This article was contributed by James Davis with Future Money Trends.

This past trading week alone, from Monday through Friday, silver’s SPOT PRICE (yeah, the one manipulated down for years) rose by 17.80%.

I celebrated my 39th year on this planet recently, so I wasn’t ALIVE when silver saw a similar move – it was 40 years ago.

As it stands, silver has hit a 7-YEAR HIGH!

Courtesy: Zerohedge.com

Most people will say that we’re definitely entering a bubble after a move like that, but they DON’T UNDERSTAND the dynamics of the silver market.

Future Money Trends believes that silver prices above $22/ounce are a given for at least another 12 months.

In other words, silver miners are WORTH MUCH MORE than their current prices.

We will be covering THREE new stock profiles in this sector in the weeks ahead. The miners are the absolute BEST STRATEGY right now since the spot price doesn’t need to MOVE AN INCH from here and they’ll still be making a lot of money.

Most people will also assume that we’re definitely going to EXPERIENCE A CORRECTION after this type of move. They’d be wrong for the second time in a row.

This move has confirmed a trend that actually lowers the risk of betting on silver.

The thing is that its upside potential is $3, up to $26, judging by its long-term chart analysis that we presented last week, while its downside is $1.20, so the risk/reward on the metal ISN’T GREAT.

This is ANOTHER REASON, perhaps the chief one, to bet on the silver stocks instead of the metal itself.

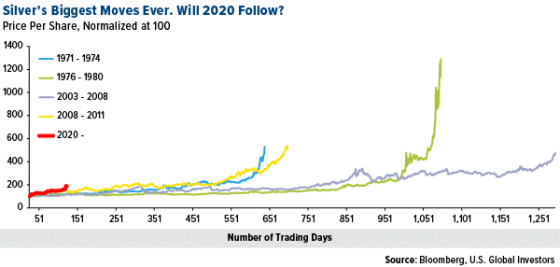

Courtesy: U.S. Global Investors

By no means am I UNDERESTIMATING SILVER. Profits from silver helped me fund my honeymoon in 2011, so I owe it lasting gratitude, and as you can see from the chart above, silver HAS NEVER had a bull market that didn’t end in a HOCKEY STICK-SHAPED top, or less than a 400% gain, so if we calculate $12/ounce as the starting point, our long-term target ought to be $48/ounce.

I’ve lost any shred of hope that the global monetary system or its leaders have any idea what they’re ACTUALLY DOING.

The thing is that I’ve had ZERO FAITH in them since 2006 when I first bought gold for $640/ounce. Many millions of MAINSTREAM INVESTORS, which are the majority of the population, are now sitting at home during the pandemic and learning all about the things that we’ve known for years.

Last week, a private real estate fund that I’m a client of, called to pitch me a deal in TX through its representative salesperson. After 20 minutes of going through all the various details, which included BUYING IN at half off, I turned it into a more casual conversation by asking what she had been doing with her time at home.

Nothing prepared me for what came next. She began to tell me about the Federal Reserve not being a government entity and talked about the Rockefellers and the Bohemian Grove.

This is a person that would never be interested in these topics unless she (1) had some free time and (2) felt upset about what’s happening in the world.

Similar to 2008, COVID-19 is BIRTHING a new class of DISSATISFIED PEOPLE who understand that they’re being played.

These people are as EXCITED ABOUT silver as you were when you first learned about it.

My point is that while you may have lost your silver virginity in 2010, many NEW INVESTORS are looking at it and thinking that it is currently 50% below its 2011 price.

The trend is VERY STRONG!

0 Comments