This article was contributed by Lior Gantz of The Wealth Research Group.

This TICKING TIME BOMB cannot be defused any longer. While government and central banks are PUSHING THE LIMIT on what sort of debts and currency excesses the global economy can tolerate and withstand, every additional experiment is leading us closer to the BREAKING POINT.

Governments are telling us that, besides serving as a TRANSACTIONAL TOOL, you’d be a fool to store wealth in cash, plain and simple.

They’re ENCOURAGING you to be in real estate, bonds, stocks or in precious metals, but NOT TO BE in fiat currencies.

Not that they want us to all go out and spend, but they are absolutely INTENT ON delivering the message that fiat currencies are not EFFECTIVE at measuring one’s purchasing power.

Therefore, the Covid-19 response from government serves as a PIVOTAL MILESTONE.

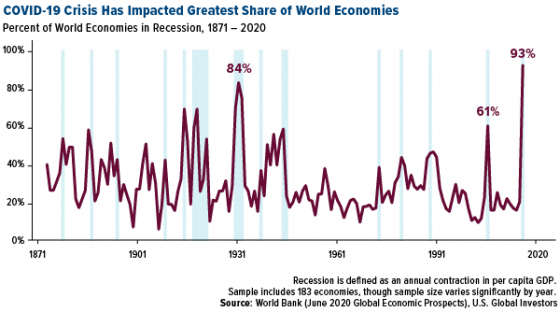

Courtesy: U.S. Global Investors

The global economy is more INTERCONNECTED than at any other point in human history. Literally, if damage is sustained in the U.S., everybody feels it. The same goes for China and to a lesser extent with Japan.

Germany and other large markets are also DOMINANT ENOUGH to impact other regions; the planet is one vast economy in many ways.

As you can see above, no country has been LEFT UNSCATHED by Covid-19 and the more important question is which industry can LEAP IN FRONT first.

The way currency is created is so weird that my BIGGEST CONCLUSION is that no one can predict how it behaves.

There are just TOO MANY variables. In fact, in Forex trading, 93% of brokerage accounts show a NEGATIVE RETURN. It is simply a FOOL’S ERRAND to try to nail currency swings over time.

What’s certain, ABSOLUTELY CERTAIN, is that precious metals are superior stores of value for savings than fiat currencies.

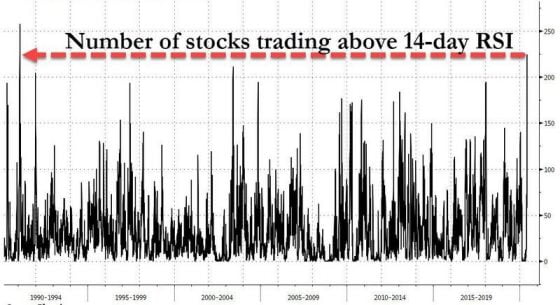

Courtesy: Zerohedge.com

Buyers, as you can see by their bullish stance, have forgotten what INVESTING MEANS, in our opinion – they haven’t been this bullish since 1991!

How do you price a business? What determines the price of stocks and the S&P 500 or the NASDAQ 100, for that matter?

VARIABLES IN DETERMINING STOCK PRICES

When an individual or an institution is looking at risking a given amount of present purchasing power, the goal is to OWN an instrument (private/public business, land/house/warehouse, bond, commodity, etc…) that can APPRECIATE in value.

Many assets can APPRECIATE in value, but some do it more predictably and more consistently than others, which make them safer and, FOR THE MOST PART, more expensive, as a result.

Safety has a premium attached to it, which is the reason the best businesses are rarely priced at a large discount.

In other words, the first determinant of price is RISK. Next in line comes the variable of alternative choices. If there are many assets that can produce HIGH RETURNS, an abundance of them makes them cheaper. In other words, RARITY AND SCARCITY determine price.

Third and very important, is the MANDATORY DEMAND in an asset class. In the stock market, for example, we know that pension funds and sovereign wealth funds MUST BUY stocks, so it creates an ARTIFICIALLY-HIGH demand for them.

To summarize, risk, supply/demand, alternatives, and regulatory compliance are the big picture components. They derive prices for assets, globally.

Lastly, the SIZE OF A MARKET is critical. In the world’s largest markets, there are far more buyers/sellers and that helps to PROPERLY PRICE assets since they are liquid. Therefore, liquidity is the fifth Big Picture factor.

The above five are what I call LOGICALLY-DRIVEN variables, but they’re not the MOST POWERFUL ones; instead, there’s one GRANDDADDY of them all and it is called FEAR.

It distorts data and makes buyers/sellers act in a way that doesn’t MAKE SENSE.

Most people invest much more as a result of fear, or lack thereof (meaning greed) than with PURE DATA.

Right now, the data shows that the RISK posed to businesses due to uncertain industrial conditions is MASSIVE.

Therefore, we anticipate more DOWNSIDE-VOLATILITY.

The last time this occurred, we were ready and CAPITALIZED NICELY, using our watch list of blue-chip companies that we follow, provided with limit orders.

I’ve just created a NEW ONE, which you can access HERE.

With the PANIC to the healthcare system out of the way, companies are now busy understanding their clients in the NEW REALITY.

The process won’t be without friction, so anticipate some BACKFIRE. When that happens, look at THIS LIST.

0 Comments