It may seem like a child’s birthday party, with bubbles floating around all over the place. We’ve got the real estate bubble, the oil bubble, the government debt bubble, and a bubble we don’t often mention, but one that affects millions of people, the college bubble. Conservative Daily Blog writes Trend Forecast: The College Bubble Will Burst:

Those in college at this moment are utterly throwing precious time and taking very serious risks incurring massive debt. Your degree will not be worth the paper it is printed on in the very near future, prepare to accept any job you have the opportunity for. Most will be working the equivalent as a gas station attendant. Forecasts follow:

A few items must be examined to bring this forecast into view; therefore I simply look no further than current events. Here are just a few.

* Average tuition at four-year public colleges in the U.S. climbed 6.5 percent, or $429, to $7,020 this fall as schools apologetically passed on much of their own financial problems, according to an annual report from the College Board, released Tuesday. At private colleges, tuition rose 4.4 percent, or $1,096, to $26,273. (Huffington Post Oct 2009)

*Since 2004 tuition and fees have risen by up to 20% (Time Magazine)

*Because of a budget in peril, UCLA inflated college costs by 32% in November of 2009 (AP)

* College tuition has increased by more than three times the rate of inflation for the last 20 years, despite U.S. wages flat-lining since 2000. (Forbes Magazine)

This begs the question: why did prices increase to these obscene levels in the first place? (Hint: for the same reasons the real estate boom happened):

Despite the best intentions, Government intervention distorts free market principles and creates zero incentive for businesses to lower costs or modify services.

—

The straw man argument typical consists of “Well, if Government didn’t provide loans, no one would be able to afford collegeâ€.

Again, we simply fall back to the free market model to demonstrate the fallacy in that claim. For if the government were to exit the student aid market, enrollment would fall through the floor. Students who were unable to attend college in the first place, without Government aid, would not enroll forcing pressure on the Universities to bring down costs to meet demand.

Wait, so we should let the free market take over? This is starting to sound more and more like something out of an Austrian economics book.

It may hurt some of those trying to enter college in the near-term, but in the long-term, prices will equalize. While the government makes that argument that thousands of students would be unable to afford college without these loans, they are in fact one of the sole reasons why the price of tuition has risen to ridiculous levels. Again, we direct readers to real estate and the average cost of a home from 1900 to 2000, which was about $110,000 when adjusted for inflation. At the top of the real estate bubble, the same homes were almost twice as expensive, averaging around $200,000. How did this happen? Simply answer: free money printed and distributed from helicopters by The Fed.

Some insightful forecasts for those thinking about entering college (or those thinking about sending their kids to college):

*Many students today must undertake massive debt in order to pay for the cost of their college education. We will continue to see an increase in the amount of debt a student must incur, as colleges continue to inflate their costs and the Government expands its role in the loans market.

*The average student enrolling in college starting in the year 2012, will accumulate debt so massive that he or she will not be able to afford in a lifetime! Yes, that is correct.

*Despite the increase in the cost of attending college, enrollment will continue to skyrocket in the short-term and then fall of a cliff by 2015.

*Every college in the nation will continue to inflate prices at a significant rate in the coming years as personal revenue falls. Because fewer will be able to afford costs, pressure will be put on the Government to step in to fill the void, which they will CERTAINLY do without any hesitation.

*We are going to see the collapse of private universities nationwide along with commercial real estate. The only private Universities with a bullish future are the Ivy Leagues for the elite only.

Like mortgages, health care, transportation, and banking, the government will ultimately attempt to take total control of the education market from birth to college graduation. For astute readers, the dangers of this are quite apparent, as every child will receive the same type of government sponsored education from before they even begin to talk. And they will be fully prepared to enter the private, errrr, public sector as soon as they graduate. (If all goes as planned, there will no longer be a private sector in America.)

Conservative Daily Blog further discusses the social implications of the bubble and its subsequent bursting, and is right on target with their forecast for the establishment of trade schools:

Instead of a liberal arts curriculum, young people nation wide will learn marketable skills such as farming/agriculture, animal raising, craft (Basket Weaving, Sewing), steelwork, construction. Amongst other things. This will be called the Second Industrial Revolution, as America’s future economy will depend heavily on export with the chief export being agricultural goods.

We are going to see a new establishment of trade schools nationwide. These “schools†will specialize in the marketable skill areas mentioned above. Those who choose to diversify their skill portfolio will have the greatest employment opportunity as we see a shift from the (PhD, MS, MBA, BA, etc) to (Intensive Pastoral Farming, Shifting Cultivation, Dairy Farming, Plantation or Tree Farming, Woodcraft and interior construction, etc)

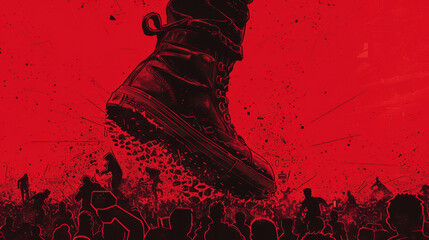

This will not only be an affect of the bursting of the college tuition bubble, but the government debt bubble. The productive capacity of America was replaced over the last five decades. Instead of skilled laborers willing to put in a 40 hour blue collar work week, we have millions of Americans who spend their time shuffling papers and living a life of mediocrity in the corporate world doing whatever they have to just to get their next paycheck. We get paid, for the most part, to provide a service, not a tangible product. This comes to mind:

One additional trend, first mentioned by Trend Forecaster Gerald Celente, is the rise of online education. As parents and students are further pressured on all fronts, they will opt for online education courses instead of traditional colleges. Taking courses online will be cheaper, more convenient, and will likely allow for more flexibility in class choices.

For a more detailed look at the college tuition bubble, especially if you are considering whether or not to send your kids to school, or they are preparing to take on a loan that will take a lifetime to repay, we direct readers to the full analysis and trend forecast at Conservative Daily Blog: Trend Forecast: The College Bubble Will Burst.

0 Comments