![]()

According to the CEO of one of the world’s top primary producers of silver, looming precious metals shortages could drive the price of gold to $5000 and silver to $100 over the next three to five years. Keith Neumeyer, who oversees First Majestic Silver and is also the Chairman of mineral bank First Mining Finance, says that with commodity prices in capitulation mining companies around the world are either reducing operations or outright shutting down, the consequence of which will be a supply crunch across the industry and a resurgence in precious metals prices.

And Neumeyer isn’t the only one who sees the trend developing. Well known investment billionaires like George Soros and Carl Icahn are rushing into gold. Soros is so convinced that a paradigm shift is in the works that after warning of financial collapse and violent riots in America he sold his holdings in major U.S. banks and allocated more of his portfolio into gold mining firms.

And here’s a little known secret Neumeyer shares in an interview with SGT Report – high net worth individuals aren’t just buying paper. Neumeyer says that the coin shortages being reported by national mints around the world are the result of direct buying of physical gold and silver from sophisticated market players:

I’m seeing the numbers coming out of the the Canadian Mint, Australian Mint and the U.S. Mint… the numbers are quite high for silver coins and to a lesser degree gold coins… I think, personally, that the commercials are buying them… I think that very sophisticated high net worth investors at banks and institutions are buying them.

Supply and demand fundamentals aside there appears to be another significant reason that major players like billionaires and central banks are shifting their holdings into precious metals.

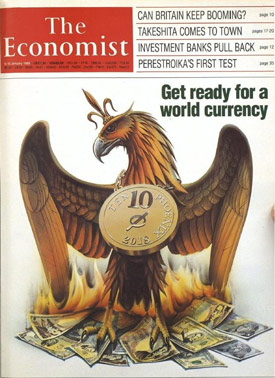

Citing a 1988 cover of The Economist depicting a phoenix rising from the ashes of the U.S. dollar while wearing a gold medallion with the date 2018 stamped on it, SGT Report asks whether insiders are now frantically acquiring precious metals ahead of a possible global currency reset or coming monetary crisis.

“I 100% agree with that,” Neumeyer responds without hesitation.

As an outspoken critic of the rampant manipulation he recently sent a letter to the CFTC noting that a small concentration of players were attempting to control the market.

But to what end? As noted in his interview, this isn’t the first time that big players vied for position ahead of major financial, economic or political changes.

SGT Report: Going back all the way to the Rothschilds… going back centuries. This is a playbook they’ve used time and time again. Drive down the price of the assets that they want to the point where the common man runs away from those assets because the common man can’t take any more pain…

Meanwhile these guys buy up those assets for pennies on the dollar… What you’re saying makes perfect sense… they’re driving down the prices of physical metals via their paper manipulation and at the end of the day they get to acquire the stuff they want in physical form at pennies on the dollar preparing themselves for what’s coming. I don’t think that’s too far off. I don’t think that’s really conspiracy theory. Do you?

Neumeyer: I think the financial crisis of 2008-2009 was completely orchestrated. I think it was known by the insiders… the banking insiders… possibly even the Federal Reserve itself knew what they were creating and knew that there was going to be a crash coming…

The same thing’s happening all over again. They’re driving down the metals and it represents another huge theft that we’re experiencing right now.

But Neumeyer says low prices won’t be around for long:

They’re doing this for a reason… We on the street here we can’t really know what’s going on behind closed doors and what the future’s going to be, but when you see these big governments doing what they’re doing you know there’s a change afoot.

…

This is why I put First Mining Finance together… I wanted to have a very gold-focused company as a result of my beliefs that gold is at lows and this is a buying opportunity of a lifetime. I wouldn’t be surprised to see $5000 gold in the next three to five years.

Are the actions of the world’s elite telegraphing that significant changes are on the horizon? If not, why would they be feverishly buying up a 6,000 year old relic that according to former Federal Reserve chief Ben Bernanke isn’t money and is held by central banks only because of tradition?

Also Read:

A Global Financial Reset Is Coming: ‘A Deal Is Being Made Between All The Central Banks’

CEO Warns Of Global Reset: “It’s In The Cards For Sure”

Massive Manipulation: “Real Producers and Consumers Don’t Appear to be Represented”

0 Comments