The Beginning of the End

A Masterstroke of Economic and Geopolitical Brilliance

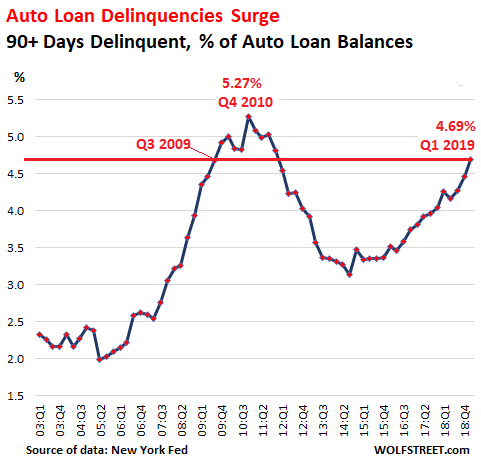

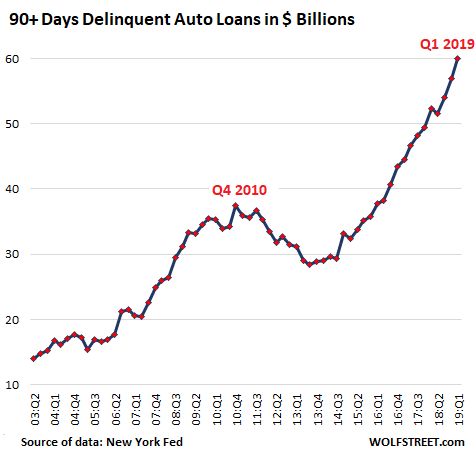

Even though the unemployment rate is historically low, delinquencies on automobile loans have spiked to levels not seen since the 2009 Great Recession. People are increasingly failing to make payments on their vehicle loans and a horrifying number of those delinquent on their car are over 90 days past due.

Serious auto-loan delinquencies (those 90 days or more past due) jumped to 4.69% of outstanding auto loans and leases in the first quarter of 2019, according to New York Fed data. This put the auto-loan delinquency rate at the highest level since Q4 2010 and merely 58 basis points below the peak during the Great Recession in Q4 2010.

Delinquencies are at crisis levels, but the unemployment rate remains low. Perhaps people are simply buying cars they can’t afford.

In the first quarter of 2019 (Q1), total outstanding balances of auto loans and leases rose by 4% from a year ago to $1.28 trillion. This amount by the New York Fed is slightly higher than the amount reported by the Federal Reserve Board of Governors as part of its consumer credit data. Over the past decades, since Q1 2009, total auto loans and leases outstanding have risen by 65%. That’s a massive amount of debt hanging over the heads of Americans.

What is bad news, is the number of auto-loan accounts has risen only 34% over the decade, to 113.9 million accounts in Q1 2019. That means that what caused much of the increase in the auto-loan balances is the ballooning amount financed with each new loan, negative equity rolled into a purchase and longer loan terms. This all causes borrowers to stretch out their payments on those loans keeping them on the books longer.

This ballooning auto loan debt is becoming an increasing problem for those sub-prime borrowers. 4.69% or $60 billion worth of car loans are seriously delinquent, meaning no payment has been made for more than 90 days.

There’s more bad news too. As we trek through 2019, there are more loans going delinquent. As this is being written, there are loans going into delinquency. As they become seriously delinquent in Q2, and the next batch in Q3, and so on, and this is working itself forward wave after wave. So the cumulative losses over the next two years are going to be pretty high.

This isn’t happening during a recession with millions of people losing their jobs and defaulting on their auto loans because they lost their main source of income. This is happening during one of the strongest labor markets in many years. It’s happening when the economy is growing at around 3% a year. It’s happening in good times. And people with jobs are defaulting.

So what’s really going on? Aggressive lending is one problem, however, Americans are simply living above their means. Once people become personally responsible again, there won’t be a need for sub-prime loans, because Americans will be intelligent enough to not borrow money under those terms.

It Took 22 Years to Get to This Point

Donald Trump has declared Volodymyr Zelensky the "bad guy" as the United States issues a security...

This article was originally published by Michael Snyder at The Economic Collapse Blog. I am so...

Protestors are clashing with law enforcement officers in California, and United States President...

Commenting Policy:

Some comments on this web site are automatically moderated through our Spam protection systems. Please be patient if your comment isn’t immediately available. We’re not trying to censor you, the system just wants to make sure you’re not a robot posting random spam.

This website thrives because of its community. While we support lively debates and understand that people get excited, frustrated or angry at times, we ask that the conversation remain civil. Racism, to include any religious affiliation, will not be tolerated on this site, including the disparagement of people in the comments section.

Too many people buying vehicles they cannot afford but they do it anyway because they are trying to impress others and want to look and feel good..After six months of payments, and the “new” wears off,the vehicle doesn’t look as good as it use to.

I don’t make enough money to qualify or even worry about any kind of credit. As soon as I get home I’m looking at some old trucks on craigslist. Cash is the only way for me.

Increasing auto delinquentcy rates are just another sign that Americans are over extended on credit and that the end of the business cycle is finally here in a classic consumer recession as I explained several times over the past year.

Here is a potential problem for some people for which they may not be aware: A few years ago Arizona, which is a title state, passed a law to protect auto lenders. If your auto loan is in arrears more than 90 days and the lender calls you and tells you they want their collateral back, you must surrender your vehicle or you can be charged by the police with a felony.

I have no doubt that other “title states” have also enacted similar laws so your state law may have changed and you might be at risk if you fall behind on payments. 🙁

Just like clockwork DepRen chimes in with his usual canned speech.

The Auto industry is toast. There are like 4.5 million vehicles un-sold just for this year. There is a graveyard out west that stores left over Autos going back to about 1948 with the keys still in them backed bumper to bumper for miles, packed in there to rust. Anybody have a link to that massive new unsold auto graveyard? Its all brand new never sold vehicles cleared out year after year for 75 yrs.

TSB, why the hell are we going down this road again? My situation has never changed and it won’t. why should I even care about credit now?

. . .just print up a bunch of fake money- then you should easily qualify for credit. . .

Agree that they are borrowing more than they can afford. They don’t care about the total balance, they only care whether they can pay the monthly payment. Understanding compound interest is something they can’t be bothered with. Ciphering is not a skill that they have mastered. Most don’t understand anything about numbers. Looky here:

A poll by Civic Science on May 11, 2019 asked “Should schools in America teach Arabic numerals as a part of their curriculum?”

Yes – 29%

No – 56%

No opinion – 15%

sheeptards…propaganda works

JRS, those results are encouraging.

Obviously, almost none of the students knew that the numerals 0123456789 are Arabic Numerals.

These kids overwhelmingly want to keep their numbers. They don’t want to be forced into using some foreign language math.

Their teachers have failed them. The kids are right even though they’re wrong.

.

Hello, Honeypot. I should have mentioned that these were adults that were polled and not students.

Zero is actually not.

Here in Charlotte , every other commercial is from automobile dealerships .

The other half is from bankruptcy lawyers .

Live about an hour outside of Charlotte and you’re right. I’ve never seen so many car commercials. Watching the news is a joke you live in a shooting gallery out there. Few more murders and you beat all of last years total. Be safe.

. . .just print up a bunch of fake money- then you should easily qualify for credit. . .

Good times are just a manufactured illusion. Just which newer cars are really affordable? Crush them to make more bomb components. Drive the price of gasoline higher, a capitalists dream.

I’m looking at vehicles from the 1995-2005 era. I’ve been pricing them on craigslist and found I can get a decent old truck for between $5000-$10000. Sure it’ll have a lot of mileage and need some kind of work but I’m used to that. I can do that in my sleep. I can only do what my circumstances allow me to do.

You say that like it’s something to be ashamed of.

I never have and never will buy new. I need money to prepare for inflation.

I will always go Toyota Corolla from now on too because they’re all the same under the hood since 1998. So easy to work on you could do it while vomiting up your kidney. And they last basically forever. They accelerate like crap but why should I care.

I have never spent more than 10k and I never will. You’d have to be insane to spend more than that. What the hell for even?

Unless at some point electric makes sense. It might. The numbers are approaching tempting. In that case I might buy three years old (almost new, gets rid of the “roll it off the lot” depreciation at least), and swap out the battery later if possible.

This is suppose to be the best economy we’ve had since the 1969-71 recession? I remember the great economies of the late 50’s & 60’s. The year 2019 is nothing close. As a matter of fact, the FUSA is as close to an economic collapse as its ever been. By the way, F stands for former. This nation is nothing like it was when I was growing up in the late 1950’s.

Who the hell wants a $40,000 box with wheels, and then to pay for it twice, basically…

Who in their right mind dumps that kind of cash into anything with not even the most basic understanding of how it mechanically functions / how to repair it?

How about pull out all the ass warmers and side curtain airbags and DVD electric BJ machines and make a box with wheels again? $9k is what a car should cost come the hell on now.

Old story, a very old story!

SW, it is old about car sales being down. It goes back to Obama.

Just bought a new vehicle last weekend. They are affordable if you have a substantial downpayment and trade. Oh and if you know what your doing. Most people lease nowadays. It’s why there is so many used cars on the lots. What kind of car you gonna get for 5k. It’s gonna be crap with 150k miles on it. Then to boot it will need things so you will have to pay to fix them and in the end you still have a worn car. New is the way to go. Warranty and worry free. You won’t have to spend the weekends fixing the car so you can get to work on Monday. I have a busy life and rather use my weekends doing other things.

Have you ever thought to render assistance, in case of an emergency.

I saw people, unable to drive or speak English — not necessarily Latino — getting luxury models impounded in rush hour traffic.

There is no logical explanation, in which they have earned that.

People, going without, have to pay for it.

P.S. — They don’t yield, for any reason.

I am not egalitarian. I cannot say that all people, in all times and places, can be trusted with adult responsibility. Mortified, as in fearful for my life, on a regular basis. Tonnage of metal, at breakneck speeds, is like watching follies in the machine shop or shooting range.

impounded, or repossessed?

when things go bad, always look first to government

HUD [Housing and Urban Development] has special automobile programs- unavailable to Whites. I have seen mexicans driving around in Cadillac Escalades

50 – 70 grand for a vehicle. 7 and 8 year loans. I guess people don’t want to pay for their vehicle after it goes to the junkyard and they sill owe.