This article was contributed by Portfolio Wealth Global.

In 2020, prices of virtually all asset classes that we follow have gone up. We published five Watch Lists (1, 2, 3, tech, and 5), were bullish on gold, silver, and Bitcoin – which just hit a new all-time high of $27,000 – and bearish on the U.S. dollar, which is suffering from its worst year in a long time.

Due to money printing and lackluster global trade, the demand for dollars is weak. If global trade is slowing down, there’s not much need to buy dollars and, of course, if tourism is restricted, that is also a major headwind for dollar demand.

Courtesy: Zerohedge.com

In the meantime, if you’re a millennial or a Gen Z and are tying the knot or looking to own your home – since the government is willing to finance something in the order of 90% of it for 30 years at the lowest interest rate in history – you’re looking for any way imaginable to qualify and apply for a mortgage.

There’s literally no better deal in the history of deals than getting a mortgage for a home right now, which is the reason Portfolio Wealth Global believes that real estate prices, housing construction and the entire industry (as a whole) will continue to prosper, boom and employ Americans for years to come.

This year, the 30yr fixed mortgage hit sixteen weekly new lows, an annual record for the number of times it has done so in a single calendar year!

Next up Bitcoin; personally, I’d be cautious with Bitcoin. Portfolio Wealth Global first covered Bitcoin at well below $700, and over the years there have been opportunities to own it below $1,000 and $5,000, but its recent run is a testament to how fast sentiment changes with it.

We’re definitely cautious.

What about stocks? Are they in a bubble? Our answer may surprise you, but we’re bullish.

We’re actually about to release our sixth Watch List and do not believe there are many reasons to see a flat year in 2021.

Valuations are rich in some sectors and with certain names, but the world is dramatically changing and investors are betting heavily on the future. In other words, if you were waiting all of these years for the reset, you’re living through it.

It may not be just what you imagined, but these are pretty much the early stages of it.

Courtesy: Zerohedge.com

What about gold? Real rates bottomed right around the election and the vaccine announcement, and are headed in the direction of -1% and lower, which will send gold, in all likelihood, above $2,000/ounce in short order.

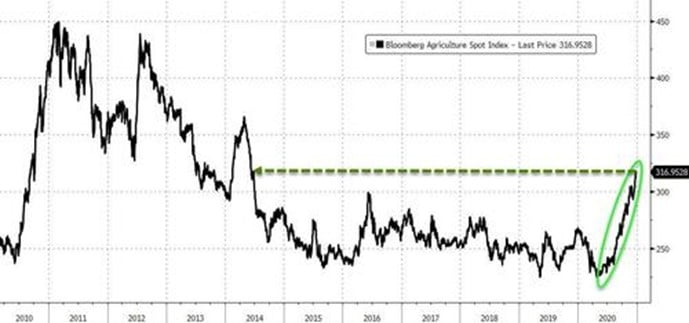

There are also clear signs of inflation, both with agricultural commodities, as well as with oil.

This is what the markets view as real-world inflation and our analysis is that 2021 will be better for silver than it will for gold. Both will do well (we forecast new all-time highs for gold), but with the right backdrop, silver could hit even $35 and $40!

Courtesy: Zerohedge.com

Clearly, the agricultural commodities have FINALLY bottomed after more than a decade and are on the rise.

If this trend is real, it will be impactful. Food and energy (oil is on the rise as well) are both items that people immediately sense in their pockets and connect with inflation.

Our conclusion is simple: it’s a recovery year, and people who are feeling the beginning of the end will rejoice and make decisions that will generate money velocity.

What all this money going into BTC equates to is a transfer of wealth. It will stay there until holders decide they want to buy the things.

As the average holder is younger, this may be good for RE.

A question is, along the lines of Hazlitt’s broken window fallacy, by placing wealth in BTC, where is it not spent?