This article was originally published by Tyler Durden at ZeroHedge.

What does Jamie Dimon know that we don’t?

Having tamped down his prior warnings of economic “hurricanes”, JPMorgan CEO warned, in an interview with the Times of India, that the world faces a worst-case scenario threat of stagflation and is unprepared for central bankers’ response (higher rates) to that outcome.

Addressing the risk of a hard- or soft landing, Dimon highlights the fact that “no one knows. There is a range of outcomes…”

“It will be affected by everything else – Ukraine, oil, gas, war, Europe,” adding that “I would be cautious.”

The most famous Fed whisperer fears the market’s false sense of complacency at a goldilocks outcome:

“I think we are feeling pretty good because of all the monetary and fiscal stimulus. But it may be a little more of a sugar high. We have to deal with all these serious issues over time, and your deficits can’t continue forever. So rates may go up more. But I hope and pray there is a soft landing.“

The JPM CEO warned that rates may need to rise further to fight inflation, highlighting the fact that the difference between 5% and 7% would be more painful for the economy than going from 3% to 5% was.

“First of all, interest rates went to zero. Going from zero to 2% was almost no increase.

Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility.

I am not sure if the world is prepared for 7%.

I ask people in business, ‘are you prepared for something like 7%?’ The worst case is 7% with stagflation.

If they are going to have lower volumes and higher rates, there will be stress in the system.

We urge our clients to be prepared for that kind of stress.

Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out.

These 200bps will be more painful than the 3% to 5%.”

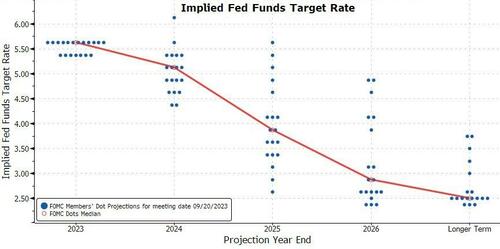

Certainly, The Fed and the market are not expecting rates to go much higher from here…

Are Dimon’s comments an open acknowledgment that inflation is not going anywhere and laying the foundation for The Fed’s recent hawkish tone to escalate? Certainly, it would be a problem for the unprepared.

“When rates go up sharply, there is stress in debt repayments. How are businesses living with such high rates?”

“The world is certainly not prepared for a 7% Federal Reserve funds rate,” Charlie Jamieson, chief investment officer at Jamieson Coote Bonds, told Bloomberg Television on Tuesday.

“At that level we would expect that we would have a deflationary asset unwind, it would burst a lot of asset bubbles, it just simply wouldn’t be sustainable.”

Additionally, and away from the main headlines, Dimon commented on the state of the banking system, dismissing claims that the recent crisis was triggered by social media-driven runs:

“I think that is being blown out of proportion. Social media and online banking existed during the great financial crisis.”

Given his warnings above on rates, he sees more pain ahead…

“The problem of interest rate exposure was known to everyone. I do not think we want a system where no bank ever fails. So, having a bunch of failures is not a terrible thing. But if it causes havoc in the system, we have to modify regulations to stop that from happening.”

And guess who would be more than happy to step in and scoop up all those deposits?

It's almost time for another small bank failure so Jamie Dimon can soak up all their deposits. pic.twitter.com/lDCcC5eTaH

— zerohedge (@zerohedge) September 22, 2023

Perhaps Dimon does know something that many in the market refuse to accept (and with regional banks utilizing over $108 billion in emergency funding from The Fed to fill their balance sheet holes, JPMorgan may be about to get even ‘too bigger to fail’).

Dimon went on to give a lengthier interview with CNBC:

0 Comments