Within the context of the current economic crisis we have often heard about the flight to quality and safety assets, with gold being discussed as one such asset. Gold, the argument goes, is the best asset to protect against inflation. While this may be true to an extent, as perceptions drive markets, the view that gold is an inflation protecting asset is not necessarily accurate. If one considers gold to be a hedge not against inflation, but rather, a defense asset against the increasing risk of government instability, then inflation is actually the result of a deeper cause.

Instability must be defined, in this instance, as not necessarily a systemic instability where complete collapse is expected or imminent, but as more of a loss in confidence of what has been thus far deemed to be stability. If for example, the public sector (government sector) begins overturning property rights laws, increasing capital gains taxes on investments, and borrowing two or three times more than usual, observers might consider this as a divergence from what has been deemed stable up to this point.

If one were to look at the chart of gold over the last ten years one would have to ask, why did gold rise? The answer is easy, right? We printed more money which led to a boom in real estate, technology, commodities, and as a result, gold. It can easily be argued, that this was an inflation-based driver for the rise in the price of gold, though it seems gold went up much higher and much faster than inflation did. There was probably a good portion of market participants who recently entered gold investments because of inflation fears, even if, humor me a little bit, we are actually in a deflationary environment.

For the sake of argument, let’s say that these inflation-driven investors see a stock market collapse, home prices collapsing, wages collapsing and commodity prices decline. Would they sell their gold along with these assets? Best guess: Probably.

Would gold collapse back to the 1999 lows of around $300 USD? Best guess: probably not.

But if there is obviously no inflation (using the example above), and deflation is the order of the day, why would investors remain in gold?

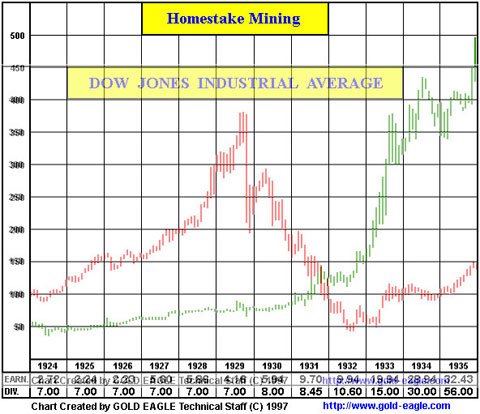

One historical example comes to us from the Great Depression. While the Dow Jones collapsed from 1929 to 1932 and then stagnated into 1935, Homestake Mining (A primary gold miner at the time) exploded in value going from $60 a share to $500 a share. And remember, we were on the gold standard then too, so it wasn’t a fear of inflation driving this move.

(sorry for the rough chart, but you get the point)

(source: gold-eagle.com)

It was a fear of something even more serious. We the people had lost total confidence in the public sector’s ability to mitigate the crisis and the situation continued to deteriorate, getting more severe as time passed. It seems that many investors believed there was only one asset that could protect them from a significant destabilizing event(s). We have seen this throughout history, whether the environment was inflationary or deflationary.

One tool that can be used to help determine the driving force behind a move in gold is the new Kitco Gold Index (KGI), as it lists the price of gold not in USD, but relative to a basket of currencies that include the euro (EUR), Japanese yen (JPY), Pound sterling (GBP), Canadian dollar (CAD), Swedish krona (SEK) and Swiss franc.

(source: Kitco)

Most of our readers are US-based, so naturally, it makes sense to look at the price of gold in terms of the purchasing power right here at home. But to get an overall idea and trend of how the other rich countries are reacting to world events, looking at the value of gold in terms of global buying power may be helpful.

A quick glance at the KGI suggests that either we have serious inflation in all of the major G7 currencies, or investors around the world are losing confidence in their governments’ abilities to mitigate the crisis. And, it looks like the smart money (globally) smelled the problem right after the tech bubble burst.

Wealth preservation, in essence, is the preservation of the value of your assets in terms of buying power for a variety of goods. So, from a wealth preservation standpoint, whether you were in Europe, Japan or Canada, gold would have helped to not only preserve purchasing power, but to increase it.

Though I probably don’t need to say it, gold has been in an uptrend globally in all currencies, which suggests that inflation is not our biggest problem. The real issue is a loss in the confidence of the public sector’s ability to maintain the stable environment we’ve become accustomed to.

When investing in gold, the question to ask is not “Will there be inflation or deflation?”, because it is irrelevant in the grand scheme. The question to ask is “Will confidence in our governments and related institutions deteriorate or improve?”

For an excellent series of articles on the public and private confidence waves, gold and an historical perspective on economics, we suggest reading everything by Martin Armstrong, but if you don’t have the time, then these will do:

The Irrational Free Markets that Are Never Wrong (See part called “The New Practical “Laws” of Global Economics for an excellent overview about why capital flees)

It’s Just the Time (This will be a classic 50 years from now)

—

Some PR for the new KGI: Kitco, well known as a precious metals haven for silver and gold enthusiasts, launched a new gold valuation tool:

The Kitco Gold Index is the price of gold measured not in terms of US Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Click here to view the new index charts (real time, 30d, 60d, 6M,1Y,5y,10Y)

0 Comments