On Monday, Aug. 3, 2009, the U.S. dollar index broke down to 77½, thus completing a double top (Nov. ’08 and March ’09). This was the major economic event of 2009 and predicts a further decline in the index to 68, which will be an all-time low.

As is well known, the precious metals and most commodities are international goods. A decline in the dollar of 13% against other currencies will translate into a rise in the dollar price of gold by 15% (versus those currencies). But since all the other currencies of the world are paper currencies and are similarly declining against goods, the actual rise in gold will be much greater. Indeed, the events of 2009 are merely the tipping point in a process which began in 1981 with the Regan tax cut bill.

In 1981, Ronald Reagan sharply cut taxes. His intent was not to reduce the size of the Government. Indeed, Government spending under Reagan as a percent of GDP reached its highest level for the last half of the 20th century (23.5% in 1983). When David Stockman (Reagan’s Director of the Office of Management and the Budget) demanded a cut in spending to match the cut in taxes, Reagan over-ruled him. Over Reagan’s 8 years as President the nation’s money supply almost doubled, and this rate of printing money continued through the Bush (Sr.) Administration.

This enormous creation of money did not seem to have its normal effect on the Consumer Price Index. For example, in 1986 the U.S. money supply increased by 16.9%. Two years later, in 1988, the Consumer Price Index rose by only 4.4%. In 1992, the U.S. money supply increased by 14.3%. Two years later, in 1994, the Consumer Price Index rose by only 2.7%. This was an apparent violation of the Friedman-Schwartz principle that after an increase in money, prices would rise 2 years later by 3-4% less. Where did this money go, and what happened to the increase in prices which was expected from it?

Part of this answer is that (in Jan. 1983) the Government changed the method of measuring the Consumer Price Index by removing housing prices. Housing prices constituted 30% of the CPI. So when housing advanced by 70% from 1997-2007, this would have fed a 21% additional advance into the CPI. Instead of computing housing prices, the Government substituted rents, but over this same period rends hardly moved at all. Indeed, when the New York Times advocated this substitution in Jan. 1983, it openly admitted that the purpose was to cause the CPI to advance less rapidly and in this way deceive the American people about the real price level.

Â

However, I do not believe that Government lying about the economic statistics is the main reason for the above discrepancy. There is a larger phenomenon which I call the commodity pendulum.

The steady rise in prices in this country began in 1963 with the Kennedy tax cut of that year. This caused the Government to run a deficit, and the deficit was financed by the creation of money. As the deficits got bigger, the money printed got bigger.

But as money was printed over the course of the 1960s and consumer prices rose, we note an interesting phenomenon. Commodity prices remained flat with the CRB index fairly steady at 100.

Adam Smith says that, when the demand for goods goes up (and money is the demand for goods), then the price will have to follow. But Adam Smith does not say anything about how long this process will take. He merely notes that in the long run this will be the result.

It was the job of Smith, the theoretical economist, to establish universal truths, which work all the time. However, it is the job of us, the practical economists, to established rules of thumb to help apply Smith’s principles to practical situations. And what we practical economists observed was that commodity prices did rise after the Kennedy tax cut of 1963, but they took an unusually long time to do it. By late 1971, the CRB index was still at 100.

Since they were now quite under valued, commodities began to make up for lost time. This was aggravated by the fact that the Presidents of the 1970s kept on printing more and more money. From 19l71 to 1980, the CRB index went from 100 to 337. Of course, as commodity prices rose, this fed through into consumer prices, and they began to accelerate to the upside. This is why we had “double digit inflation†in the late 1970s. In essence, the slowness of commodity prices to rise in pace with the money supply during the ‘60s was made up in the ‘70s. This is the commodity pendulum. First commodities lag behind the money supply; then they shoot ahead..

After making these incredible mistakes over the ‘60s and ‘70s, the economic leaders of the country repeated them in spades in the ‘80s through the present. Commodity prices were driven down (from 337 in 1980 to 183 in 1999). Commodity producers were driven to the wall, and the CRB index for 1999 was half its real level for 1971. In 1999-2001, commodity prices began a period of increase comparable to what they had started in 1971. However, since the preceding commodity weakness in this case had lasted twice as long, we can now expect the commodity up move to also last twice as long (i.e., to sometime in the vicinity of 2020).

That is what happened to the money which was created by Volcker and Greenspan in the 1980s and 1990s. There is nothing wrong with Adam Smith’s theory of supply and demand. Rather there is something wrong with Friedman and Schwartz’s theory that the price increase would occur 2 years after the money supply. This was true over the period that Friedman and Schwartz studied. But in this period all of the price increases were sharp and sudden (because associated with wars). In the 1960s, a new type of price increase occurred , a routine and gradual increase which was considered a normal part of the economy. Commodities were much slower to respond to this type of increase, and it is only when commodities finally make their advance that consumer prices fully reflect the money which has been created at the earlier stage.

So the money authorities did not get away with anything in the ‘80s and ‘90s. The money was printed, and there will be a corresponding increase in prices. However, instead of being delayed by 2 years (as was the case prior to 1960) or by 10 years (as was the case during the 1970s, this time the price increase is being delayed by (order or magnitude) 20 years.. In 1999-2001, the real prices of commodities were extremely low. I have researched wheat prices (for example) back to the early 19th century, in terms of dollars. (For the benefit of non-U.S. readers, the U.S. was on a gold or gold/silver standard for most of the period `1788-1933. And through this time U.S. prices were stable.) Repeatedly through this period, one finds that the low price of wheat is 50¢/bu. The low for wheat prior to the Civil war was 50¢/bu. The low for wheat in the silver campaign “depression†of 1896 was 50¢/bu. And the low for wheat in what is called the great depression of 1933 was also 50¢/bu. This would suggest a degree of price stability in real terms. in wheat and other commodities.

But at the commodity low of 1999-2001, the real price of wheat got down to 17¢/bu. One can only imagine the economic pressure on farmers, and of course the same thing was going on with regard to other commodity producers.. As Adam Smith noted, when a price is driven down too low by government power (such as the power of the central bank), this causes a decline in production and an increase in consumption. That is, commodity producers are throwing in the towel They are giving up and looking for other ways of making a living.. (Canadian lumber mills are a good example here.)

For the good of society, the world desperately needs those commodity producers. The united governments of the world have combined to promote real estate. They have lowered mortgage rates and given all sorts of advantage to real estate developers. The world is quickly moving to a condition where it has too many houses and not enough food. Every time a housing developer constructs a new development he is likely to begin by buying a large section of farmland. You have seen the bumper sticker: SUPPORT YOUR LOCAL FARMER, OR WATCH THE HOUSES GROW. It is your job as a good commodity speculator to support your local commodity producer by buying commodities here while commodity prices are still low

Support your local farmer or watch people starve. We got an early preview of this in the spring of 2008. Eric Holt-Gimenez and Lauren Peabody reported:

“Not surprisingly, people have taken to the streets in Mexico, Italy, Morocco, Mauritania, Senegal, Indonesia, Burkina Faso, Cameroon;, Yemen, Egypt and Haiti. Over 100 people have been killed and many more injured. In Haiti, the poorest country in the western hemisphere, with food price increases of 50-100%, driving the poor to eat biscuits made of mud and vegetable oil, angry protestors forced the Prime Minister out of office.â€

“From Food Rebellions to Food Sovereignty: Urgent call to fix a broken   food system,†by Erick Hold-Gimenez and Lauren Peabody, Food First  BACKGROUNDER, Spring 2008, Volume 14, Number 1,  Click here to read

(Search for BACKGROUNDER Spring 2008, Volume 14, Number 1.),    Researched on 8-8-09.

It is my view that the food riots of spring 2008 were not the real thing. Rather they were a precursor. The commodity pendulum has about another decade to run and will create commodity shortages far worse than we saw in the spring-summer of 2008. Last year was just a warning. A bad situation was made worse by bad commodity speculators who were buying food and holding it off the market. Overall, speculation is a good thing. In order to make money the (good) speculator has to buy (increasing prices) when prices are low. This increases supply. He has to sell (decreasing prices) when prices are high, and this supplies food to the market when it is most needed. The bad speculators of spring-summer 2008 were hurt seriously last autumn and will not distort the markets by their misjudgements in the future.

But the food shortages which will hit over the coming decade were caused by the massive commodity undervaluation of 1999-2001. Food (and other commodity) producers were gradually forced out of business After mistreating these people over decades, you cannot just snap your fingers and expect them to come running back into business. By forcing commodity prices so low (via his repeated easings), Alan Greenspan ruined their lives and caused them great personal pain and heartbreak. They will not come when some politician of the future announces that we have a world food crisis. To develop many commodities is a process which requires many years. To get your first harvest of coffee beans requires that the newly planted bushes mature for (I believe) 5 years. To get your first ounce of gold requires a lot of exploration before you even find the gold and then more time to get it out of the ground.

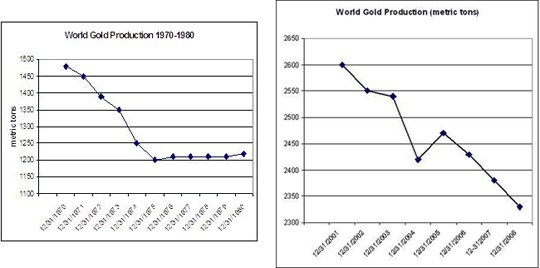

Above (left) is a chart of world gold production over the past decade. Note that it is completely counter-intuitive. As the price of gold has risen from $250+ to almost $1000, the amount of gold produced has declined. Above right, we see that the exact same thing occurred through the 1970s. As the price of gold rose from $35 to over $800, the supply produced also declined.

These facts do not repeal the law of supply and demand. Rather they tell us something about the enormous time lags involved between cause and effect. The very low (real) gold prices of 1971 and 1999-2001 had a significant effect on production. The low price of ’71 caused a decline in production which lasted 10 years. The low price of ’99-‘01 can be expected to cause a greater decline, and so far that decline is still under way. In the first case, the high real prices of 1980 did eventually lead to a rise in production, but the prelude to that was a period of great excitement in the (speculative) exploration companies (of the type listed on the CDNX). Many gold bugs have lamented the fact that these exploration companies have been lagging and under performing. This is true, and it is also true that one day they will come to life. But the fact that they have not yet come to life is a sign that the general increase in the price of gold HAS A LONG WAY TO GO.

Playing the gold bull market has subtleties to it. And one of them is to understand that, AT THE PRESENT TIME THE PRICE OF GOLD IS STILL TOO LOW. If it were not, then the exploration companies would be all over the charts. Their day will come, but until it does we are in the period when one can make good money in both gold itself and the good blue chip companies. If you play it right, you can make the same profit twice. First you bought some good blue chip golds (HUI) early in the 21st century. Many years from now you will sell these blue chips and put the money into exploration companies as gold itself nears its high. Then the exploration companies will do in a short time what the blue chips did over a longer period. Vale, same profit twice. Good play. The farmers and the gold miners of the world thank you. The (soon to be) starving people of the world thank you. You are a good speculator.

To guide good speculators, I publish a newsletter, the One-handed Economist. You can subscribe ($300) at my website, www.thegoldspeculator.com You can also visit (no cost) my blog site, www.thegoldspeculator.com. This week’s blog is about how the Pilgrims abolished communism and switched to private property and celebrated their success with the holiday of Thanksgiving (which ought to be celebrated Aug. 8 instead of in November).

# # #

0 Comments