trading real money for monopoly money. They don’t even know what they have!

Although it is completely disgusting what these scam artists are getting away with, the main reason I bring this up is not necessarily to expose this greedy business. It is to let you in on a secret. These businesses would not be so motivated to rob you if they didn’t have an incredible appreciation for the value and potential for growth in precious metals. So, not only should you not be selling your gold and silver. You should be acquiring more of it if you can. If you can’t pay the rent have a garage sale. But selling your gold and silver should be the absolute LAST thing on your list.

The Future of Commodities

Hindsight being 20/20 I bet you wish you’d bought some oil, gold and silver back in 1999, don’t you? Me too. Since commodities have been on a bull run for 10 years some may think it is stupid to get in at this point. Is it too late now? Legendary investor Jim Rogers says no. In his book Hot Commodities, Jim Rogers quotes a study by Barry Bannister which shows that for the past 130 years “…stocks and commodities have alternated leadership in regular cycles averaging 18 years.†Rogers backs this up with his own observations when he says “It looks as if God himself were a trader who enjoyed playing the stock market for 18 years or so, and then switched to [commodities], until he got bored again…†If they are right, we have roughly another 8 years to go in this commodities bull run (give or take a few years). Combine that outlook with all this money printing as of late, and these next 8 years could see much bigger gains than the past 10 years because of inflation. So, I say better late than never.

Special Thanks

I want to give a special shout out to my friend Mac Salvo at www.shtfplan.com for recently giving the Schaef Report a spot on his website. Now you can view the Schaef Report on his site (along with a lot of other great stuff). Also, thank you to all the new subscribers I picked up from that site. Tell your friends if you like what you read. As always, comments are appreciated.

Bye for now,

Schaef

The Schaef Report is an independent newsletter contributed to SHTFplan.com by Mr. A Schaef. You can receive the Schaef Report in your inbox. It’s Free! Subscribe below by providing your name and email address and you’ll be automatically added to the monthly distribution list. The Schaef Report and SHTFplan.com take your privacy very seriously and will not distribute or share your email address with other parties.

Error: Contact form not found.

0 Comments