Though they have been used for millenia as a means of exchange, from Sumeria where silver was used to conduct transactions over 6000 years ago to the United States of America which, up until the 1970’s, linked the value of the US dollar to an ounce of gold, some economists and leading bankers will argue that neither is a viable means of exchange in modern day economies.

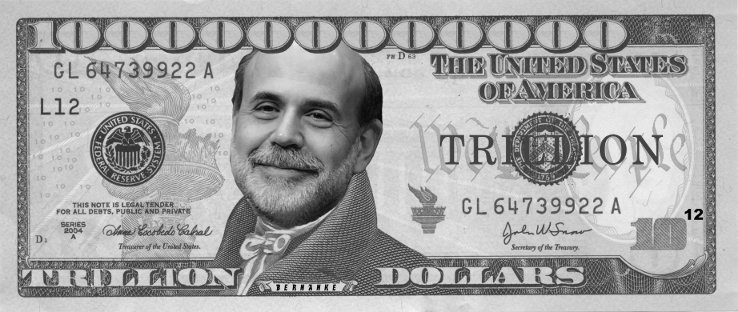

Chief of those who simply dismiss the use of gold and silver as nothing but old world tradition is Federal Reserve Chairman Ben Bernanke, who recently made the argument under questioning by Representative Ron Paul (R-TX):

Ron Paul: Do you think gold is money?

Ben Bernanke: (…long pause…) No. It’s a precious metal.

Ron Paul: Even if it has been money for 6000 years, somebody reversed that and eliminated that economic law?

Ben Bernanke: Well, it’s an asset. Would you say Treasury bills are money? I don’t think they’re money either, but they’re a financial asset.

Ron Paul: Why do central banks hold it?

Ben Bernanke: It’s a form of reserves.

Ron Paul: Why don’t they hold diamonds?

Ben Bernanke: Well, it’s tradition. Long term tradition.

Ron Paul: Some people still think it’s money.

In What is money when the system collapses? we put forth a definition for money as provided by economic analyst Mike Shedlock:

“Like all commodities, it has an existing stock, it faces demands by people to buy and hold it. Like all commodities, its price in terms of other goods is determined by the interaction of its total supply, or stock, and the total demand by people to buy and hold it. People buy money by selling their goods and services for it, just as they sell money when they buy goods and services.”

Thus, money is essentially any unit of exchange, be it a commodity or otherwise, that people are willing to trade for the procurement of goods. While the US dollar and other paper currencies are used in modern economies as a unit of exchange, Mr. Bernanke’s view that only these ‘currencies’ are money is close-minded.

For a more open minded perspective, we draw on one of the leading alternative market thinkers of our time, Brandon Smith of Alt-Market:

As for what an Alternative Market is; it is essentially any method of trade outside the establishment-controlled economy. It could be based on the barter of goods and skills, or the proliferation of precious metals to break our dependence on the fiat dollar (or Federal Reserve Note), etc. It could be a network of people across a county or state, or, an agreement between two friends.

Source: Alternative Markets Are The Lifeboats That Will Save Us

They key point here, is that money is anything that two parties agree is money. It is and always has been a faith based system.

Whether you are using personally panned gold to buy bread, like many are doing in Zimbabwe, or collecting and exchanging barter points for services you provide or need, if you and the other party agree it’s money, it’s money.

Like any faith based system, the US dollar will be considered money only as long as the world believes in it. And the way things are going now, it won’t be long before Mr. Bernanke’s “money” is no longer worth the paper it’s printed on. We wonder what Mr. Bernanke will consider as money once this happens. Our guess is it will be just another paper currency, perhaps an Amero style reserve note, or a global unit of exchange like a SDR-bill from the International Monetary Fund.

What we can be certain of is once faith in Bernanke Bills has been lost, the population of those countries affected (and there are lots that use the dollar as a primary medium of exchange, including Zimbabwe), will determine on their own what will be used as money. Things like gold, silver, tobacco, alcohol – and depending on the severity of the currency crash – even food, clothing, and skills (medical, carpentry, security, machining, farming, etc.) will become the monetary units of exchange.

Of important note is also Mr. Bernanke’s reasoning for why the price of gold is rising. Notice that he did not mention rising inflation. On this point, we agree with Mr. Bernanke:

I pay attention to the price of gold. But I think it reflects a lot of things. It reflects global uncertainties. I think the reason people hold gold is as a protection against tail risk – really, really bad outcomes. And to the extent that the last few years have made people more worried about the potential for a major crisis then they have gold as a protection.

It is and has been our view for quite some time that inflation is merely a by-product of underlying problems within the system. The decade long rise in gold has resulted from exactly what Mr. Bernanke suggested – uncertainty.

The ironic thing about this is that, among other things, it is uncertainty in the very monetary unit of exchange, the US dollar, that Ben Bernanke purports is the only “real” money!

We suspect that the uncertainty in what happens next to our economy, government finances, politics and global relationships will continue, which suggests that the price of gold will continue to rise.

Money and governments are faith based systems. So long as the people continue to lose confidence in these systems, the price of tangible assets, including gold, will continue to rise.

And no matter what Mr. Bernanke thinks, if you have an ounce of silver or an ounce of gold, there will always be someone willing to trade you for it. In our book, that makes it money.

Take special note, also, about Mr. Bernanke’s tail risk comment. The price of gold has risen from around $300 in the 1990’s, to over $1500 now. This suggests that a lot of people are expecting a “really, really bad outcome.”

For those concerned that Ben Bernanke’s version of money will lose value, or collapse, bringing on some really, really bad outcomes, we suggest putting some other “traditional” monetary units in your personal reserves.

0 Comments