Schaef Report

Issue: Fall 2009

“Watching the news, you might have thought that the only question was whether the plan was too big, too ambitious. Yet many economists, myself included, actually argued that the plan was too small and too cautious.†– Paul Krugman, March 2009 (referring to the $787 Billion stimulus package)

This is an important quote, because it shows that not only is there a large voice in this country which is in favor of the expansion of our money supply, but they even go so far as to criticize the current administration by saying it’s not being expanded enough. Why would anyone want inflation? What is driving that kind of thinking? It is a concept that Keynesian economists fear much more than inflation. It is the dreaded “deflationâ€.

THE ARGUMENT FOR DEFLATION

“Deflation†and “inflation†should have completely opposite definitions, but today they do not. As I have said before, inflation is NOT a rise in prices. Inflation is an expansion of the money supply, which eventually leads to an overall rise in prices. Because when money is injected into an economy without a proportional rise in the supply of goods and services, that means there is more money chasing the same amount of stuff, so logically things cost more. Inversely, if money is removed from an economy and no goods or services are removed then there is less money chasing the same amount of stuff, and logically prices should fall. Therefore, deflation should mean a contraction of the money supply, eventually leading to a decrease in prices.

However, when you hear the word “deflation†thrown around today people aren’t talking about a contraction of the money supply. They are just referring to a temporary decrease in prices, and only in certain sectors of the economy. We know that this kind of “deflation†always happens when a bubble bursts because the prices that existed within the bubble were not sustainable in the first place. In late 2007 housing prices began a total free fall, and this is still continuing today. But is that really deflation? Has money been removed from the economy? Perhaps equity (that is, money on paper) has been removed, but actual money (physical paper money) has not. This is simply a correction, and a massive one at that – but only in response to an equally massive bubble. Therefore, adding paper money into an economy that is losing “money on paper†(or equity) is not an even trade off – and is an especially bad idea when the system is trying to delete the “money on paper†that should have never been there in the first place.

Another contributor to the deflation scare is what retailers tend to do when they are going out of business – that is, have “fire salesâ€. Example: my wife was laid off from her retail job recently. After her company declared bankruptcy they decided to have a liquidation or “fire saleâ€. Of course, they brought in more money in the last week her store was open than they did the previous few months (not necessarily profits, but money all the same) because everything was 70% off. This kind of thing creates a situation where other stores who want to stay in business can’t compete with the bankrupt stores who are now just dumping inventory at rock bottom prices in order to raise capital quickly. Of course other stores lose sales when this happens because it’s like Wal Mart just moved into the mall for a week. The fear is that this could create a downward spiral causing more and more stores to lose sales, file bankruptcy and have liquidations, which would create more unfair competition in the marketplace, which would create even more bankruptcies, etc.

Staying on the subject of retail, the 2009 holiday shopping season is shaping up to be an interesting one. With well over 2 million jobs lost in this country since last Christmas, the retail stores – many of whom rely on the holidays to provide anywhere from 50-75% of their annual profits – are hoping it will still be business as usual this year. No one is really sure what they are basing their hopes on, but they may be in for a very rude awakening if/when shoppers don’t show up in droves this year. My wife and I, like many other families in this country, certainly won’t be spending very much money on each other this year seeing as our household income was recently cut in half. When the retail numbers come out in the beginning of 2010 it could very well lead to more bankruptcies of large, well known companies (ie. Macy’s, Sprint and a few others).

These are all reasons to believe that we are heading down a “deflationary†path. The most important question to ask, however, is: can this go on forever? I don’t believe it can. It is important to realize that, though we are experiencing many difficulties, it is just a business cycle. The fact that this is a particularly brutal cycle doesn’t mean it will go on forever in an unstoppable downward spiral. Is there anything the government can do to stop it? I don’t believe there is. In fact, trying to stop it would be like trying not to throw up after accidentally drinking window cleaner. Your body is trying to rid itself of poison, so if delaying the inevitable would just makes things worse, how much worse would it be for your body to drink more of it?

But the government and the Federal Reserve feel very differently on this matter. They have already proven that they will do anything they can to keep America from feeling the affects of the poison we have drunk. Dr. Marc Faber takes a guess at what the Obama Crew will most likely do if this so-called “deflation†continues when he attempts to sum up the current administration’s economic philosophy, “… if something goes wrong, print [money]. If it doesn’t get fixed, print more. If it then gets even worse, print more.†He jokingly calls this the “Zimbabwe School of Economics†which the US has adopted. Of course, there is no such school of economics. Zimbabwe is the country in Africa that recently experienced a 200 Million % increase in the price of goods because they kept inflating their money supply. But this could never happen to us, could it?

EXIT STRATEGY?

The panic created by those who fear deflation is being used to justify all kinds of money printing which is going on as I type this letter. But is this fear really legitimate? Furthermore, should we not expect knee-jerk reactions like this from the government to have unintended consequences later on?

So then what is the exit strategy after printing all this money? If/when the money printing takes us off the course of falling prices, and puts us on the course of rising prices again, how do we stop that affect from getting out of control? Just like George W. Bush was criticized, and perhaps rightly so, for not having an exit strategy for the Iraq war, Obama and the Fed are being criticized for not having an answer for what to do once the dollars injected into the system come home to roost.

At this point I want to use an illustration that I believe works quite perfectly here.

The 2004 Tsunami – The damage caused by the tsunami on 12/26/04 was very disturbing to watch and read about. Hundreds of thousands of people died, the ocean was polluted with all kinds of sewage and other garbage, and billions of dollars in infrastructure was destroyed. What I found to be most disturbing, however, was how many people died who shouldn’t have. Many of the locals on those islands knew that when the tide retreats out that far it can only mean one thing. Tremendous energy was building up miles offshore forming a wall of water that was about to come crashing in at any moment. Why weren’t all of those vacationers warned? Why were they allowed to actually WALK OUT onto the exposed ocean floor and unknowingly wait for certain death? Simple. There was no efficient warning system in place. Also, for every one person who knew what was about to happen there were probably tens of thousands of people who had no clue.

The Coming Economic Tsunami – Let’s use this example and apply it to economics. Money is the water, and the business cycle is the tide. When the tide of money retreats in a normal pattern, it doesn’t mean there is less of it. It simply means it got displaced into another sector of the economy for a while, only to return when the cycle comes back around. But when something drastic happens in the economy like a housing bubble forming and then bursting, this disturbance in the system can be likened to an underwater earthquake causing a “tsunamiâ€. However, unlike oceanic tsunamis, economic tsunamis are not natural occurrences. They are always man made and usually come about from government intervention. And the scariest thing is that governments have the power to make them even worse! Right now the economic tide has retreated out further than it has since the Great Depression and everyone is screaming “Do something! There is not enough money!†But by printing hundreds of billions of dollars in a recession, governments are only adding power to an already huge wave of money that is on its way back in. That is why Dr. Faber says, “Given what the government is doing, I believe there will be a short period of deflation, followed by hyperinflation in the United States.â€

It has been said that “a rising tide lifts all boats.†Therefore, make sure you are inside one when that wave comes. The people who are walking out onto the exposed ocean floor right now are the people who have their money in savings accounts, money market accounts, government bonds, etc. They think they are safe. But when the unstoppable force of inflation comes roaring in unexpectedly, everything they have is going to get wiped out. Accounts that don’t earn interest at the rate of inflation will be drastically undervalued when commodity prices go through the roof. Therefore, the only way to stay on top of the wave is to invest in the very things that go up with inflation – commodities!

DOUBLE DIP RECESSION?

Shifting gears here, I want to talk about something that has been the subject of many a blog recently: the potential for a double dip recession.

Many people are comparing this time to the Great Depression, yet we have not seen the mass poverty, bank runs, 25% unemployment (as reported by the government at least), etc that the Great Depression had…. yet. Why then are people talking about today’s financial crisis as if it can be compared to a time when the stock market lost almost 90% of its value over 2.5 years? After all, the DOW would have to go down below 2,000 in order for that to happen. Perhaps because it has not completely run its course yet? Perhaps the worst is still in front of us? Perhaps the fundamentals for a healthy financial system are not in place? I am merely posing questions here. I’m not necessarily trying to make a definitive prediction. But what would you do if all of a sudden people who knew a ton more about the market than you could ever know started selling stock like there was no tomorrow? Would you be the slightest bit worried about your own portfolio?

Colin Barr, Senior Writer for CNN Money asks in a column written on 9/12/09, “Can hundreds of stock-selling insiders be wrong?†when he points out that, “Corporate officers and directors have been selling shares at a pace last seen just before the onset of the subprime malaise two years ago.†Lastly, he says, “Though the wave of selling by insiders doesn’t necessarily predict a pullback in their stocks or the market as a whole, it’s hard to put a happy spin on the recent trends.†He is steering away from making a prediction here, but is clearly trying to sound the alarm bell for anyone who will listen.

On 9/18/09, Bob Hoye of Institutional Investors was a guest on Howe Street Radio and outright predicted that this fall we would, in fact, see a significant pullback in the US stock market. He points out that in October of 1929 (as the market crash that began the Great Depression was unfolding) the DOW dropped approximately 47% over the course of 2 months and then had a rally which lasted approximately 5-6 months before imploding again for the next 2 years. Sound familiar? How many people got back into the market when that short-lived rally happened because they thought the crash was over? History tells us that many people did, unfortunately.

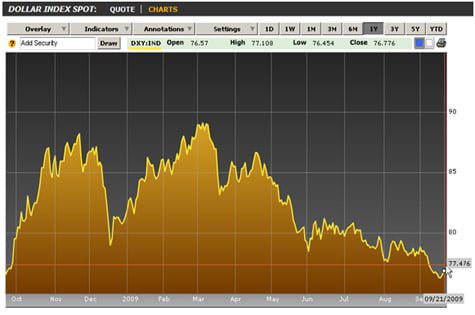

Hoye further points out that currently 92% of people polled today are considered to be “bullish†on the stock market. Why isn’t that a good thing? Because a number that high can mean only one thing – it has almost nowhere to go but down. The thought process here is that as the bullish sentiment maxes out, the market also maxes out with it. All it may take is the slightest bit of bad news to trigger a decidedly different sentiment and then a decline could very well start again. Hoye confirms this when he says, “A decline from this level of enthusiasm is inevitable.†He also points out that the US dollar has been flirting with its 52 week low recently and that it is due for a rally. As the dollar rallies it will most likely be accompanied by a decline in the stock market.

Notice that the dollar peaked out in early March ‘09 – the same time that the DOW was at its 12 year low. Since then, the dollar has moved in the exact opposite direction that the DOW has. This tells many economists that this rally in stocks is not due to confidence in the market, but due to a devaluation of the dollar through money printing. Therefore, if the dollar does rally and the negative correlation continues we will see a fall in the stock market to accompany it.

The planets could be aligning here for another major selloff in stocks. Don’t be surprised if silver, gold, oil and other commodities follow suit too, as they have been mirroring the market as of late. That trend cannot continue forever, though. When inflation finally hits, commodities are expected to decouple from the equities market and, not necessarily move in the opposite direction, but move up no matter what stocks do. Once again, the place to be is commodities.

Bye for now,

Schaef

The Schaef Report is an independent newsletter contributed to SHTFplan.com by Mr. A Schaef. You can receive the Schaef Report in your inbox. It’s Free! Subscribe below by providing your name and email address and you’ll be automatically added to the monthly distribution list. The Schaef Report and SHTFplan.com take your privacy very seriously and will not distribute or share your email address with other parties.

Error: Contact form not found.

0 Comments