This article was contributed by James Davis of Future Money Trends.

On Sunday, I wrote the first of two WARNING ALERTS about the stock market. Today, I am publishing the second one. My message boils down to this: as of right now, the S&P 500, the NASDAQ 100, and the Dow Jones Industrial Average are EXPENSIVE.

The chief reason for this is the LACK OF VIABLE ALTERNATIVES for generating returns in a ZERO-RATE world.

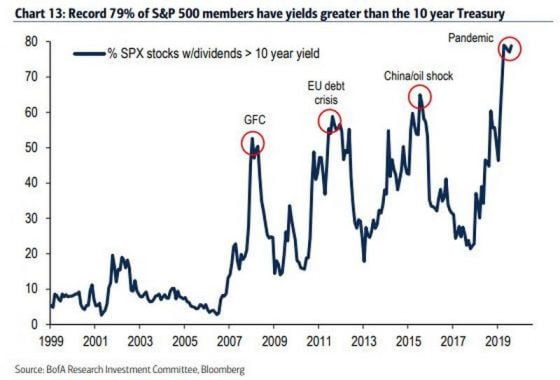

This is factored in, but some people still SHAKE THEIR HEADS in disbelief regarding how much the markets have extended themselves, so here’s some perspective as to how much more expensive GOVERNMENT BONDS are than stocks:

- A 10-year U.S. Government Treasury bond is GUARANTEED to lose income since it yields 0.65%. As a whole, the G-10 governments offer less than 2%. On the flip-side, the S&P 500 has a P/E ratio of 27, which implies an earnings yield of 3.7% (100/27). Add the dividend yield of 1.7% and the “lack of judgment” on the part of investors becomes clear: STOCKS are better than BONDS. It’s not even a question. Given the choice, I’d buy an index fund over a bond any day of the week.

- The RISK FACTOR with bonds and stocks has changed. Bonds used to be looked at as ULTIMATE SAFE HAVENS, but fewer and fewer people ASCRIBE A PREMIUM to a government than to the world’s best businesses.

Can anyone really say that they are more concerned about the future prospect of a company like Google or Starbucks than with Washington? To me, the safety that some companies have in their brand’s loyalty is bulletproof.

Some businesses are bigger, better, and more resilient than most of the world’s treasury departments.

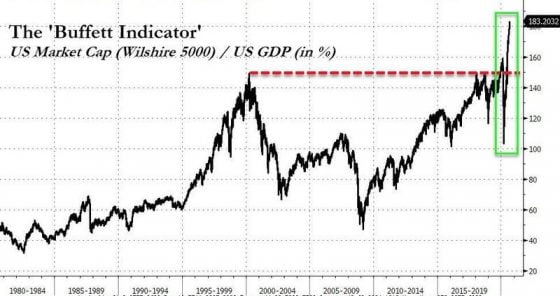

Courtesy: Zerohedge.com

But, as much as I think that a basket of high-quality stocks are more attractive than bonds, I also have to say that GOLD STOCKS beat the traditional equities right now!

No matter how I spin it around, I love the resource sector’s health, strength, corporate behavior, and I MOST LOVE the fact that the product it sells is in HIGH DEMAND and its price is in a bull market.

Since June 2019, this newsletter has profiled more than TEN OPPORTUNITIES that have doubled in price or more. One company is up close to 400% and another is close to 300%, yet I feel that it isn’t the end of this.

In September, some of this EUPHORIA MODE with retail investors will die off.

No one knows how SEVERE IT will be, but any LOSS OF MOMENTUM would immediately shine a light on gold again.

Courtesy: Zerohedge.com

As you know, Warren Buffett is buying stocks, so he clearly knows that he can’t KEEP WAITING for lower valuations like in the last few decades because we live in a DIFFERENT REALITY.

The point is that stocks do look more attractive than bonds, but the resource sector is the MOST UNDERVALUED within the major industrial sectors.

Any weakness exhibited by the S&P 500 will serve as a MIRROR OF CONTRAST to how good gold companies have managed their BALANCE SHEETS.

Don’t struggle with why stocks are so richly valued as an index:

- Either act as a STOCK PICKER, focusing solely on those that offer good value, OR

- Step outside of the general equities and look at the value in the resource sector!

When gold SURGES ABOVE $2,000/ounce again, this sector will ERUPT!

0 Comments