In his November 2009 Gloom Boom & Doom Report, economist Dr. Marc Faber discusses the difficulties of measuring economic growth and decline in relation to the US Dollar.

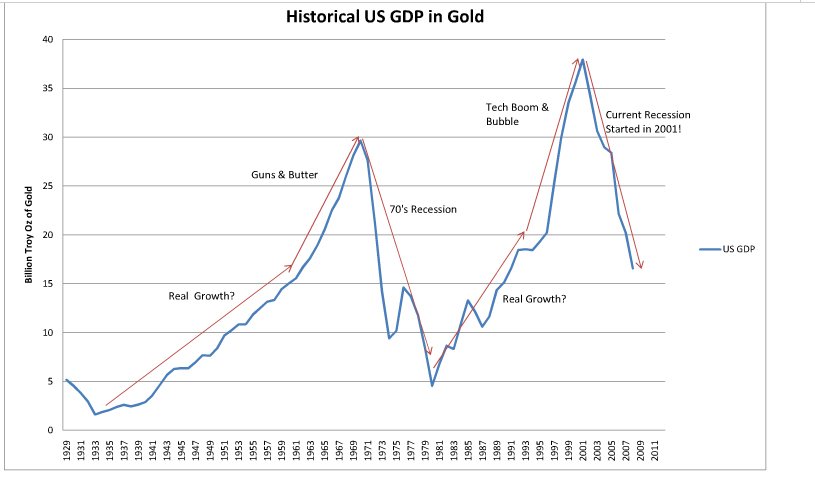

Now, I really don’t wish to pretend that I have all the answers for measuring true economic growth, progress and development, which would also have to take into account whether an overall improvement or deterioration in peoples quality of life took place. But, suspecting that all currencies are now in the process of being debased (it seems every country is trying to follow Mr. Krugman’s advice to lower the value of the currency in order to get industrial production up), it may be time also to measure GDP in gold terms.

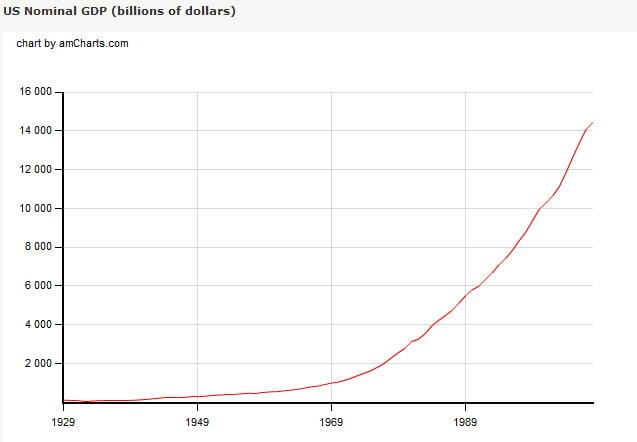

For comparison sake, GDP growth in terms of US Dollars is charted below and provided by Measuring Worth. This is followed by a chart recommended by Dr. Faber and provided by John Beecroft, which displays the growth/decline of the US Economy in terms of gold.

(Click for larger image)

In terms of dollars, GDP growth has been straight up since 1929. By this measure, it looks like the US economy didn’t experience any contraction whatsoever. But looking at GDP in terms of gold, we see a starkly different story.

Marc Faber continues:

Now, I suppose that measuring GDP in gold is also imperfect, but maybe less so than measuring the economy with flawed inflation indices. Also, Figure 6 (Beecroft’s Chart) would seem to confirm the performance of the US economy in hard currency terms: healthy growth late 1930 to 1970, poor growth (or contraction) 1970-1980, strong growth 1980-2000, and thereafter weak growth (or contraction).

When currencies around the world are being debased simultaneously, it is nearly impossible to get accurate economic figures by measuring the economy in terms of the debased currency. And while gold may not be a perfect tool by which to measure economic growth or even asset growth, it seems to be one of the best tools for determining real value during times of economic distress.

For additional information and analysis, we recommend the November Schaef Report: The Fed Playing God with Our Money, where you can see the value of the Dow Jones, Oil and other assets priced in terms of gold for the last decade.

0 Comments