According to Kiplinger Economic Forecasts, a recession still looms, but it isn’t likely to happen until 2024. The rising interest rates have not culled public consumerism and spending, and that’s what is keeping the economy afloat.

Interest rates have soared, and short-term rates are much higher than long-term rates, a classic recession indicator. And yet, the economy keeps chugging along.

If a recession hits, it’s likely to come later than we and many forecasters once thought. The second half of 2023 seemed like a good bet. The first half of 2024 may see a downturn. Probably no sooner than that. Why not? Unlike in prior cycles of rising rates, the steep hikes implemented by the Federal Reserve are doing little to slow the economy so far. Normally, higher rates quickly curb demand for houses and automobiles, since they are typically financed. Declining sales lead to layoffs in home building and manufacturing, spooking consumers into spending less. Soon, a general dip in spending leads to a recession.

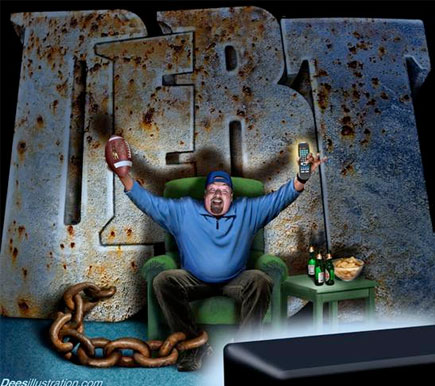

Americans are carrying much more credit card debt on higher interest-rate cards now than they were before. In this debt-based economic slave system we are living under, debt continues to propel the economy and keep a recession at bay.

Demand for cars and houses is up, in spite of much higher interest rates. Pent-up demand for cars dating back to the pandemic is still there. And since few homeowners are putting their homes on the market, opting to hang on to superlow mortgage rates that were scored during the COVID-19 scamdemic, the market for new homes is heating up. Builders are busy and hiring more workers if they can.

Growth will be slow through the rest of this year and well into next, even if we dodge an official recession. Continued slow growth likely means the Fed will keep hiking interest rates. At least two more quarter-point hikes seem likely. Inflation is falling, but too slowly. Only a recession would get Fed Chair Jerome Powell to ease up on fighting inflation. -Kiplinger

The downturn is likely delayed, but still imminent. Consumers will eventually have to face the repercussions of fueling the slave system with credit card debt. At some time, we will have to pay for it, and it’ll be in the form of another recession.

0 Comments