This report was originally published by Chris Martenson at PeakProsperity.com

I hate to break it to you, but chances are you’re just not prepared for what’s coming. Not even close.

Don’t take it personally. I’m simply playing the odds.

After spending more than a decade warning people all over the world about the futility of pursuing infinite exponential economic growth on a finite planet, I can tell you this: very few are even aware of the nature of our predicament.

An even smaller subset is either physically or financially ready for the sort of future barreling down on us. Even fewer are mentally prepared for it.

And make no mistake: it’s the mental and emotional preparation that matters the most. If you can’t cope with adversity and uncertainty, you’re going to be toast in the coming years.

Those of us intending to persevere need to start by looking unflinchingly at the data, and then allowing time to let it sink in. Change is coming – which isn’t a problem in and of itself. But it’s pace is likely to be. Rapid change is difficult for humans to process.

Those frightened by today’s over-inflated asset prices fear how quickly the current bubbles throughout our financial markets will deflate/implode. Who knows when they’ll pop? What will the eventual trigger(s) be? All we know for sure is that every bubble in history inevitably found its pin.

These bubbles – blown by central bankers serially addicted to creating them (and then riding to the rescue to fix them) – are the largest in all of history. That means they’re going to be the most destructive in history when they finally let go.

Millions of households will lose trillions of dollars in net worth. Jobs will evaporate, causing the tens of millions of families living paycheck to paycheck serious harm.

These are the kind of painful consequences central bank follies result in. They’re particularly regrettable because they could have been completely avoided if only we’d taken our medicine during the last crisis back in 2008. But we didn’t. We let the Federal Reserve –the instiution largely responsible for creating the Great Financial Crisis — conspire with its brethern central banks to ‘paper over’ our problems.

So now we are at the apex of the most incredible nest of financial bubbles in all of human history.

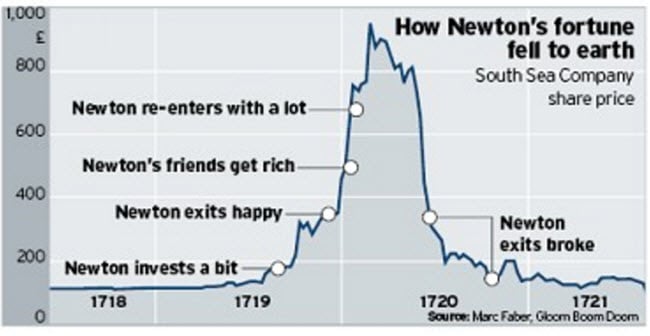

One of my favorite charts is below, which shows that even the smartest minds among us (Sir Isaac Newton, in this case) can succumb to the mania of a bubble:

It’s enormously difficult to resist the social pressure to become involved.

But all bubbles burst — painfully of course. That’s their very nature.

Mathematically, it’s impossible for half or more of a bubble’s participants to close out their positions for a gain. But in reality, it’s even worse. Being generous, maybe 10% manage to get out in time.

That means the remaining 90% don’t. For these bagholders, the losses will range from ‘painful’ to ‘financially fatal’.

Which brings us to the conclusion that a similar proportion of people will be emotionally unprepared for the bursting of these bubbles. Again, playing the odds, I’m talking about you.

How Exponentials Work Against You

Bubbles are destructive in the same manner as ocean waves. Their force is not linear, but exponential.

That means that a wave’s energy increases as the square of its height. A 4-foot wave has 16 times the force of a 1-foot wave; something any surfer knows from experience. A 1-foot wave will nudge you. A 4-foot wave will smash you, filling your bathing suit and various body orifices with sand and shells. A 10-foot wave has 100 times more destructive power. It can kill you if it manages to pin you against something solid.

A small, localized bubble — such as one only affecting tulip investors in Holland, or a relatively small number of speculators caught up in buying swampland in Florida — will have a small impact. Consider those 1-foot waves.

A larger bubble inflating an entire nation’s real estate market will be far more destructive. Like the US in 2007. Or like Australia and Canada today. Those bubbles were (or will be when they burst) 4-foot waves.

The current nest of global bubbles in nearly every financial asset (stocks, bonds, real estate, fine art, collectibles, etc) is entirely without precedent. How big are these in wave terms? Are they a series of 8-foot waves? Or more like 12-footers?

At this magnitude level, it doesn’t really matter. They’re going to be very, very destructive when they break.

Our focus now needs to be figuring out how to avoid getting pinned to the coral reef below when they do.

Understanding ‘Real’ Wealth

In order to fully understand this story, we have to start right at the beginning and ask “What is wealth?”

Most would answer this by saying “money”, and then maybe add “stocks and bonds”. But those aren’t actually wealth.

All financial assets are just claims on real wealth, not actually wealth itself. A pile of money has use and utility because you can buy stuff with it. But real wealth is the “stuff” — food, clothes, land, oil, and so forth. If you couldn’t buy anything with your money/stocks/bonds, their worth would revert to the value of the paper they’re printed on (if you’re lucky enough to hold an actual certificate). It’s that simple.

Which means that keeping a tight relationship between ‘real wealth’ and the claims on it should be job #1 of any central bank. But not the Fed, apparently. It’s has increased the number of claims by a mind-boggling amount over the past several years. Same with the BoJ, the ECB, and the other major central banks around the world. They’ve embarked on a very different course, one that has disrupted the long-standing relationship between the markers of wealth and real wealth itself.

They are aided and abetted by both the media and our educational institutions, which reinforce the idea that the claims on wealth are the same as real wealth itself. It’s a handy system, of course, as long as everyone believes it. It has proved a great system for keeping the poor people poor and the rich people rich.

But trouble begins when the system gets seriously out of whack. People begin to question why their money has any value at all if the central banks can just print up as much as they want. Any time they want. And hand it out for free in unlimited quantities to the banks. Who have their own mechanism (i.e., fractional reserve banking) for creating even more money out of thin air.

Pretty slick, right? Convince everyone that something you literally make in unlimited quantities out of thin air has value. So much so that, if you lack it, you end up living under a bridge, starving.

Let’s express this visually.

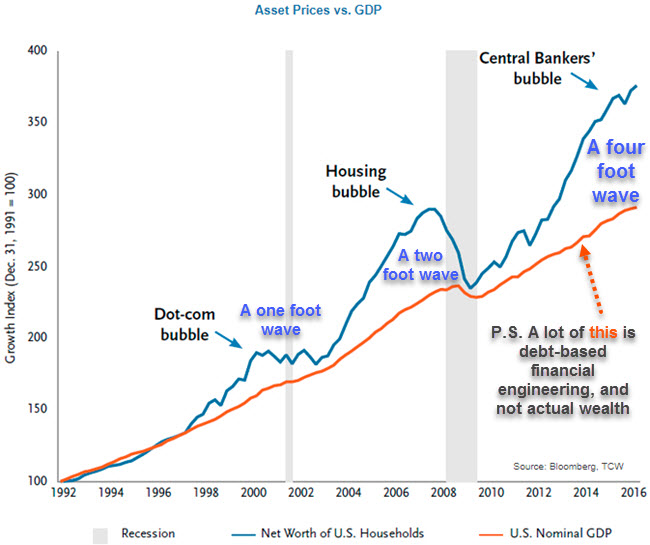

“GDP” is a measure of the amount of goods and services available and financial asset prices represent the claims (it’s not a very accurate measure of real wealth, but it’s the best one we’ve got, so we’ll use it). Look at how divergent asset prices get from GDP as bubbles develop:

(Source)

What we see in the above chart is that the claims on the economy should, quite intuitively, track the economy itself. Bubbles occurred whenever the claims on the economy, the so-called financial assets (stocks, bonds and derivatives), get too far ahead of the economy itself.

This is a very important point. The claims on the economy are just that: claims. They are not the economy itself!

Yes the Dot-Com crash hurt. But that was the equivalent of a 1-foot wave. Yes, the housing bubble hurt, and that was a 2-foot wave. The current bubble is vastly larger than the prior two, and is the 4-foot wave in our analogy — if we’re lucky. It might turn out to be a 10-footer.

The mystery to me is how people have forgotten the lessons of prior bubbles so rapidly. How they cannot see the current bubbles even as the data is right there, and so easy to come by. I suppose the mania of a bubble, the ‘high’ of easy returns, just makes people blind to reality.

It used to take a generation or longer to forget the painful lessons of a bubble. The victims had to age and die off before a future generation could repeat the mistakes anew.

But now, we have the same generation repeating the same mistakes three times in less than 20 years. Go figure.

In this story, wishful thinking and self-delusion have harmful consequences. It’s no different than taking up a lifelong habit of chain-smoking as a young teen. Sure, you may be one of the few who lives a long full life in spite of the risks, but the odds are definitely not in your favor.

The inevitable destruction caused by the current froth of bubbles is going to hurt a lot of people, institutions, pensions, industries and countries. Nobody will be spared when these burst. The only question left to be answered is: Who’s going to eat the losses?

This is not a future question for a future time; it’s one that’s being answered daily already. Pensioners are already taking cuts. Puerto Rico will not be fully rebuilt. Shale wells drilled when oil was $100/barrel, but being drained empty at $50/barrel, represent capital already hopelessly betrayed. Young graduates with $100,000 of student debt face lost decades of capital building. The losers are already emerging.

And there’s many more to follow. This story is much closer to the beginning than the end.

The bubbles have yet to burst. We’re just seeing the water at the shore’s edge beginning to retreat, wondering how large the wave will be when it arrives. Hoping that it’s not a monster tsunami.

The End Is Nigh

History’s largest bubbles have had the exact same root cause: an expansion of credit that causes leverage to go up faster than the income available to service it.

Simply put: bubbles exist when asset price inflation rises beyond what incomes can sustain. They are everywhere and always a credit-fueled phenomenon.

Look at the ridiculous trajectory of the S&P 500, especially since Trump got elected. I don’t know about you, but pretty much everything that has happened in the US over the past year has been either a diplomatic clown show or a financial cruelty to the average citizen. And yet prices have risen at their highest pace in two decades?

My view is that the Trump election was a totally unexpected black swan shock for the global central banking cartel, and it freaked out. With the Dow down -1,000 points in the late night hours following Trump’s surprise win, the central banks dumped gobs and oodles of money into the equity markets to prevent carnage.

All that money calmed investors and sent prices roaring higher over the following months. The resulting 80-degree rocket launch will hurt a lot when it comes back to earth. Good going central banks!

This is all happening when we’re as close as ever to a military (if not nuclear) confrontation with North Korea, Russia is busy beefing up its war machine, Saudi Arabia has pivoted away from the US towards China and Russia, and most of our European allies are inching away from us.

Meanwhile, the FCC is about to rule against the vast majority of the public and allow US corporations to turn the internet into a pay-for-play toll road — completely undermining the core principle of the most transformative and useful invention of the millennium. By eliminating net neutrality the FCC has ruled ‘against’ you, and ‘for’ the continued usurious profits of the cable companies.

Worse, heath care premiums continue to increase by double-digits each year. They’re going up by a horrifying 45% in Florida and 57% in Georgia, to name just two unfortunate states out of many.

And to really rub salt in the wounds of the nation, the DC swamp is busy passing a tax change that will further drive an enormous gap between the 0.1% and everybody else by lowering taxes on corporate profits (already the lowest in the world if you measure both tax on profits and value-added taxes).

How to pay for the massive cost of this deficit-exploding bill? Easy, just eliminate deductions for average people (such as the state and local tax deductions) and begin taxing the waived tuition of graduate students. That’s right, the government helped to massively bloat tuition fees via massive lending to students and then wants to squeeze the poorest and hardest-working among them.

I wish I were kidding here. But like a cruel joke re-told at the wrong moment, the GOP is busy destroying the meager and precarious financial situation of our citizens just so it can toss a few more dollars into the already-bloated wallets of the richest people in the country.

The long rise of the ultra-wealthy is not some mystery. It arose as a predictable consequence of the financialization of, well…everything that began in the 1980’s:

The above chart speaks to a deeply unfair system that punishes hard working people in order to give more to those who merely shuffle financial instruments around or own financial assets.

This is the system that the Fed is working so hard to preserve. This is the system that Washington DC is working so hard to sustain.

It’s flat out unfair and punitive. It both punishes and rewards the wrong folks, respectively. Debtors are provided relief while savers are punished. The young are saddled with debts and face impossible costs of living mainly to preserve the illusion of wealth for a little longer for the generation in front of them.

For so many reasons, folks, none of this is sustainable. If the system doesn’t crash first under the weight of its excessive debts or the puncturing of its many asset price bubbles, the brewing class and generational wars will boil over if the status quo trajectory continues for much longer.

In Part 2: When The Bubbles Burst… we detail what to expect as the unraveling starts. When these bubbles burst, as they inevitably must, the aftermath is going to be especially ugly.

Understand the likely path the carnage is going to take and position yourself wisely ahead of the crisis — so that you and those you care about can weather the turmoil as safely as possible.

Remember: the role of bubble markets is to injure as many people as badly as possible when they burst. Don’t be one of the victims.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

0 Comments