I’ve heard the “experts” on precious metals making claims since 2008. In fact, they began their permanent bullish rhetoric in 2005, and we even have on record some of the most reputable gold analysts pounding the table back in 1979. You’d be wise to ignore them, since their view is flawed.

We are living through challenging times, both concerning the ungodly levels of debt floating in the balance sheets of governments, central banks, corporations, and individuals and regarding wealth inequality around the globe and within our cities.

But, with all that said, we’ve been here many times before, just not in our lifetime.

Before corrupt governments, rogue agencies, secretive central planners, and the shadow state operators that we have today, there were evil monarchies, cruel dictatorships, lunatics running governments and marching armies, and bloody wars fought for the sole purpose of conquest and enslavement. This is a common theme throughout human history, so it’s a bit naïve to believe that these times are any different.

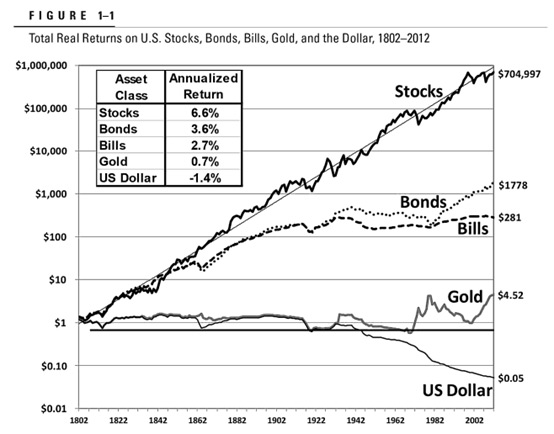

Take a look:

Courtesy: Stocks For The Long Run

Study this chart carefully, and you’ll realize that no matter which monetary system we live under, great businesses are the surest means to achieving investment returns.

Even you wholeheartedly believe that the stock market is a casino. The most important step you can take is to remove the mystery away from stocks and understand which ones work.

Wealth Research Group focuses on a niche group of 52 companies, which have beat 96 out of every 100 fund managers in the past 30 years. On top of that, we publish many Exclusive Reports on these unique businesses.

As you can see, there’s no comparison between returns made by long-term investors, who focus on compounding, and all other types of investment options. But at specific times (roughly 5.4%-7.3% of the time) there’s a small, negligent industry, which normally receives little attention from funds and suddenly becomes the place to be.

You see, gold is a highly cyclical commodity, due to its heritage and performance during times of uncertainty and the restraints it enforces on corrupt bankers and politicians.

That’s the reason some people are die-hard believers in its importance. I own physical gold and silver. In fact, I see precious metals as a key component of my personal portfolio.

I hold two years’ worth of savings in gold and silver in vaulted storage, but those are defensive assets.

When I go on the offense, it is by using a proprietary strategy of leverage.

You see, in the 5.4%-7.3% of the time that this strategy works, the alternatives severely underperform it, mostly because this strategy involves the junior mining sector, which is more tiny and price-sensitive than all other industries.

Right now, we’re nearing the end of a business cycle that started in 2011.

The economy is becoming overheated, due to pent-up energy caused by central bank monetization. There are too many dollars, too many bonds, and too much debt, so inflation is becoming a real issue!

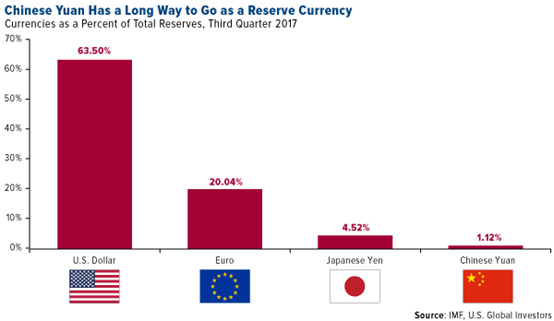

Courtesy: U.S. Global Investors

In today’s world, where cryptocurrencies are revolutionizing peer-to-peer transactions, and China is becoming the world’s largest economy, the need for the USD is lessening, yet it is still much the dominator.

This all says inflation is going to hit us hard, to the tune of 4%-6% officially, which will trigger a raging bull market in mining shares.

We’re still not there, so I’m personally building a significant position with one specific gold company, which owns five world-class assets.

You see, what the gold “experts” would have you believe is that “it’s always a good strategy to buy gold and gold equities,” but that’s completely false.

Mining is a boom and bust industry, which outperforms other investments only under specific conditions, like those which existed in 2004 through to 2006 and 2009 through to 2011.

Today, they’re nearing that timeframe again, which is why I say that there’s only a two-year window.

I’ve done my research and have committed a leveraged position with this company, which was up 22% in last week’s trading session.

Analysts have given it price targets, which are three-times today’s price, and as far as I’m concerned, they’re conservative.

The USD is entering a bear market, while gold prices are on the verge of breaking out above their resistance at $1,365.

Check out the full report HERE!

0 Comments