When former Federal Reserve Chairman Ben Bernanke was questioned by Ron Paul during a 2011 monetary policy report, he famously told the Congressman that gold is not money and the only reason central banks hold it is because of “long-term tradition. ”

Bernanke’s comments have since been cited by financial pundits as expert advice on why precious metals investments should be considered no different than other traditional investments like equities or bonds. Suggesting they may be a safe haven asset or that there are thousands of years of evidence supporting the claim that gold and silver are money are often laughed at and marginalized.

But if gold and silver are not real money and they are not safe haven assets, then why did the central banks of Switzerland and Norway just print $2 billion dollars in currency and immediately move that paper currency into gold mining companies?

Because they obviously know how risky and experimental these policies really are, they are now jumping ship and leaving us this colossal debt load to suffocate on…

The Swiss central bank has taken this to the next level and recently disclosed a massive one billion dollar position in mining stocks… these 25-plus companies… as a result shot up 400% to 600% this year alone.

Here is the list of gold related holdings owned by the Swiss Central Bank:

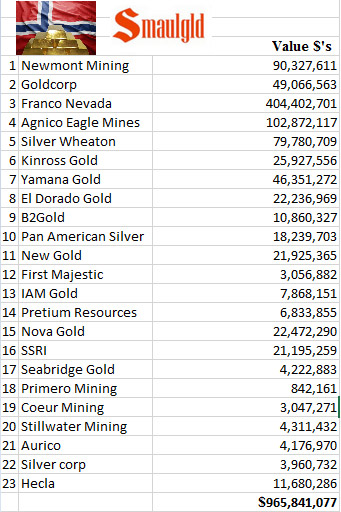

And the Swiss aren’t alone. Norway’s central bank has done the same thing. After initially trying to keep their holdings secret, an amended 13F shows that they, too, spent $1 billion on gold and silver mining companies:

Norway’s Central Bank, Norges Bank has filed with the United States Securities and Exchange Commission (the SEC) a request that its Form 13F* for the period ended June 30, 2016, be given confidential treatment. The Norges Bank filed its 13F** with the list of its security holdings redacted.

…

This Amended Form 13F contained a list of equity securities held by the Norges Bank at then end of the second quarter of last year.

(Image Courtesy SmaulGld)

(Image Courtesy SmaulGld)

It’s been suspected for quite some time that central banks are actively taking positions in collapse-related assets like gold and silver. We now have confirmation that at least two of them have done it. There are likely more.

There can be only one explanation. Our monetary masters know without a shadow of a doubt that their policies will fail and they have lost confidence in their ability to stabilize the system.

Consequently, they, like billionaire investors and major financial institutions around the world, are rapidly shifting their worthless paper money into the world’s historical assets of last resort: gold and silver.

Small-Cap stocks that are takeover targets will be the next wave of Gold riches. Learn exactly how to identify them with this Special Report.

For more video reports like this one visit Wealth Research Group

0 Comments