This is directed toward those readers who have heeded the siren song of the establishment and have put their assets into the stock market. I say to you: NO STOCKS, NO STOCKS, NO STOCKS, not at this time.

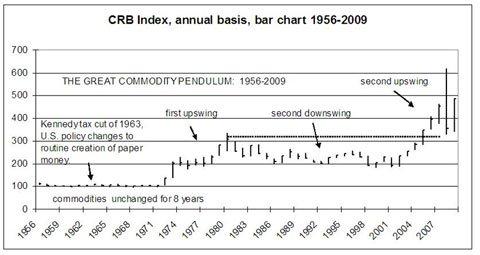

The basic reason is that we are in the second upswing of the commodity pendulum. First, what is the commodity pendulum? And second, why should this affect your decision to put your assets into stocks?

Above is the chart of the CRB (Commodity Research Bureau) index since it was created in 1956. Note carefully, here are the important events:

- In 1963, President Kennedy, on the advice of his Keynesian advisors, deliberately cut taxes in order to create a budget deficit. Such Federal budget deficits are a signal to the Federal Reserve to print money. The great mass of the idiots out there do not know that the government does not borrow money from the people, or even from foreigners, to meet its deficits. (The great to-do in the media about China and Japan funding our deficits is the same misdirection a magician uses with his slight-of-hand.) Government “borrows†from itself (if such a thing makes any sense). That is, the Fed prints money out of nothing and “lends†it to the U.S. Treasury. The Fed, which is in practice an agency of the U.S. Government, lends money to the Treasury, which is an agency of the U.S. Government. And somehow this makes everything all right. Imagine if you tried the same sort of thing. Your family has spent more than its income, and you need to borrow money. No problem, you just buy your son a printing press. He prints up a bunch of money and lends it to you. Presto, your family’s economic problem is solved. In U.S. history prior to 1963, this had been a temporary expedient, used only for the financing of wars. In ‘63, it became the routine way of doing business.

- Despite this printing of money, commodity prices did not change from 1963 to 1971. During the same time consumer prices began a regular advance. For example, consumer prices rose by 6.2% in 1969. This advance led commodity prices to decline in real terms (although they were constant in nominal terms). Adam Smith argued that prices had to move in the direction indicated by supply and demand over the long run. This is good theoretical economics, but it is not of much help to the speculator. The speculator has to know when prices are going to rise. And a study of this period (1963-1971) illustrates the fact that commodity prices lag behind (are less elastic than) consumer prices. This was the first downswing in the commodity pendulum.

- By 1971, commodity prices were at their lowest real level in American history. Commodity producers were getting old (1963) prices for their products but had to pay new (1971) prices for labor, materials, shipping, etc. They were hurting, and many of them started to go out of business. By the early ‘70s, the supply of most commodities was going down, and at the same time Nixon ramped up the amount of money in the country (9.2% increase in 1972) which of course represents demand for commodities. Prices exploded over the course of the decade. Consumer prices doubled, and commodity prices tripled (correcting their under valuation). But, and here is the important point, with commodity prices moving up aggressively some of this increase passed through into consumer prices. The relationship between money supply and consumer prices was temporarily altered. For example, consumer prices rose by 12.3% in 1974. For prices to outrun the increase in money in this manner had never happened previously in American history.

- With prices galloping ahead at their greatest rate in peacetime American history, with price and wage controls having completely failed to stop “inflation,†the Fed was forced to step into its public role as “inflation fighter.†Actually, it is only the Fed which makes prices go up. The Fed was given the paper money power in 1933, and since that date prices in the U.S. have multiplied by a factor of 17. To call the Fed the nation’s inflation fighter is similar to calling Al Capone the nation’s top policeman. As the Fed tightened credit (to slow the growth in money), this forced the stock market lower. From early 1973 to late 1974, the DJI fell almost in half. This is characteristic of an upswing in the commodity pendulum. Commodity prices move aggressively higher. Some of this feeds through into consumer prices, and these rise more rapidly than the money supply. The Fed is alarmed; it tightens credit, and this causes a sharp drop in stock prices. From 1966 to 1982, the U.S. stock market lost ¾ of its real value. So much for the notion that stocks always go up. They may go up during the downswing of the commodity pendulum but not during the upswing.

- By 1980, commodity prices had caught up with a more normal real level. Ronald Reagan had an opportunity to restore the country to normalcy by reversing the evil decision of 1963 and stopping the printing of money. But Reagan was a New Dealer. He had been a New Dealer in the 1930s, and he was still a New Dealer in the 1980s. He continued the policy of massive budget deficits and the printing of money. His innovation was to call this conservative. (Prior to this time conservatives were known for balancing the budget.) Reagan was conservative in what he said, not what he did. During his two terms in office the U.S. money supply almost doubled. However, the nation was now in the downswing of the commodity pendulum. Commodity prices fell from their high of 337 in 1980 to a low of 182.95 in 1999. They fell even more sharply in real terms. By 1999-2001, the real CRB index was only one-half its (very under valued) level of 1971. So you see, if commodities rose rapidly in the 1970s, they were going to rise twice as rapidly in the early years of the 21 st century.

- And that brings us up to today, dear reader. Today Obama is following the policy of Nixon. He is setting incredible records in the printing of money. Except Nixon was satisfied with $billions. Obama is printing $trillions. What is the difference between a billion and a trillion? Only a factor of 1,000. So if prices were rising in the 1970s by approximately 10% per year, does this mean that they will be rising in the 2 nd decade of the 21 st century by 10,000%? A rational examination of this subject does not allow us to give specific objectives because much depends on what Obama and Bernanke do. Both of these men have a lot in common with Arthur Burns (Fed chairman of the early ‘70s) about whom I made up the following poem:

For what he say, and this is true,

Is far removed from what he do.

Bernanke has not yet tightened (as Burns did in ’73). But there is a lot of pressure on him to do so. There is a general sense in the media that he has been too easy too long. And a Fed chairman who defies the media is chopped up into ground hamburger and served to the dogs. He who rides the tiger must be very careful when he decides to dismount.

This is the problem with a bullish stock position at the present time. We are in the upswing portion of the commodity pendulum. Commodity prices are rising rapidly, and they will soon spill over into consumer prices. That will force the Fed to tighten. And here we have a stock market which is more over valued than any market in history. From 1982-2007, the DJI went up by a factor of 18.2. It is still 13.6 times its 1982 low. The two previous great bull markets of the 20 th century (1922-29 and 1949-66) both multiplied by a factor of 6.

One of the statements which clearly illustrates the ignorance of the economic establishment is their assertion that stock prices always go up. I heard the same argument when I first entered the market in the early 1960s. (“Buy good, sound stocks for the long pull.â€) As above, the stock market immediately proceeded to lose ¾ of its value in real terms (while gold was multiplying by 12½ in real terms).

Evidently, no one in the establishment knows how to do simple arithmetic. When researching stock prices, it is important to keep an index in real time. Indexes constructed after the fact tend to leave out those companies which went bankrupt over the period (and hence are not around when the index is constructed at its end). Indexes constructed after the fact do much better than the average investor (who could not know which of his stocks would go bankrupt and had to act in real time).

The first real time stock index in American history was an index of rail stocks constructed by Charles Dow in 1885. This index moved sideways from 1885-1896, when it was replaced by the Dow Jones Averages. From 1896 to 1933, the Dow Jones Averages also moved sideways (the bull move of 1922-29 being offset by the bear move of 1929-32). That is, for almost half a century real time stock indexes moved sideways.

This is indeed what stock indexes do in a free market economy (which includes a gold standard). The wealth created by the productive geniuses of the country flows through to the average person. The large gains in the productive genius’ stock are offset by the declines in his competitors’ stocks. The people get richer, and the stock market goes sideways. The only reason that the stock market has gone up since 1933 is that F.D.R. introduced the printing of money and the easing of credit. As interest rates go down, stock yields go down along with them, and this of course means that stock prices and P:E ratios have to go up. (F.D.R. knew this. His motive was to rob from the poor and give to the rich. So you see, pretty much everything you have been taught is a lie. And we are now very close to the point where that lie is going to cost you dearly.)

So you are buying into a very overbought stock market. If Bernanke has to tighten, then it will drop like a stone. The stock market is still bullish at the present time, and I can’t predict when Bernanke will tighten. (I won’t need to. All one has to do is to wait and watch. The tightening will precede the stock decline, and one will have an opportunity to desert the sinking ship.) I have no big quarrel with the short term stock trader who is nimble and does not fall in love with his trades. (However, he is missing a great opportunity in gold.) But the person who buys the whole establishment line will be destroyed in the second upswing of the commodity pendulum just as he was destroyed in the first. (And since he provides political cover for the paper aristocracy, which is stealing from the American people, he will be getting exactly what he deserves.) On the other hand, experience shows that commodities can ride out a Fed tightening. And gold is the easiest commodity to trade. It is well-traded, does not have volatile moves and obeys technical signals very nicely. In the game of speculation, one must put the greater probability on one’s side. And recognizing that we are in the second upswing of the commodity pendulum is the first step in this process.

To guide honest people through these terrible times of ignorance and lies, I publish a fortnightly (every two weeks) newsletter, the One-handed Economist ($300 per year). You can subscribe by going to my website, www.thegoldspeculator.com, and pushing the Paypal button. If you don’t like Paypal (which are my sentiments), then you can subscribe by sending a check through the U. S. Mail. $10.00 discount for using the mail (send $290). Special bulletins are put out when necessary. Thank you for your interest.

Note on Obama’s socialized medicine proposal, which is very much in the news at this writing. Having failed to win the votes needed for passage, his supporters have resorted to the tactic of “deeming†it passed, violating the Senate’s rule allowiing filibusters and are trying to bully the country into submitting. The social fabric is being torn in a manner I have never seen in my life, and violent revolution is a possibility. I have never seen the country in so much turmoil.

# # #

0 Comments