This article was originally published by Tyler Durden at Zero Hedge

Back in 2017, when they were making their supportive case for Trump’s tax cut and offshore tax repatriation holiday, the largest US technology companies promised they would go on hiring sprees and boost the economy. Just over a year after getting what they wanted, fund flow data shows that – contrary to Goldman’s recent calculations – these firms gave most of their huge tax savings to investors in the form of buybacks.

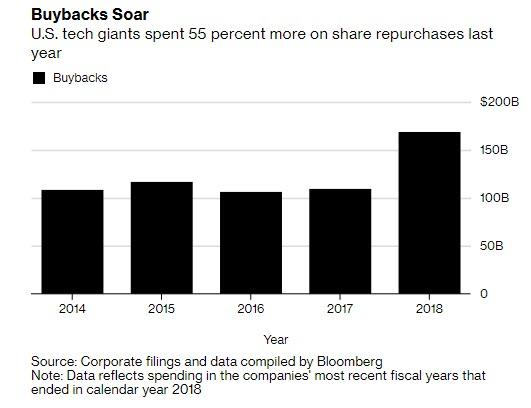

According to Bloomberg calculations, the top 10 US tech companies spent more than $169 billion purchasing their shares in 2018, a record 55% surge from the year before the tax changes. And, according to TrimTabs, the industry as a whole authorized the greatest number of share buybacks ever recorded, totaling $387 billion: more than triple the amount in 2017.

While many analysts have been writing countless research reports in recent weeks defending the practice of stock repurchases, which as “the most important trader on Wall Street” recently explained was illegal until 1982 due to “market manipulation” concerns, the truth – much to the chagrin of banks like Goldman which has written no less than three report in the past month defending stock buybacks against a legislative onslaught that seeks to curb or ban outright corporate repurchase, the truth is that while buying back stock is great for shareholders and company executives as it boosts a company’s earnings per share and increases the value of the holdings of shareholders, including insiders whose compensation is frequently linked to stock return, stock repurchases do little if anything for the economy, especially when compared with other potential uses of that money, including hiring more workers.

When Trump signed the Tax Cuts and Jobs Act into law in the final days of 2017, it cut the corporate tax rate to 21% from 35%, while offshore profits could be repatriated at a special rate of 15.5%, and was meant to encourage companies to bring the money back to the U.S. Once back, the theory went, the companies would invest it domestically, boosting the economy.

They did not. Instead, much of the proceeds were spent on buybacks.

Overall, US companies ended up saving 30% in tax expenses overall in 2018, according to ITEP, and as we have reported on numerous prior occasions and Bloomberg noted over the weekend, “Tech companies were the main beneficiaries of the cash repatriation provision.” Before the law, the largest overseas cash hoards among U.S. companies were held by Apple, Microsoft Corp., Cisco Systems Inc., Oracle Corp. and Alphabet. It is these companies that in the past year unleashed a historic buyback spree the likes of which have never before been seen.

The verdict, at least according to Bloomberg, is that “the U.S. has given up hundreds of billions of dollars in corporate tax revenue for the promise of other benefits.”

A year in, the results don’t show much of a payoff. Buybacks are already being targeted by some politicians. U.S. Senator Chris Van Hollen, a Democrat from Maryland, threatened to introduce legislation that would make it more difficult for executives to sell stock right after their companies announce they’ll repurchase shares. Senator Marco Rubio, a Republican from Florida, said he wants to crack down on the tax benefits companies get from buybacks.

Worse, buybacks – many of them funded with debt that yield-starved investors have no choice but to buy – pick up where the Fed’s own middle-class crushing policies end: “Buybacks are one factor driving economic inequality in the U.S., as top corporate executives tend to benefit disproportionately from them,’’ David Santschi, director of liquidity research at TrimTabs, wrote in a recent report, reiterating a point which sends defends of stock buybacks into an apoplectic frenzy.

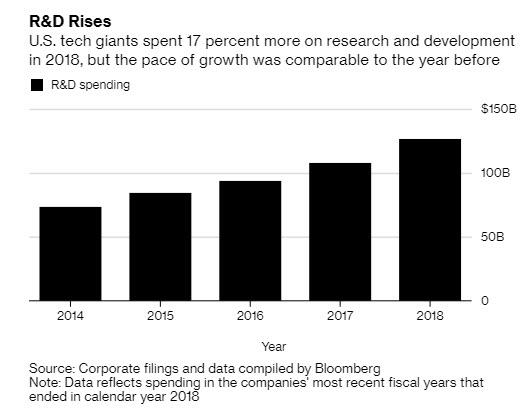

To be fair, not all the tax savings were transferred into investors’ pockets: spending on R&D climbed slightly, while capital expenditures rose because Alphabet and Facebook almost doubled spending in that category. On the other hand, Apple and its peers “have yet to bring manufacturing back to the U.S., as President Donald Trump had hoped.” And, most importantly, there was no surge in tech hiring.

* * *

As Bloomberg notes, while it is still too soon to measure the full consequences of the law, “there are signs it will miss the stated goals.”

Trump said it would bring $4 trillion in overseas cash back to the U.S. Corporate America repatriated $665 billion in 2018, according to the Commerce Department. Tech sector buybacks ate up more than half of that. Trump said the corporate tax cuts would spur so much economic activity that they would pay for themselves. But economic growth hasn’t improved: 2.3 percent year-over-year growth in the final quarter of 2017 versus 2.2 percent in the last three months of 2018.

Here’s what we do know about corporate cash use in the past year.

Bloomberg analyzed 2018 spending by 10 of the largest U.S. tech companies: Alphabet, Amazon.com Inc., Apple, Cisco, Facebook, Intel Corp., International Business Machines Corp., Microsoft, Oracle and Qualcomm Inc. The study looked at six common uses of corporate cash: buybacks, dividends, hiring, acquisitions, capital expenditures and research and development. The 2018 statistics were compared with previous years.

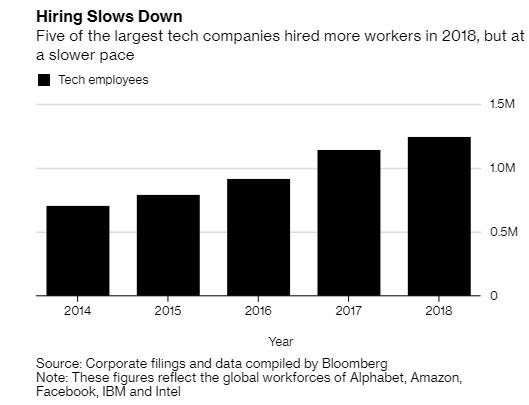

Contrary to the above mentioned 55% surge in buybacks, as the top 10 tech companies spent more than $169 billion on buybacks in 2018, up from $109 billion in 2017, hiring fizzled, as worker ranks grew just 8.7% in 2018, versus 24% the year before. Clearly boosting employee numbers was not the key concern for corporate executives.

Things were less dire in other spending categories: research and development spending by the 10 tech companies rose 17% last year, a slight uptick from the 15 percent increase in 2017. Even so, the acceleration was mostly driven by just two companies – Alphabet and Amazon – which have invested heavily in cloud computing.

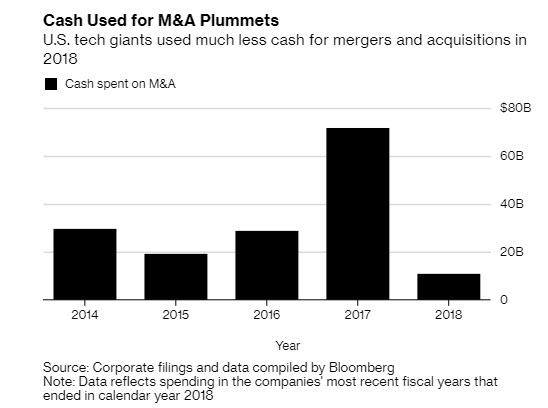

With buyback spending generating the highest and quickest IRR for management teams, it is no wonder that spending on M&A – much of which had been driven by the desire to create tax-safe offshore shelters via reverse mergers – tumbled, and after swelling in 2017, the amount of cash tech giants used for mergers and acquisitions collapsed in 2018.

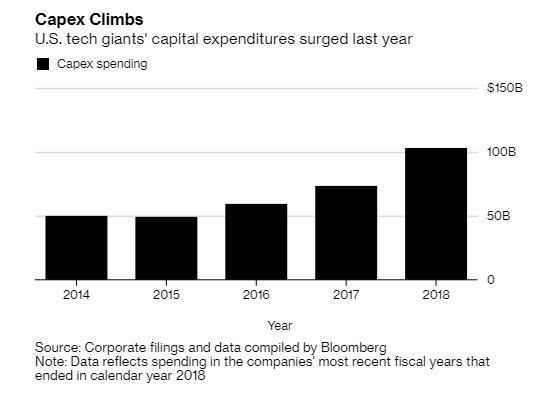

Finally, the all important “other” category, namely capital expenditures, did surge in 2018, but once again largely to just two companies as Alphabet and Facebook nearly doubled their Capex spending, which includes computers for their huge data centers. That helped boost the overall metric to 40 percent growth, from 23 percent the year before.

Of course, as Bloomberg observes, in many ways these results were foreseeable: In 2004, President George W. Bush launched a similar corporate tax holiday in the U.S. that allowed companies to pay 5.25 percent on overseas profits if they returned the money to the U.S., rather than the standard 35 percent rate. The administration pitched it as a jobs booster, but it was followed by large share repurchases. Back then, companies figured out a simple ruse to bypass the artificial spending limitations:

The 2004 law explicitly forbade companies from using the money for buybacks, but they used this new source of cash to pay other expenses and used the money they otherwise would have spent on those expenditures for share repurchases.

Fast forward 12 years, when the largest US companies lied…. again.

When Trump won the 2016 election, some tech companies saw another chance. IBM Chief Executive Officer Ginny Rometty wrote to the president-elect in late 2016, stating that his proposal to cut taxes on businesses and their repatriated overseas earnings would prompt companies to invest domestically.

“Your tax reform proposal will free up capital that companies of all sizes can reinvest in their U.S. operations, training and education programs for their employees, and research and development programs,’’ Rometty wrote.

So what happened next? IBM cut 16,000 workers on a global basis last year, and its R&D budget declined. Capital expenditures increased by less than $166 million, or 5 percent. And while buybacks were relatively unchanged, this followed many years in which IBM repurchase so many shares and issued so much debt to fund these purchases, the company at times was on the verge of losing its pristine investment grade rating.

Oracle also lobbied hard for the tax law…. and since then the software maker has since poured cash into stock buybacks and dividends – recently giving the go-ahead to repurchase about $10 billion of shares each quarter. Putting this in contast, in previous years, the company authorized share repurchases of more than $10 billion about once a year. This not only boosted the stock price, but helped concentrate the ownership of company co-founder Larry Ellison.

“While the company is rewarding shareholders with its capital return program, we believe Oracle is significantly underinvesting in R&D compared to peers at the expense of revenue and operating income growth,” Christopher Eberle, an analyst at Nomura Instinet, wrote in a recent note.

What about the world’s most valuable company?

Soon after the passage of the 2017 tax act, Apple said it would contribute $350 billion to the U.S. economy over five years, including a plan to open a new campus. The amount included some investments that were already planned. While Trump has tried to pressure the company to bring manufacturing back to the U.S., that hasn’t happened yet. Instead as Bloomberg notes, what Apple did do is unleash a historic buyback spree: Apple authorized a $100 billion buyback in May, and spent $73 billion on repurchasing shares in 2018. Apple said its U.S. workforce grew by 6,000 last year, to 90,000.

As for jobs… don’t hold your breath:

Apple’s largest manufacturing partner, Foxconn, promised to create 13,000 jobs at a U.S. facility as early as 2022, winning its own huge tax breaks from Wisconsin. It has waffled on the pledge, and it’s unclear if all of those manufacturing jobs will ever materialize.

And while most companies lied about their cash use intentions, one said the truth: Cisco CEO Chuck Robbins was upfront about the tax reform. In November 2017, he said his company would “obviously” pursue stock buybacks and dividends, as well as more mergers and acquisitions and investments in innovation centers.

In the time since, Cisco decreased its capital expenditure spending, boosted R&D expenses by less then 4.5 percent, and the company hired 346 additional people worldwide from the end of fiscal 2017 to Dec. 31. Cisco’s buybacks, however, jumped by almost $14 billion.

So while US workers got the short end of that particular deal, one can still argue that the megatech names did boost the economy: after all in a world in which “the S&P500 is the economy”, the hundreds of billions the tech industry spent to repurchase their own shares and push their stocks to all time highs “helped” bolster the impression, or rather illusion, that just because the Nasdaq (and S&P) is at all time highs, the economy must be healthy too. Nothing could be further from the truth, as the inevitable end of the buybacks spree will soon demonstrate.

0 Comments