This article was contributed by The Wealth Research Group.

Yesterday, I sold 20% of my stake in a company that we featured in our Tech Wreck May 2021 Watch List, which has surged by 60% in less than two months. I also booked profits of 85% in the only oil holding I own, reducing the size of it to half of what it was prior and letting the rest of it ride.

I don’t know if you can smell it as well, but my gut instinct is that it’s just too easy right now and that the bubble is back! Everything is going up in price…

In fact, I feel like companies are pressured by their core shareholders to do an IPO since they know investors will “buy anything” right now – so going public is a way to capitalize on animal spirits.

So many money-losing businesses are deciding to take a chance in the stock market, so much so that we haven’t seen such an orgy of losing corporations since 1999!

Courtesy: @Sentimentrader, Zerohedge.com

The market is filled with zombies; they’re infiltrating our ranks and are after your hard-earned cash. I’m stunned by this and can only say that I’m giving you a fair warning — my gut feeling is that it’s not out of the question to see a big correction of -5% to -10% fairly quickly.

When the large-caps go down by that much, the small-cap, the high-growth, and the zombie money-losers crater by -20% to -50%.

Even though the FED said no interest rate hikes in 2022, bettors are adamant the FED is either lying or just not on top of things; therefore, the market is pricing in a December 2022 hike!

It’s not just that, but the market believes that hiking will be aggressive:

Courtesy: Zerohedge.com

What should you consider doing?

- Determine how much you’ve got at risk and at stake in the markets, but at the same time will need those funds in the next few months for expenditures.

I personally have zero money that is actively in trades and simultaneously needed elsewhere a few weeks/months down the road.

We’re not at “bargain territoryville.”

The major indices are at all-time highs, with graveyard companies entering the markets every day, since their management teams are greedy.

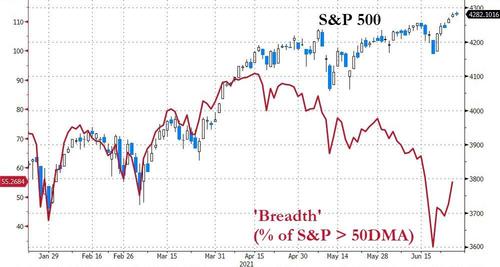

Just to give you an idea of how much this is hanging by a thread, the S&P 500’s record high a few days ago has coincided with less than half of its constituents, trading above their 200-DMA!

Courtesy: Zerohedge.com, Bloomberg

I told you that I’m being careful, so the second thing I’m doing is avoiding putting any money in the indices, at this point. I simply refuse to.

This type of low breadth, coupled with new highs is what happened in 1999, right before the massive collapse.

Lastly, I’m not shy about taking profits!

Unless I bought something at a 2016 or 2017 level, I’m open to letting it go; there is just too much froth out there.

0 Comments