“The strength of a nation’s currency is based on the strength of that nation’s economy; and the American economy is by far the strongest in the world. Accordingly, I have directed the secretary of the Treasury to take the action necessary to defend the dollar against the speculators [who benefit from currency crises]. I have directed Secretary Connelly to suspend temporarily the convertibility of the dollar into gold or other reserve assets except in amounts and conditions determined to be in the interest of monetary stability and in the best interest of the United States.†– Richard Nixon, August 15th 1971, as he revealed to the nation his plans for a temporary removal of the US dollar from the gold standard.

Just like “temporary tax increasesâ€, the removal of the US dollar from the gold standard turned out to be very permanent. At the time gold was priced at $35 per ounce. Today gold is reaching new highs at just over $1200 per ounce.

What Makes Some Metals “Preciousâ€? 4 basic metals in the world today are considered to be “preciousâ€: gold, silver, platinum, and palladium.

Gold and silver are the only 2 that have been considered to be “money†by most civilizations at one time or another. Why is this? What do gold and silver have that iron, aluminum, copper, lead, nickel, etc. don’t have? For starters they don’t react with oxygen and corrode over time (in other words, they will never rust). In addition they are softer and therefore easier to work with than any other metal, they have the highest melting points, they are by far the most rare, and, lastly many consider them to be the most beautiful metals on the planet. Since civilization began to industrialize it has also been found that gold and silver are the best conductors of electricity known to man. As we will talk about later, silver especially has been found to have many special qualities that set it apart from other metals. Who knows what other special properties gold and silver may have which have yet to be discovered? Only time will tell.

GOLD AND SILVER AS MONEY – A BRIEF HISTORY

Before the use of gold and silver many things were used as money including feathers, shells and rocks. During that time precious metals were around, but were mainly used for jewelry. In primitive civilizations, most of the time bartering or trading was the primary means of exchange, but the problem was that if you couldn’t find someone who wanted what you had, trade would be difficult.

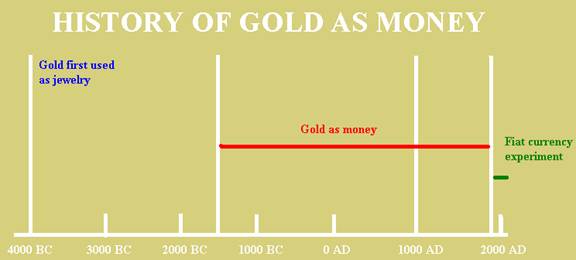

As society began to evolve and occupations started to get more specialized gold and silver became the staple means of exchange in most civilizations because of their beauty and special properties, and the dawn of a new era which would last roughly 3500 years was born. By 1500 B.C. gold and silver was being used as money all over the world.

The Goldsmith. This “new era†created the need for a new occupation known as the goldsmith. To give each piece of gold and silver the same value, the goldsmith would melt down the metals and forge them into equal round pieces. Thus, the very first coins were formed. Now, each piece of gold and silver being the same size, they could easily be traded in the market place for goods and services.

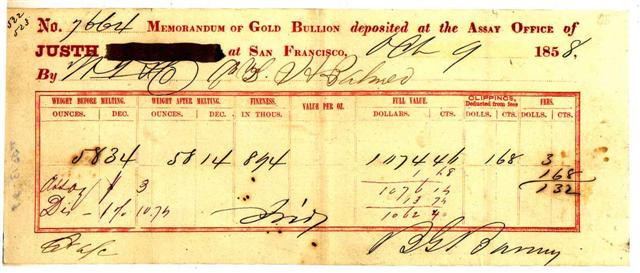

The goldsmith also served another purpose. People were always afraid that thieves would break into their houses and steal their gold and silver from them. So to protect their wealth they would keep their precious metals with the goldsmith who would lock it in his vault for them, for a small fee of course. In exchange for their gold and silver he would give them little paper receipts. A more modern day example of this is shown below:

Because these receipts were redeemable in gold they were eventually thought of to be “as good as goldâ€, so people began trading them in the market place instead of the coins themselves. And just like that the first paper currency was born!

The Importance of the Gold Standard. The goldsmith had now become a banker, and after watching what was going on in the market place with his paper receipts, the banker got wise to something. He thought “Since the paper I am creating is as good as gold, why don’t I just print more of these for myself?” After a while he found himself in a predicament, however. The people began to grow suspicious of his wealth and word spread quickly that perhaps not all the receipts in circulation really represented true gold in his vault. This rumor caused everyone all at once to run to the goldsmith’s vault with their receipts in hand demanding to have their gold and silver back (now known today as a run on the bank). Once it was realized the rumors were true, their receipts were immediately devalued because all the gold and silver in the vault had to be divided by the number of receipts (regardless if they were real receipts or fake ones). People were so angry about this that they had the goldsmith hanged in the town square. Then they hired a new goldsmith and made him promise to only print receipts which truly represented actual gold in his vault.This new gold standard of banking assured holders of paper money that their currency would not be devalued (stolen, in other words) the way it was with the first goldsmith.

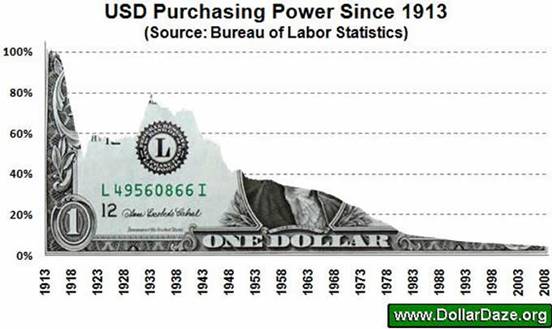

Today, we don’t refer to printing money backed by nothing as “stealingâ€. We refer to it as “inflationâ€. Inflation is something that we have been conditioned to accept as normal, but it’s not any more normal than someone breaking into your home and taking what belongs to you. We earn the money we have through hard work, but when the Federal Reserve decides it needs more, instead of earning the money it simply prints more dollars which are not backed by anything other than trust and confidence in the dollar itself. This is the hidden tax on us called inflation. How do some choose to minimize this hidden tax? They create their own gold standard by diversifying their savings into gold and silver.

“The dollar is based on an illusion and on false trust. It simply cannot continue because the trust will eventually be lost.†– Ron Paul , Texas Congressman.

In 1971 President Richard Nixon took the United States off of the gold standard by “closing the gold window†meaning the US would no longer allow its dollars to be redeemable in gold. So why did Nixon do this? Was it really because of currency speculators manipulating its value? Other countries were removing their gold standards and were threatening not to accept US dollars anymore unless we allowed it to float as well. Many say Nixon just caved in to the pressure. Whatever the reason, this last act of desperation for economic world dominance was the final nail in the coffin for the dollar.

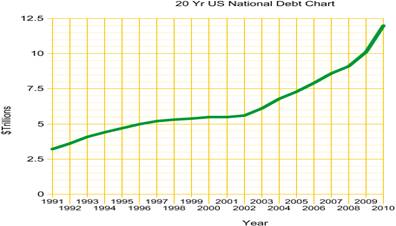

Since then gold and silver have soared in price. As our debt grows so does the value of gold and silver. There is no escaping that fact. Because gold and silver are real money, the dollars which are printed today will just end up chasing gold and silver tomorrow, driving up their prices.

I firmly believe that the gold standard is necessary to have a sound currency. However, there are some people out there who don’t think it’s a good idea at all. In fact, some people think it will wreck our economy. So I thought I would find someone who vehemently disagrees with me on that subject and present his argument against the gold standard and then, of course, proceed to tell you why he is TOTALLY WRONG! 🙂

THE ARGUMENT AGAINST THE GOLD STANDARD

It took me a long time to find a video on youtube which is actually against buying gold, because every time you search the subject you get thousands of videos that say you should buy it. However, after quite a bit of searching I found a few people who are both against buying precious metals as well as backing our currency with them. The most articulate one I could find was this one:

I suggest everyone watch this video because there is a good chance you will hear the same arguments when you speak to others who are cynical about precious metals.

In this video, its creator “Etramway†begins by saying the following 2 things about gold:

- It is not a “medium of exchange†like paper money. In other words, you cannot walk into a store and exchange gold for goods.

- It is not a “standard of value†like paper money. In other words it is not always worth the same thing. Paper money has the value printed right on it so there is no questioning its value.

Because it does not contain the 2 qualities above he considers gold not to be money. Rather, he says, gold is an “investment†and a “non-financial investment†at that, because it is a “hard assetâ€. And he then compares gold to real estate or a collection of baseball cards. “Financial investmentsâ€, he says, are things like stocks, bonds, bank cds, etc. Financial investments are better than gold too, he says, because they are more accepted by society. Some financial assets are even guaranteed by the federal government! 🙂

Let’s stop here for a second and address these points. He is right. Gold is not a literal medium of exchange… anymore. As history tells us, precious metals have been a medium of exchange for thousands of years, though, while paper money has only been for hundreds of years. More importantly, the gold standard for paper money ended just 39 years ago in the United States. So that’s 3500 years of gold and silver as money versus 39 years of using a floating fiat paper as the world reserve currency. This fiat currency (that is, currency backed by absolutely nothing but faith in the government which prints it) is nothing more than an experiment and WE ARE THE SUBJECTS!

He is also right to say that you can’t walk into a store and pay for groceries with gold… anymore. You must first take the step of converting your gold into paper money before you can spend it. So what’s the big deal? There are precious metals dealers all over the place who will do that for you. Don’t you also have to do that with stocks, bonds and bank cds as well? This just means that it is not as liquid as cash… currently. However, should we not be more concerned about the value of our money rather than its liquidity?

And, yes, paper money has a number on it which never changes. But, in the world we live is the value of paper money reflected by the number printed on it or is its value reflected by what it can buy? After all, if the numbers on our paper money actually reflected all the inflation that has happened since the creation of the Federal Reserve in 1913 every dollar bill would say “5 cents†on it today!

Again, I agree with Etramway when he says that gold is a “hard assetâ€. However, it is not like real estate or baseball cards. Please tell me what other hard assets in the world have been used to back currencies besides gold and silver? I’ve never heard of the real estate standard or the baseball card standard. This part of his argument is silly at best.

He then goes on to say that no countries use the gold standard anymore because gold is “static†in that it doesn’t increase at the rate that the population increases. The thought here being that the supply of money should increase at the rate of the population, because the demand for money is increasing with the population. This is nonsense. Money needs to be backed by something of real value and should only increase as we accumulate gold and silver. If the amount of money grew slower than the population, the cost of goods would actually go down. We would have gradual deflation over time instead of the gradual inflation we have had since 1913, so the dollar would be stronger! Also, I believe this nation would be investing quite a bit more in the mining industry than it does today if it meant that the only way we were able to print money was by digging up gold and silver. In fact, if we still had a gold standard precious metals mining would probably be one of our nation’s top priorities resulting in more gold and silver in our vaults today.

Gold as an Investment. Etramway then displays a very dramatic looking graph he created on yahoo finance illustrating how gold is a bad investment. It shows how the DOW Jones Industrial Average clearly would have been a better investment from 1996 to today (the CBOE Gold Index [^GOX] is the red line and the DOW [^DJI] is in blue).

Very compelling. However, beware of the spin here. Anyone who has ever made historical comparisons knows that the charts look incredibly different depending on what time you start the chart. Look at what happens when you start the chart in 1999 (which happens to be the year all experts agree was the beginning of the current bull run for commodities -once again, the CBOE Gold Index is in red and the DOW is in blue).

Gold doesn’t look too bad now, does it? A 300% return sounds pretty good to me. And how about that DOW Jones Industrial Average? Nothing like a 15% return after 11 years of investing, huh? (Note: I encourage you to do this comparison for yourself on yahoo finance to check the accuracy of these claims).What’s the point here? The point is that we are currently in a cycle where commodities are better investments than stocks. There will come a time again when stocks are better to be in than commodities, but this ain’t it. All commodities experts will agree that 1999 was the tipping point where stocks began to underperform and commodities took over as the primary bull market. Commodity bull runs typically last anywhere from 16 – 20 years, but I believe that gold and silver should not necessarily be lumped in with all other commodities. With the inevitable implosion of the US dollar gold and silver will no longer be considered an investment, but a safe haven against a complete currency failure. Even given the tremendous return already seen in gold, it is definitely not too late to get in, but buy on the pullbacks.

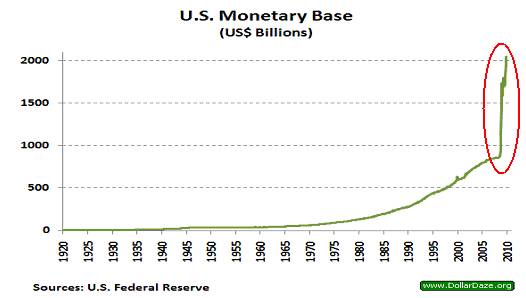

The Dollar’s Battle of the Bulge. The US government is not stupid. It knows it is in trouble. This fiat money experiment it is conducting can only end 1 of 2 ways: a return back to the gold standard for the United States or the complete destruction of the US dollar. I’m afraid the latter appears more likely because, instead of changing course, the Federal Reserve has clearly decided to slam down on the gas pedal in the same direction it has been going. Again, addressing Etramway’s point about gold being “static†and paper money being “fluidâ€; it is true that fiat money can be printed by the Federal Reserve at the rate of the increase in our population. But is that really what is happening? Has our population doubled in the past 2 years? I know I have shown this chart before in previous reports, but at the risk of being redundant and boring, take a look at what has happened to our monetary base since 2008:

This is unprecedented. How this alone is not currently causing worldwide panic for those who hold US dollars is astounding. Now, to be fair most of this extra money was created only as “bank reservesâ€, according to Fed Chairman Ben Bernanke. He says “It is sitting there idly… it’s not chasing any goods.†But for how long is it going to just “sit thereâ€? Why was it put there in the first place if it was meant to just “sit thereâ€? Is it supposed to “sit there†forever, or is the Fed going to take it back? Where did the money go? These are all questions that the American people deserve to know, but most likely will not know until it is too late. There has been a massive effort to audit the Federal Reserve because of its unruly practices, but so far this effort has been unsuccessful.

In the past the Federal Reserve generally printed money for 2 reasons: 1. To enable the US’s level of goods consumption to grow while at the same time producing less, and 2. To enable interest payments on the ever increasing debt we are continually accumulating through our excessive goods consumption. Recently, they have found a third reason to print money: Stimulus and Bailouts. The recent large spike in money printing due to stimulus packages and bailouts can be compared to Hitler’s last ditch efforts to win WWII shortly after he realized he was quickly running out of resources. Just like the famous Battle of the Bulge our recent money printing is giving a short-lived appearance that it is winning the war against recession, but in the end this move will be seen as something which made our problems much worse. As this money inevitably floods into the world economy it is sure to cause all kinds of inflation-related chaos.

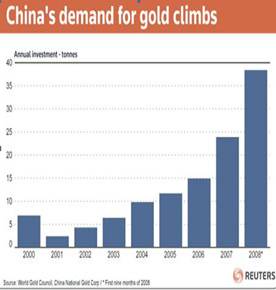

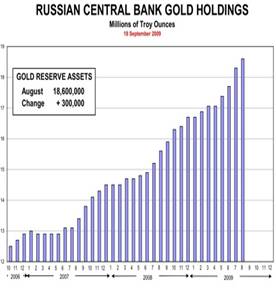

Other Nations Responding to US Money Printing. Russia and China are clearly beginning to worry about the value of the US dollar reserves they hold. What are they doing in order to diversify their assets away from the US dollar? Well, let’s take a look:

Hmm… So, if it is an outdated concept for countries to back their currency with gold, apparently Russia and China didn’t get that memo because they are buying up the yellow metal like the end of the world is coming! Is it?

We’re living in interesting times, my friends. If you don’t own at least some physical precious metals, its gonna get a whole lot more interesting for you.

HOW TO BUY GOLD AND SILVER

There are multiple ways to expose yourself to the gold and silver market. You can buy mining stocks (a purely speculative investment which I do not recommend). You can also buy gold and silver ETFs (such as GLD and SLV) through a brokerage account. These ETFs directly track the price of the metals they are based on (minus the expenses to run the funds), however they are not entirely secure. Just like the goldsmith’s ponzi scheme, it is widely rumored that these ETFs do not hold even close to the amount of physical metals that the monies in the funds represent. If the forecasted dollar crisis runs its course these funds will surely be wiped out as the ponzi scheme gets revealed. The last way you can get into the market is by owning the actualphysical metals. This offers the utmost peace of mind and security against the crisis that I believe is coming.

Which Brands to Buy. There are a lot of brands out there, but according to Greg McCoach, precious metals expert, the best brands are as follows: Englehard, Johnson-Matthey, Credit Suisse, and Pamp Suisse when it comes to bars, and United States Gold and Silver Eagles when it comes to coins. The more recognizable the brand, the better off you will be when/if you actually have to use them to purchase things.

The Difference Between Bullion and Numismatic. This is EXTREMELY important. If you are interested in buying gold and silver as an insurance policy against a failing dollar you want to buy bullion only! Whenever you see commercials selling a coin with Obama’s face on it or with a picture of the world trade center or something you need to realize that is not bullion. Those are numismatic items. Numismatic coins and memorabilia are not priced according to their weight or purity in the metal. They are priced according to the pretty picture on them. Unless you fancy yourself a collector, stay away from the numismatics. Below are a couple examples of these differences:

BULLION (Johnson Matthey bars and Gold America Eagle coin)

NUMISMATIC (garbage)

Where to Buy Gold and Silver Bullion. The best precious metals dealer I have found is “American Precious Metals Exchange†www.apmex.com. Their prices are fair and they have a very helpful and friendly staff. Even though they sell both, they are upfront about which items are bullion and which are numismatics on their site. There is no trickery or bait and switch. You always know what you are getting. They will mail you your items discreetly to you (so that the box doesn’t say “ GOLD†all over it). Also, they will buy back everything they sell at present market value.

Where to Store Your Gold and Silver Bullion. There are many ways to store your precious metals safely. I recommend a fireproof safe in a secret location that only you and a trusted loved one knows about. If the safe is in your home I highly recommend bolting it down to the floor. Some people bury their gold and silver in their back yards. If you do this mark it with a large rock or something hard to move so you are able to find it again. Whatever you do, don’t keep your gold and silver in plain site in your home. Hopefully, if thieves break in they won’t know what they’re looking at, but as gold and silver ownership gets more and more popular I wouldn’t count on that. Historically, it has been a popular thing to keep your precious metals in a safety deposit box at your local bank. However FDR’s order to confiscate all gold from bank safety deposit boxes during the 1933 gold seizure changed all that. No one knows if that could ever happen again, but why risk it? The safest place for precious metals to be is in your possession.

SILVER – THE POOR MAN’S GOLD OR THE SMART MAN’S BET?

“As gold goes, so will silver – but even more!†– Peter Schiff

It’s amazing that for all the gold commercials on TV and all the “money for gold†scams out there today you hardly ever hear about silver. I really have no idea why this is. But one thing I do know is that silver has much more potential to go up in price than gold does at the present time. This is really no secret at all for people who study precious metals. Any expert will tell you the same thing.

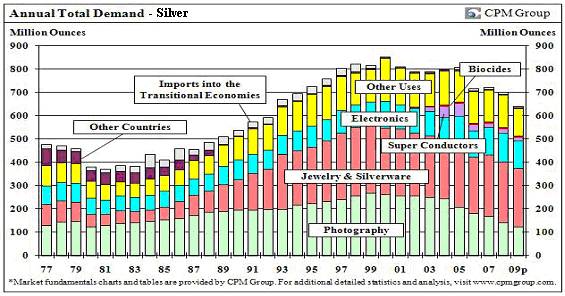

Silver’s Industrial Applications. Just like gold, silver is used in jewelry quite a bit. However, what makes silver different from gold is its dual purpose as money and an industrial metal. Silver’s industrial uses include, but are not limited to:

- Silverware

- Photography (every camera contains silver)

- Electronics (every cell phone, computer, TV, washing machine and refrigerator contains silver)

- Dentistry

- Mirrors and Optics

- Superconductors

- Clothing Manufacturing

- Biosides

- Other Medicinal Applications

“Without silver, life as we know it would not exist†– Adrian Douglas, Silver Expert.

What does all this mean? It means that silver is literally consumed – thrown away, in other words. Every electronic device, camera, mirror, fork, knife, etc that contains silver which has ended up in a landfill will never be retrieved again, adding to its scarcity. Meanwhile 95% of all the gold that has ever been unearthed is still in human possession.

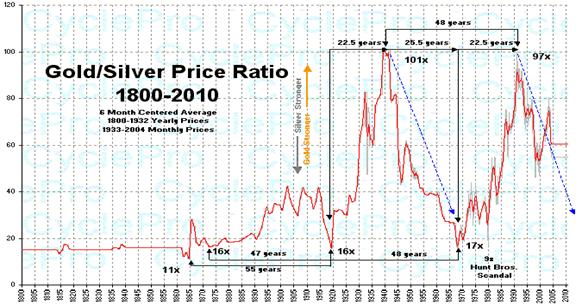

Taking Advantage of Volatility. Silver is much more volatile in price than gold. That can be a good thing if you are into taking risks. The more volatile a commodity is the better chance you have of make money with it… if you get in at the right time. Below is the gold/silver ratio chart which shows 1 ounce of gold priced in ounces of silver for the past 200 years. As the ratio climbs gold is outperforming silver, and as it falls silver is outperforming gold. So when it comes to playing ratios the rules of investing get flipped. You want to buy high and sell low.

For example, hindsight being 20/20, you could have traded in 1 ounce of gold for 100 ounces of silver in 1940, and then converted all your silver back into gold in 1968. If you would have done this you would have turned 1 ounce of gold into 6.25 ounces – a 525% return on your money just by making the right moves at the right time. The important thing to remember here is that we don’t care how much gold and silver cost in terms of dollars – we only care about the ratio. A common error is to look at commodities in terms of dollars and think that they are either cheap or expensive. Inflation is a constant; therefore it is the commodity’s historical ratio to other commodities that counts.

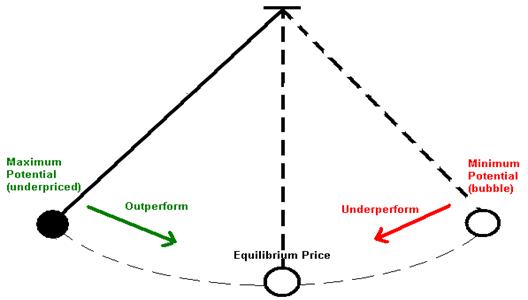

The Price Ratio Pendulum. Another way of looking at the chart above is to explain it in terms of a pendulum. As we know, when a pendulum in motion reaches its lowest point, momentum continually causes it to overcompensate or overshoot it. Right now silver is in the process of sling-shotting forward to get to the correct equilibrium price ratio with gold. If history repeats itself, it will not only reach that point, but it will go way past it.

Looking at the past 100 years, the equilibrium gold/silver ratio is somewhere around 50:1. Today it is at 63:1, which means it is still on the left side of the equilibrium price and is poised to outperform gold. Counting on momentum to carry it forward, silver should shoot past 50 and test historically low ratios once again in the coming years. Eventually, silver will become a bubble, but its not even close to that yet.

Taking into consideration silver’s growing scarcity because of its industrial usage and its ratio to gold at present, this is a strong indicator that it will continue to slingshot forward and outperform gold. The fundamentals are there for this to happen. Not to mention that currently gold is at its all time high while silver is not even at 50% of its all time high.

“What is the best commodity to be buying today? Perhaps silver.†– Jim Rogers

Thanks for reading, and goodbye for now – Schaef.

The Schaef Report is an independent newsletter contributed to SHTFplan.com by Mr. A Schaef. You can receive the Schaef Report in your inbox. It’s Free! Subscribe below by providing your name and email address and you’ll be automatically added to the monthly distribution list. The Schaef Report and SHTFplan.com take your privacy very seriously and will not distribute or share your email address with other parties.

Error: Contact form not found.

0 Comments