This article was originally published by Tyler Durden at ZeroHedge.

Four words from Donald Trump during his Panama City Beach rally on Wednesday night is all it took for the rug to be pulled from under markets: “China broke the deal” Trump said with Chinese Vice Premier Liu He on route to Washington for two days of talks, and then said another three to cement the sell-off: “They’ll be paying.”

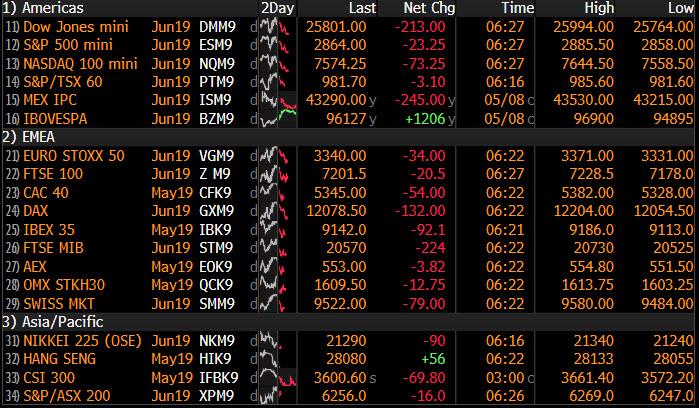

And though Trump added that “it will all work out”, Beijing warned it will retaliate should the U.S. hike tariffs as advertised at 12:01 am on Thursday against Friday. With traders already extra jumpy in a week in which the trade war tide reversed unexpectedly and furiously, that’s all it took to accelerate this week’s slide in risk, and world shares tumbled for a fourth day running on Thursday, the result a sea of red amid global markets…

… with S&P500 futures dropping again on Thursday, sliding as much as 0.8% as the deadline approached for America and China to raise reciprocal tariffs.

If talks indeed fail to reach a deal, Washington is set to raise tariffs on $200 billion of Chinese goods to 25% from 10% at 12:01 a.m. ET on Friday. Kazuhiko Fuji, a senior fellow at RIETI, a Japanese government-affiliated think-tank, said the trade talks looked fragile.

“I would suspect the U.S. will just hand China an ultimatum. No wonder the U.S. yield curve is almost inverting again,” he said.

“Markets remain on edge ahead of the Chinese vice premier’s visit to Washington today,” Rabobank analyst Bas van Geffen said. “Doubt that this tariff increase can be avoided is growing,” he added as Goldman Sachs also put the chance of a hike at 60 percent.

“In the event of a complete breakdown in talks and higher tariffs, we would expect this to see U.S. stocks trade 10–15 percent below their highs and a fall of around 15–20 percent in the Chinese market,” Mark Haefele, global chief investment officer at Global Wealth Management at UBS, said.

With tariffs imminent barring a last-minute miracle, the FT reported that US trade official said the additional tariffs on Chinese goods would apply to goods exported from Friday and will not include goods already in transit, which reports noted provides negotiators a window between 2-4 weeks before the full impact of higher tariffs.

As the flight from risk continued, Treasuries and the yen climbed with gold as investors sought havens, while the yuan fell to its weakest since January. European stock markets sank almost immediately after a torrid day for Asia. Europe’s Stoxx 600 hit session low shortly after the open, falling for the third time in four days, led lower by shares in cyclical sectors including automakers and miners, European tech stocks dropped as much as 1% dragged by a drop in semiconductor shares after Intel’s disappointing forecasts while banking stocks tumbled, with Banco BPM down 6.3% after disappointing quarterly results. The Stoxx 600 was down as much as 1.1%, its lowest level since March 29; the index has fallen 3.6% since hitting its peak in late April, on track to post its biggest weekly drop since December. There was broad-based carnage in tech as well: wafer-maker Siltronic -3%, Infineon -2.6%, STMicro -2.6%, and AMS -1.6% all tumbled after Intel gave long-term forecasts for low, single-digit sales growth. Smaller European chip peer and Apple supplier Dialog Semiconductor gives up early gains to trade 0.3% lower after saying 2019 underlying revenue likely to decline this year.

Earlier in the session, Asian stocks fell for a fourth day, headed for their largest decline in six weeks led by technology and material firms; the rout was led by China, whose Shanghai Composite – which is often seen as the bellwether for how this trade war hits home – tumbled 1.5% while South Korea plunged 3%.

Most Asian markets were down, with Japan, South Korea and Hong Kong leading declines. The Topix gauge fell 1.4%, led by Toyota Motor Corp. and Honda Motor Co. The Shanghai Composite Index closed 1.5% lower, with Kweichow Moutai Co. and Ping An Insurance Group Co. among the biggest drags. The S&P BSE Sensex Index declined as much as 1%, as Reliance Industries Ltd. and HDFC Bank Ltd. contributed the most to losses.

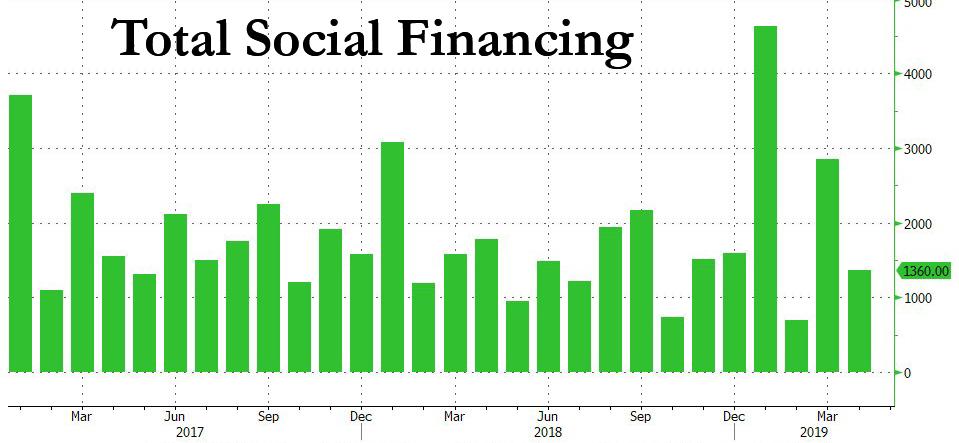

Further hurting sentiment was the latest credit data out of China, where April money and credit growth decelerated from the rebound in March, with new CNY loans and total social financing below expectations. Overnight, the PBOC reported that new CNY loans were RMB 1020bn in April, below the RMB 1200bn expected, while Total social financing increased only RMB 1360bn in April, well below the RMB 1650bn consensus. According to the PBOC, TSF stock growth was 10.4% yoy in April, vs. 10.7% yoy in March. The implied month-on-month growth of adjusted TSF was 9.2% SA ann, lower than 11.5% in March.

In addition to trade headlines, traders will also be closely watching the pricing on ride-hailing firm Uber’s initial public offering, which is set to be the biggest of the year so far.

In the currency market, the Japanese yen surged to a three-month high of 109.64 yen as one-week yen volatility surged to its strongest level in four months, while China’s yuan fell half a percent to hit a four-month low of 6.838 and was headed for its worst four-day decline in a year as Australia’s currency falls on weak China credit growth data. A hawkish Norges Bank saw the krone climb against the euro even as faltering risk sentiment and depressed oil prices limited gains after the central bank signaled a June rate hike. The pound was on track to wipe out last week’s advance against the euro as a Brexit deal resolution still proves elusive. Losses in sterling were limited as Prime Minister Theresa May earned a stay of execution from her Conservative Party.

In geopolitical news, following initial reports that North Korea had fired an unidentified projectile, further reports indicate this was likely 2 short-range missiles. Prior to the further reports, South Korea stated that it is unclear whether North Korea fired single or multiple projectiles.

In rates, Treasury 10-year notes jumped due to the escalation in risk-aversion, just hours after Wednesday’s auction saw the weakest demand for the benchmark bond in a decade. The yield spread between three-month U.S. government bonds and the 10-year notes shrank to 3 basis points, compared with about 15 basis points a few weeks ago. The spread first turned negative in late March, spooking investors, who read the development as portending a recession. The benchmark 10-year Treasury yield stood at 2.4529%, having touched its lowest level in five weeks of 2.426 percent on Wednesday before an especially poor 10Y auction sent the yield surging.

Commodity markets also felt the U.S.-China trade strains according to Reuters. Brent crude futures dropped 0.6 percent to $69.92 a barrel, while U.S. West Texas Intermediate crude also retreated 0.6 percent to $61.75 despite a surprise fall in U.S. crude stockpiles. London copper hit its lowest in nearly three months, going as low as $6,111 a tonne.

Expected data include PPIs, trade balance, jobless claims, and inventories. Canadian Natural Resources, Hydro One, Dropbox, and Yelp are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.8% to 2,864.25

- STOXX Europe 600 down 0.8% to 379.05

- MXAP down 1.4% to 156.55

- MXAPJ down 1.8% to 515.76

- Nikkei down 0.9% to 21,402.13

- Topix down 1.4% to 1,550.71

- Hang Seng Index down 2.4% to 28,311.07

- Shanghai Composite down 1.5% to 2,850.95

- Sensex down 0.8% to 37,474.17

- Australia S&P/ASX 200 up 0.4% to 6,295.33

- Kospi down 3% to 2,102.01

- German 10Y yield fell 1.5 bps to -0.059%

- Euro down 0.07% to $1.1184

- Italian 10Y yield fell 0.4 bps to 2.243%

- Spanish 10Y yield fell 0.4 bps to 0.956%

- Brent futures down 0.3% to $70.15/bbl

- Gold spot up 0.3% to $1,285.02

- U.S. Dollar Index little changed at 97.58

Top Overnight News

- U.S. President Donald Trump declared China’s leaders “broke the deal” he was negotiating with them on trade, before adding that “it will work out.” Chinese state media warned that “fighting while talking” may become the new normal in trade relations with the U.S

- China’s credit growth slowed more than expected in April after record expansion in the first quarter

- North Korea fired at least one unidentified projectile Thursday, South Korean military officials said, in the country’s second test launch of weapons in less than a week

- The Bank of Japan will quickly consider additional easing steps if risks such as protectionist moves by the world’s two largest economies wipe out upward price momentum in Japan, its Governor Haruhiko Kuroda said

- U.K. Prime Minister won a reprieve from her Tory party after a key panel of lawmakers kept the rules on leadership challenges unchanged. May agreed to meet with the executive of the so-called 1922 Committee of Tory Members of Parliament next week to discuss her future

- Theresa May earned a stay of execution from her Conservative Party after a key panel of lawmakers kept the rules on leadership challenges unchanged, as talks with the opposition Labour Party to find a compromise on Brexit gained new life

- The U.S. Treasury on Wednesday saw the weakest demand for its benchmark 10-year note in a decade, illustrating the diminishing appetite among some investors to accept current yields

- Trump issued an executive order on Wednesday prohibiting the purchase of Iranian iron, steel, aluminum and copper, ratcheting up tensions with the Islamic Republic less than a day after it declared it may begin enriching uranium again in two months

- House price growth in the U.K. remained weak in April as the slump in southeast England and London depressed the market, the latest survey from the Royal Institution of Chartered Surveyors showed

Asian equity markets were mostly negative as US-China trade uncertainty kept global risk sentiment cautious ahead of trade talks in Washington and as the region also digested a heavy slate of corporate earnings, as well as mixed Chinese data. Nonetheless, ASX 200 (+0.4%) was the exception due to corporate updates. Nikkei 225 (-0.9%) was weighed by currency effects and with individual stocks driven by a plethora of earnings releases, while Hang Seng (-2.4%) and Shanghai Comp. (-1.5%) were the worst hit on trade concerns after the US issued a notice confirming that tariffs will be increased on Friday and with China’s Mofcom mulling countermeasures. There was also some saber rattling from US President Trump who alleged that China broke the deal in trade talks and warned to not back down until China stops cheating US workers, otherwise the US will not do business with them. Furthermore, overnight data releases were mixed in which Chinese CPI printed inline and PPI topped forecasts, although lending data disappointed with both New Yuan Loans and Aggregate Financing below expectations. Finally, 10yr JGBs initially saw a mild upside on the risk-averse tone and with the BoJ present in the market focused in the belly. However, the gains were later pared amid mixed comments from BoJ Governor Kuroda who reiterated to continue with powerful monetary easing under YCC given that inflation is still below target, but noted that JGB purchases are slowing and suggested that even if BoJ bond purchases slow to JPY 30tln annually, it would not cause huge trouble.

Top Asian News

- Bahrain Is Set to Receive $2.3 Billion From Allies in 2019

- Singapore’s First 2019 Mainboard IPO Falls in Trading Debut

European bourses have succumbed to the risk aversion [Eurostoxx 50 -1.0%] seen in Asia and Wall Street, with the downbeat tone exacerbated by reports of further missiles tests in North Korea. Sectors are largely lower with the exception of defensive sectors such as Utilities (Unch) and Consumer Staples (+0.2%). A few themes are in play today; 1) a guidance cut by Intel yesterday has prompted a sell-off in European chip names with Infineon (-2.8%) and STMicroelectronics (-2.8%) shares plumbing the depths, albeit Dialog Semiconductor (+0.2%) is bucking the trend on the back of optimistic earnings. 2) Mining names bear the brunt of sentiment-subdued base metal prices coupled with ArcelorMittal’s (-3.9%) 33% drop in profits, thus Rio Tinto (-0.9%), Antofagasta (-1.3%) and Glencore (-1.8%) all weigh on the sector. 3) Against the backdrop of weaker auto earnings, Continental (-3.2%) also reported dismal numbers which dragged its peers Michelin (-0.9%) and Pirelli (-1.2%) lower in sympathy. Finally, Renault (-2.0%) shares declined amid press reports that Nissan could lower its 2022 guidance. Back to earnings, some analysis from JPM notes that thus far, 55% of the Stoxx 600 companies topped EPS estimates (vs. 76% in the S&P 500) whilst 58% of firms are beating on topline with sales growth at 1% Y/Y (vs. +5% Y/Y in the S&P 500), “This is consistent with our view that sales growth in Europe would underwhelm relative to the US, given the weaker macro momentum in the region” JPM says.

Top European News

- Continental AG Sees China Auto Rebound Boosting Second Half

- Norges Bank Says It Will ‘Most Likely’ Raise Rates in June

- Airbus 320 Makes Emergency Landing in Sweden After Cabin Smoke

- SocGen Introduces Crypto to $2 Trillion Market for Covered Bonds

In FX, demand for the Yen remains fervent and the Franc is also back in favour as tensions rise ahead of the US/China face-off in Washington, while geopolitical factors are also weighing on sentiment given the US-EU-Iran sanctions dispute and NK firing an unidentified projectile. Hence, Usd/Jpy has retreated a bit further from 110.00+ to fill/trip a few stops between 109.75-70 and test the top end of decent option expiry interest spanning 109.60-50, while Usd/Chf and Eur/Chf have pulled back from 1.0200+ and 1.1400 respectively.

- USD – Notwithstanding the greater appeal for safer-havens noted above, the Dollar retains a firm underlying bid vs the other G10s and especially EMs that are suffering in their own right. Indeed, the DXY continues to find support below 97.500 and its 30 DMA (97.398) with the index currently hovering in a 97.702-517 range.

- AUD – The major underperformer and most prone to the threat of a complete breakdown in US-China trade dialogue that would trigger an exchange of more aggressive tit-for-tat tariffs. Aud/Usd has recoiled from recent recovery highs towards this week’s multi-month low around 0.6963 and Aud/NZD has unwound more post-RBNZ spike gains to sub-1.0600 as Nzd/Usd holds more comfortably above 0.6550 and depths plunged in wake of Wednesday’s NZ rate cut. On that note, Governor Orr has reiterated that the policy outlook is now more neutral and it is too soon to assess if more easing is required ahead of testimony on the latest meeting and action to a parliamentary select committee.

- NOK – Staying with the Central Bank theme, but in stark contrast to the RBNZ, Norway’s Norges Bank flagged a hike at next month’s meeting and the Nok shot up across the board in response. However, gains were rapidly eroded and reversed at one stage amidst the aforementioned risk-averse tone before the Norwegian Crown regained bullish momentum on the fact that rates are set to rise against the general global grain of steady to easier policy. Eur/Nok is back under 9.8000, albeit just within 9.7784-8393 trading parameters and eyeing hefty expiry interest (1.1 bn) at the strike.

- EUR/GBP/CAD – All narrowly mixed vs the Greenback, but with a bearish bias below 1.1200, 1.3000 and only just over 1.3500 respectively. Eur/Usd has multi-bn expiries stretching from 1.1150 to 1.1200 and beyond to keep price movement contained along with the 30 DMA (1.1223) and interim chart support at 1.1155, while Cable has gleaned some traction around a Fib (1.2980) and ahead of the 200 DMA (1.2960), but needs to recapture the 100 DMA (1.3013) to revisit best levels of 1.3025. Back to the Loonie, Canadian trade data looms alongside house prices.

- EM – More widespread losses vs the Usd, but once again the Try is underperforming and has been down to through 6.2450 with the Lira lamenting another decline in Turkish foreign reserves.

In commodities, Brent (-0.5%) and WTI (-0.4%) prices are choppy, with prices initially subdued amid the general risk sentiment as markets await US-China updates and the most recent geopolitical developments being reports that North Korea has fired an unidentified projectile at 16:30 local time, although it is still unknown whether it was a single or multiple projectiles. Despite the recent price action being sentiment-driven, the macro picture still stands, with Iranian/Venezuelan sanctions, Libyan tensions and OPEC-led cuts still on the table. Thus, Barclays revised their Q3 2019 Brent and WTI forecasts higher by USD 4/bbl amid expectations of tightening market conditions. In terms of US supply, ING highlights that refinery run rate remain at a season-low at 88.9% last week amid a heavier maintenance season alongside several unplanned outages. Meanwhile, gold (+0.3%) has been accumulating some risk premium in light of the aforementioned developments in the Korean peninsula whilst conversely, copper is pressured by the humdrum risk tone emanating from the seemingly escalating US-Sino tensions and geopolitical concerns. Finally, China State Planner stated that strict pollution related controls will be imposed on steel-making capacity in key pollution area whilst also raising domestic iron ore production. It’s worth noting that earlier in March, a level 1 smog alert was issued which requires steel mills to curb production by 40-70%. Although, it is worth assuming that iron ore production will be hiked to offset volatility in the base metal. China’s State Planner state they will impose strict controls on steel-making capacity in key pollution areas.

Looking at the day ahead, we will get the April PPI report where the market consensus is pegged at +0.2% mom for the core. Expect there to be focus on the health care and portfolio management services components of the report as a read-through for the core PCE deflator. Away from that we’ll also get the latest claims reading and March trade balance print, followed later by the final March wholesale inventories revisions. Away from that we’re due to hear from the ECB’s Hakkarainen while over at the Fed, Powell is scheduled to speak in the early afternoon, albeit only opening remarks with no Q&A to follow. The Fed’s Bostic and Evans also speak today.

US Event Calendar

- 8:30am: PPI Final Demand MoM, est. 0.3%, prior 0.6%; YoY, est. 2.3%, prior 2.2%

- PPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%, YoY, est. 2.5%, prior 2.4%

- 8:30am: Trade Balance, est. $50.1b deficit, prior $49.4b deficit

- 8:30am: Initial Jobless Claims, est. 220,000, prior 230,000; Continuing Claims, est. 1.67m, prior 1.67m

- 9:45am: Bloomberg May United States Economic Survey; Bloomberg Consumer Comfort, prior 60.4

- 10am: Wholesale Trade Sales MoM, est. 0.55%, prior 0.3%; Wholesale Inventories MoM, est. 0.0%, prior 0.0%

DB’s Jim Reid concludes the overnight wrap

As US/China trade and Brexit talks looked increasingly more vulnerable yesterday at least here in the UK we had the first glance of a new royal baby to distract us. I was disappointed he was named Archie rather than Divock after Liverpool’s Tuesday night heroics which has still yet to fully sink in. As it stands I have a one-way flight to Madrid booked and no final tickets. I also haven’t run the idea of a weekend away watching football by my wife yet. I thought I’d work on this in stages. Flight out first (only tick so far), ticket second, flight back third, accommodation next (but I could camp) and then ask permission. No point asking permission and firing a bullet if you can’t logistically do it. If Liverpool’s performance was astonishing one would have to say Spurs also coming back from 3-0 down in the tie at HT against Ajax last night and winning on away goals deep in injury time was also remarkable. My long-time work colleague Nick Burns is a Spurs season ticket holder and entitled to final tickets and as I reserved him a flight to the final yesterday just in case I will assume he’s reserved me a ticket this morning. This morning could be the defining moment in his 2019 appraisal.

Outside of the knowledge of the craziness of sport, the last 24-48 hours has taught us that markets have no greater insight as to whether this week’s trade developments are just hardball from Trump or the start of a very real threat to the global growth narrative. If it’s the latter then you can’t help but feel that markets look extremely complacent at this point. However, if it’s just hardball negotiation en route to a deal then we’ll likely resume the rally. A big bid offer admittedly, but in the very short term, the risks probably look greater than the rewards as it feels unlikely that either side can back down in the near term. Maybe over weeks but not over the next few days.

At the time of writing, China’s top trade negotiator Liu He is flying over to Washington DC for talks with Lighthizer and Mnuchin. Time is not on China’s side though with tariffs due to kick in in a little under 24 hours after the Office of the US Trade Representative yesterday signed off that tariffs on $200bn of China goods are to be raised on Friday morning at 12:01 am ET.

In line with the back-and-forth newsflow, markets slipped between gains and losses before ending the US session slightly lower. Just four minutes before the Office of Trade statement in the late morning US time, President Trump tweeted that China were “coming to the US to make a deal” which appeared to at least hold some hope of optimism in markets. A bigger boost came after White House spokeswoman Sarah Sanders said that the White House had received an “indication” that China is ready to make a deal. Within half an hour, however, a commerce department statement from China said that “The US intends to raise the tariff of 200 billion US dollars of Chinese exports to the United States from 10% to 25% on May 10. The escalation of trade friction is not in the interests of the people of the two countries and the people of the world. The Chinese side deeply regrets that if the US tariff measures are implemented, China will have to take necessary countermeasures.”

Overnight, while addressing a rally in Panama City Beach, Florida, President Trump has said that China’s leaders “broke the deal” he was negotiating with them on trade and added there’s “nothing wrong with taking in $100 billion a year” in tariffs on Chinese imports, in the absence of a trade deal. However, he also said, “they come in tomorrow and whatever happens, don’t worry about it. It will work out. It always does.” Elsewhere, the WSJ has reported that China’s Vice Premier Liu He is not carrying the title of President Xi’s “Special Envoy” while visiting the US for trade negotiations and this means that he cannot make any big concessions. China’s Global Times is also reporting this morning that China won’t flinch in the face of a tough-talking US and is likening the trade talks to a “Banquet at Hongmen”, a Chinese reference to a historical event that took place in 206 BC at Hong Gate and implies a treacherous situation. So emotions and rhetoric are being raised in both sides. It should be worth watching China’s regular ministry of commerce briefing at 03:00 pm Beijing time (08:00 am London) to get further insight into the situation.

All nice and straightforward then. The end result to the conflicting headlines yesterday was a bit of volatility for the S&P 500 just before Europe went home, opening -0.37% lower before rallying to +0.47%, but ultimately closing -0.15% after a sharp late drop. That leaves May’s returns at a still pretty mild -2.24% though considering all that has gone on. The VIX touched an intraday high of 21.74 yesterday though – a level it hasn’t closed at since January 3 – before ending at 19.92, trading in a range of 3.5pts. That’s the third consecutive day with a range of over 3pts, the first such stretch since January 4. The NASDAQ fell -0.26% and the DOW traded flat (+0.01%), while in Europe the STOXX 600 finished +0.15% after spending the bulk of the session in the red.

Meanwhile, bond markets couldn’t quite make their minds up yesterday with 10y Treasury yields rising +2.7bps, +5.9bps off the morning low but 2bps lower again in Asia. The 3m10y curve steepened +1.9bps yesterday, taking it back to +5.8bps after flirting with another inversion over the last few sessions. The 2y10y is still hovering around 18.3bps and the reality is that this has been in a broad 10-20bp range ever since December. Bunds have been more of a beneficiary of the risk-off moves, hitting an intraday low of -0.065% yesterday before closing at -0.044% as risk rallied back into the European close. For reference, the recent low mark for Bunds was -0.095% on an intraday basis back at the end of March. BTPs have been caught up in the broader risk off move – with the recent budget headlines also not helping – though they retraced their +7.7bps intraday move yesterday to end the session flat. Elsewhere EM FX traded flat overall, with the Turkish lira again underperforming (-0.56%) as the government announced plans to re-hold the Istanbul elections. Balancing this was a +0.26% rally by the South African rand, as the country held national elections yesterday, with the results due this morning.

This morning in China we saw the release of April aggregate financing data which came in at CNY 1,360bn (vs. 1,650bn expected and 2,859.3bn last month) with new loans standing at CNY 1,020bn (vs. 1,200bn expected and 1,690bn last month). Weakness in China’s credit data along with the possibility of further escalations in the trade war is continuing to weigh on Asian markets with the Nikkei (-1.01%), Hang Seng (-1.95%), CSI (-1.90%), Shanghai Comp (-1.35%), Shenzhen Comp (-1.03%) and Kospi (-1.67%) all down over -1% alongside most Asian markets. China’s onshore yuan is down -0.39% to 6.8090, the weakest since January. Other EM Fx is also trading weak this morning with the exception of Turkish Lira which is up +0.37% while the Korean won is leading losses (-0.56%). G10 Fx is also weak with the exception of the Japanese yen which is up +0.14%. Elsewhere, futures on the S&P 500 are down -0.53% and crude oil prices (WTI and Brent both down -0.74%) are also weak. In terms of other data releases China’s April CPI came in line with consensus at +2.5% yoy while PPI stood at +0.9% yoy (vs. +0.6% yoy expected).

In other news, cross-party talks between the Conservatives and Labour continued yesterday but finding common ground remains elusive. In the meantime, the BBC has reported this morning that Labour Party’s Jeremy Corbyn is set to launch his European elections campaign later and will say that the party backs “the option of a public vote” if a “sensible” Brexit deal cannot be agreed and there is not a general election. Elsewhere Prime Minister May looks set to survive for at least another week as the 1922 committee failed to agree on any changes to Conservative party rules at this week’s meeting. The 1922 head Graham Brady said he expects May to hold a vote on the Withdrawal Agreement Bill next week, which could possibly still leave time to exit the European Union before the European Parliament elections but that is looking very very unlikely.

Back to the US and Fed Governor Brainard made some headlines yesterday by expressing interest in a form of yield curve control as a future policy option. She said, “we might turn to targeting slightly longer-term interest rates — initially one-year interest rates, for example, and if more stimulus is needed, perhaps moving out the curve to two-year rates.” This would potentially allow the Fed to better signal how long it plans to keep rates low. Such tools could be needed in a future recession if short-term interest rates again approach zero.

Oil prices rose +1.101% before this morning’s fall as tensions between the US and Iran continued to intensify and the outlook for Iranian oil exports continues to darken. First, Iran announced that it is also withdrawing from the nuclear deal, following the US’s move exactly one year ago. While the Iranian government did not declare an intention to renege on all the deal’s elements, they did announce their plans to resume stockpiling low enriched uranium and heavy water and signaled that they would resume construction of a closed reactor if Europe fails to compensate for the US’s unilateral sanctions. That comes after news that Europe’s mechanism to avoid US sanctions, which reportedly would have allowed Iran to export more oil, will actually only apply to food and humanitarian aid. Finally, the US administration followed up by adding new sanctions to Iran’s iron, steel, aluminum, and copper industries.

Before we wrap up, the data yesterday included a better than expected March industrial production print in Germany (+0.5% mom vs. -0.5% expected) albeit somewhat offset by downward revisions to February. In the UK the Halifax house price index rose +1.1% mom in April and more than expected. US mortgage applications rose +2.7% last week, the first rise since March.

Finally to the day ahead, where there are no data releases due in Europe this morning however in the US this afternoon we will get the April PPI report where the market consensus is pegged at +0.2% mom for the core. Expect there to be a focus on the health care and portfolio management services components of the report as a read-through for the core PCE deflator. Away from that, we’ll also get the latest claims reading and March trade balance print, followed later by the final March wholesale inventories revisions. Away from that, we’re due to hear from the ECB’s Hakkarainen while over at the Fed, Powell is scheduled to speak in the early afternoon, albeit only opening remarks with no Q&A to follow. The Fed’s Bostic and Evans also speak today.

0 Comments