This article was originally published by Michael Snyder at The Economic Collapse Blog under the title: Why Are Online Banking Services Suddenly Being Disrupted On A Massive Scale All Over The United States?

Should we be concerned about all of the problems that are suddenly erupting at our banks? U.S. banks have been shutting down hundreds of branches, they have been laying off thousands of workers, and as I discussed yesterday vast numbers of customer accounts are being unceremoniously shut down without any warning whatsoever. If all of that wasn’t bad enough, now endless “glitches” are plaguing our banking system. For example, the glitch that caused paychecks not to be deposited at many banks on Friday still has not been fully resolved…

Customers at major U.S. banks including Bank of America and Wells Fargo complained about delays with their direct deposits on Monday, following a glitch with processing payments that began Friday.

The Federal Reserve on Friday said the problem wasn’t related to a cybersecurity issue and that it had been resolved. But customers on Monday continued to report delays with direct deposits, reaching out to their banks on social media to report that their paychecks hadn’t landed in their accounts as expected.

Wells Fargo and Bank of America referred questions to The Clearing House, a payments company that operates the only private-sector automated clearing house (ACH) system in the U.S.

I have never seen a problem with direct deposits that is so widespread.

The Clearing House is promising to have things fixed “as quickly as possible”, but that could mean just about anything…

The Clearing House, the private operator of ACH, told CNN on Monday it is working with banks and the Federal Reserve to “resolve this issue as quickly as possible.”

“Many of the delayed payments have already posted, and we will continue working with financial institutions to ensure the remaining transactions are processed,” The Clearing House spokesperson Greg MacSweeney said in an email.

An industry source confirmed to CNN on Monday that it’s likely some customers haven’t received their deposits yet. The source stressed that banks are at the mercy of the originating bank to resend payment files.

Meanwhile, online banking services are suddenly being disrupted all over the country on a massive scale. Steve Quayle was reporting this on his website, and this prompted me to go to downdetector.com to check it out for myself.

And I discovered that all of the big banks were experiencing unusual outages on Monday.

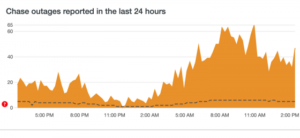

The following is a screenshot of Chase outages…

Citibank suddenly started getting hit by a spike in outages during the early morning hours on Monday too…

Unfortunately, the same thing also happened to Bank of America…

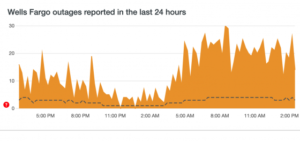

And outages followed the same pattern at Wells Fargo…

So why was there such a dramatic spike in outages all of a sudden?

Is this evidence that our banks are being hit by cyberattacks?

I don’t know.

Hopefully, things will settle down and these “glitches” and outages will start to subside.

But the credit crunch that has now begun is not going to go away any time soon.

According to the Federal Reserve, lending standards for business loans got even tighter during the third quarter…

Banks continued to tighten standards for business loans in the third quarter, according to a survey of loan officers conducted by the Federal Reserve.

In addition, a “significant” number of banks tightened lending standards for credit-card, automobile and other consumer loans.

Key details: Banks tightened standards on loans to firms of all sizes. Tightening was accomplished in premiums for riskier loans, spreads of loan rates over the cost of funds and costs of credit lines.

And a survey that was recently conducted by Goldman Sachs found that nearly 80 percent of small business owners in the U.S. “are concerned about their ability to access capital”…

A survey by Goldman Sachs quizzed small businesses owners, who reported serious concerns that the nationwide credit crunch is hindering their growth. Some expressed fear that they would have to close up shop.

According to the survey, 78% of small business owners are concerned about their ability to access capital, and 29% say they can’t afford to take out a loan given current interest rates. In addition, 85% say that if access to capital continues to tighten it will impact their growth forecast. Of those, 67% will halt expansion plans if credit continues to tighten, and 21% would close their business if the credit market continues on this trajectory.

Banks all over America have gotten very tight with their money.

And that is going to have enormous implications for the U.S. economy in 2024 and beyond.

The era of easy credit is over, and now our banks are drowning in mountains of bad debt. In a desperate attempt to save money, banks are shutting down branches and laying off workers.

In fact, at this moment workers at Citigroup are waiting to see who will survive and who will get the axe during the wave of layoffs that is rapidly approaching…

When Citigroup CEO Jane Fraser announced in September that her sweeping corporate overhaul would result in an undisclosed number of layoffs, a jolt of fear ran through many of the bank’s 240,000 souls.

“We’ll be saying goodbye to some very talented and hard-working colleagues,” she warned in a memo.

Employees’ concerns are justified. Managers and consultants working on Fraser’s reorganization — known internally by its code name, “Project Bora Bora” — have discussed job cuts of at least 10% in several major businesses, according to people with knowledge of the process. The talks are early and numbers may shift in coming weeks.

In my new book entitled “Chaos”, I warn about the extreme financial instability that is dead ahead.

The flow of credit is going to get even tighter, more bank branches are going to be shut down, and more prominent banks are going to fail.

And that is really bad news for all of us because the banks are the beating heart of our economic system.

We desperately need healthy banks, but now we stand on the verge of a banking crisis that will be unlike anything we have ever seen before.

Michael’s new book entitled “Chaos” is now available on Amazon.com, and you can check out his new Substack newsletter right here.

About the Author: My name is Michael and my brand new book entitled “Chaos” is now available on Amazon.com. In addition to the new book I have written seven other books that are available on Amazon.com including “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, and “Living A Life That Really Matters”. (#CommissionsEarned) When you purchase any of these books you help to support the work that I am doing, and one way that you can really help is by sending copies as gifts to family and friends. Time is short, and I need help getting these warnings into the hands of as many people as possible. I have also started a brand new Substack newsletter, and I encourage you to subscribe so that you won’t miss any of my articles. I have published thousands of articles on The Economic Collapse Blog, End Of The American Dream, and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe. I always freely and happily allow others to republish my articles on their own websites, but I also ask that they include this “About the Author” section with each article. The material contained in this article is for general information purposes only, and readers should consult licensed professionals before making any legal, business, financial, or health decisions. I encourage you to follow me on social media on Facebook and Twitter, and anyway that you can share these articles with others is definitely a great help. These are such troubled times, and people need hope. John 3:16 tells us about the hope that God has given us through Jesus Christ: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life.” If you have not already done so, I strongly urge you to invite Jesus Christ to be your Lord and Savior today.

.

0 Comments