This article was contributed by James Davis with Future Money Trends.

Nothing stays idle, but especially not these kinds of markets, WHERE THEY presently stand.

The Coronavirus has, from an economic perspective, TRIMMED THE FAT, leaving the S&P 500, NASDAQ and Dow Jones indices in their MOST CONCENTRATED stance ever!

Never in the history of the public markets have so few companies been so valuable, compared with the whole range of them.

This phenomenon is referred to as low MARKET BREADTH and it is best shown in the A/D line, which is short for Advance/Decline line.

The line basically measures HOW MANY component companies are shrinking in terms of market cap, versus how many GROW THEIRS in any given time.

Courtesy: Zerohedge.com

Just in the PAST FEW DAYS, it was plain to see how these performances of 495 components of the index behave, as opposed to the BIG FIVE – this is the divergence on FULL DISPLAY.

History doesn’t tell a bullish story on what comes after such RARE DISPARITY, since it mostly happens right before the biggest market tops of our times – but I HAVE MY DOUBTS this time.

We must consider the circumstances in which we find ourselves and remain OPEN TO THE POSSIBILITY that we’ve never entered a recession when leverage was this low, as in this case.

In recessions, there’s typically a BLATANT MISMANAGEMENT of the balance sheets in one or more industries. Clearly, this time around, there was very little of that.

The banking sector, for example, wasn’t leveraged whatsoever. Banks didn’t even REQUIRE A BAILOUT.

This is important, since it means the banks aren’t RUSHING TO DELEVERAGE, and they’re able to renegotiate terms of payment for borrowers, even delaying payment altogether.

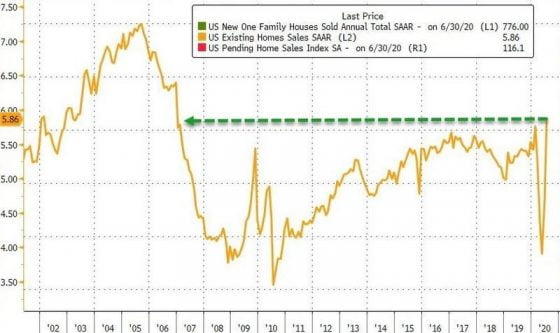

Think of the number of people who will now have a POSITIVE EXPERIENCE with their bank – it will CARRY WEIGHT and allow millennials to feel safe and HAVE TRUST in their next few dealings with the banks, just as they want to BUY HOMES.

Courtesy: Zerohedge.com

In 2020, I’ve personally invested more funds in real estate than ever before. Since the Covid-19 outbreak, with many real estate segments ON THE HOOK, such as office buildings, parking lots, casinos and hotels, malls and recreational parks, the number of opportunities one can access IS MASSIVE.

Debt on notes is ranging 8% to 10% and with all these funds CHASING FEWER DEALS, multifamily complexes that are collecting rents in states less hard-hit, as well as companies constructing single-family homes in suburbs, the Return-On-Equity could yield 12%-16%, comprised of 6% cash flow and 10% appreciation.

This money is INCREASING in VELOCITY.

I have my doubts on whether or not the economy is in a “W”-shaped recovery, with a second recession underway, as many predict.

For that reason, I cherish diversification and implement ways of GENERATING RETURNS in private equity, which doesn’t fluctuate as much as the public markets do.

No one has all the right answers, but what we do see, by speaking with large funds and CEOs, is that there’s AVAILABILITY TO CREDIT.

To me, this means, first and foremost, that the worst is behind us. There’s trust and trust is the FIRST STEP towards better days.

Markets won’t stay here. 495 businesses will either recover, sending the index MUCH HIGHER, or they won’t, in which case the BIG FIVE won’t be able to carry the weight for long.

0 Comments