This article was contributed by Portfolio Wealth Global.

For months now, the theme has been that the economy is heating up.

If you free-search the term “Overheated Economy,” tons of articles, showing packed malls and fully-booked resorts appear.

The notion that bond yields are going to keep rising and that the FED must tighten soon is flawed in the eyes of FED Chair Powell.

If he’s wrong, the gloom-and-doom crowd believes inflation will get out of hand.

I want to show you Powell’s arguments that inflation will not rise above the 2.2%-2.4%, where the FED wants it to be for the next few years, and then I’ll show you where Powell could be wrong.

WHY DISINFLATION IS LIKELY

Disinflation doesn’t mean deflation. It means that inflationary expectations aren’t met.

It means that deficit spending and unsecured government debts are not going to cause a worst-case scenario, despite the in-your-face emotional rants of people who despise them.

Here’s why Powell believes disinflation (2.2%-2.4% long term) is more likely:

- Supply Chain Congestion: This is a big one. His reply is that any supply chain matters are fleeting and will be resolved. I agree. The capacity to manufacture in today’s world is nearly inexhaustible.

- Technological Boom: A crucial point is that breakthroughs in technology are making our lives much more affordable.

If I think about twenty years ago when people wanted to chat with a friend of theirs, while riding the bus, the SMS technology was expensive!

A text message used to cost a fortune. If I tried to live the same life I did twenty years ago, my life would be 50% cheaper than it is right now, so technology is driving prices down.

- Mature Economy: No robust economy with a long-standing currency system has ever suffered from crazy inflation.

It is true that all fiat currencies in history have gone to zero, but it’s also misleading since the population had ample time to exchange the old currency for the new one before the old expired into nothingness.

- Competitive Global Economy: In the 1970s, America was the clear dominator and no one else was even close. Today, the ability to produce and manufacture is uncanny and before companies raise prices, there better be a very good reason for it.

- Phillips Curve Theory Failed: In the last few years, we saw unemployment levels in the U.S. go down so much, yet inflation never became an issue. The jobs market was so tight that people were quitting left and right and companies still didn’t raise wages by that much, since they looked outside the U.S. for talent.

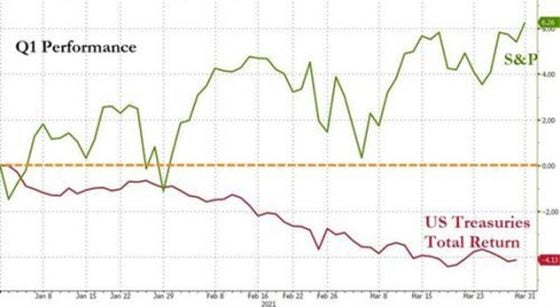

Courtesy: Zerohedge.com

Bonds have clearly been a horrible asset to hold in 2021, but with the 10-year bond dishing out 1.714%, as I write this, get inside the head of a pension fund manager, with billions to deploy and a mandate that he must hold government bonds.

He looks at the available supply of bonds and sees that in Europe, every government will borrow from you, but none of them will pay anywhere near what Washington will and some might even charge you interest!

Inflation might not become a pressing issue, so don’t bank your livelihood on hyperinflation.

Instead, take baby steps and do what’s right for you today, with the available information at your disposal, not with some theory that 51 years after we’ve gone on the fiat currency system, suddenly everyone will treat it like a house of cards.

It might not happen…

Creationists believe the Earth was warped through catastrophic forces, and may end, at any time, according the doctrine of imminency.

But, elitists live in a perfect state of emotional security.

afaic, productive countries, factories, mines, machines, and workers can be retired, for no particular reason, whether that is to cover some fake, legal fee, or to maintain their perpetual balancing act between hoarding and waste.

The power to balance is still absolute tyranny.

Do we really believe that irrational exuberance can continue with no repercussions? Do we believe our currency can metaphorically be printed into oblivion with no consequences? Does this banking & stock market centric model (MMT) have no limits?

Sure, lots of folks are heavily invested in the status quo, but I suggest there is a problem with SUSTAINABILITY.

I’m not a money manager like this “contributing author”, but I wouldn’t invest my money with him. He says it costs 50% more to live his lifestyle today than it did 20 years ago, then attributes that to technology.

If he’s a money manager he should have heard of the Rule of 72. Applying the Rule of 72 at 2% (the low end of his inflation assumption) you get a doubling in 36 years. This means a 50% increase occurs at 18 years…or 2 years less than his scenario. So just pure inflation caused the increase, not technology.

The whole intention, in the first place, was to prevent against booms and busts, in the short term.

Since they penalize other sectors, or fund liquidity in bonds, maybe, he thinks it’s not “pure” inflation.

Part of peoples’ incredulity is thinking it’s comes out of the blue.

I think, the way money acts, is akin to matter and energy, which is never conventionally created nor destroyed, just takes on different forms.

Money can take on different forms, such as credit, or currency, but it is all created at the point of the loan. It is a debt based system. It is entries in a bank ledger… an entry on the bank side as an asset and an entry on the borrower side as a liability. It can also be created as credit on a card (same ledger entries).

Where it all goes awry is when interest is added to the credit, or mortgage, or loan. Say you take a $500,000 30 year mortgage out with a 3.75 % interest rate. You would pay over $333,000 in interest over the life of the mortgage. Where does this interest come from? The borrower must get it from someone else who has borrowed it into existence in order to pay it back. He can get it by working, but it still was borrowed into existence.

So the whole M2 money supply (debt supply) must constantly grow in order to pay the banker usury. It is why the debt of the world constantly grows. Notice how the Fed has stopped updating the M2 chart (it was looking like a hockey stick). M2 will never shrink until there are too few resources left to back up the rolling debt. Then, it means worldwide collapse.