Not surprisingly, Existing U.S. Home Sales Decreased More Than Forecast:

“Sales of existing U.S. homes plunged in December more than anticipated, the month after a government tax credit was originally due to expire.

Purchases decreased 17 percent, the biggest decline since records began in 1968, to a 5.45 million annual rate from 6.54 million pace the prior month, the National Association of Realtors said today in Washington. The median sales price increased for the first time in two years, reflecting fewer first-time buyers, the group said.”

But it’s not all bad news, as some analysts expect to see an increase in sales over the coming months:

“We’ll see a pickup in existing home sales in the next couple of months†as people take advantage of the tax-credit extension, said Adam York, an economist at Wells Fargo Securities LLC in Charlotte, North Carolina, who forecast a 5.4 million sales pace. Although “we’re past the bottom,†he said, “I don’t think there’s going to be a lot of buyers out there looking for a home outside of the tax-induced effects until they feel more comfortable with the labor market.â€

It looks like we’re past the real estate bottom, if Adam York of Wells Fargo is to be believed.

Let’s give Mr. York the benefit of the doubt and say that we will see an increase in home sales in the next few months. Does this mean that the real estate market has bottomed and is now in recovery?

According to our assessment in Mortgage Meltdown: Wave Two and Michael the Patriot Blogger’s more recent 20 Reasons Why The U.S. Economy Is Dying And Is Simply Not Going To Recover we’re not even close:

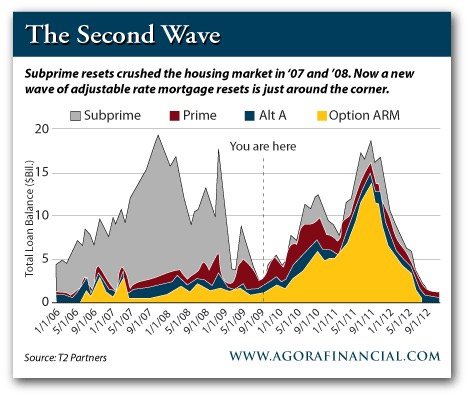

Do you remember that massive wave of subprime mortgages that defaulted in 2007 and 2008 and caused the biggest financial crisis since the Great Depression? Well, the “second wave†of mortgage defaults in on the way and there is simply no way that we are going to be able to avoid it. A huge mountain of mortgages is going to reset starting in 2010, and once those mortgage payments go up there are once again going to be millons of people who simply cannot pay their mortgages. The chart below reveals just how bad the second wave of adjustable rate mortgages is likely to be over the next several years.

Starting in May of 2010, a new wave of mortgage resets is going to make it quite difficult to keep the inventory of existing homes at current levels. It is going to become more and more difficult for home owners to make their monthly payments.

Visualize Wave Two from a Homeowner’s Perspective:

A home owner took out a $200,000 loan in 2007 at a teaser rate of 3.75% on an ARM mortgage. The total payment for this (30 year) home for the first three years is just $890 per month.

The max adjustment cap on a loan like this is around 8.75%. The first adjustment in the interest rate can be as high as 5%, and yearly caps can’t exceed 2%. So, it is quite possible that the interest rates can be adjusted upwards to 8.75% in their first, upcoming reset, though this may not be the case in the next round of resets.

At a maximum rate adjustment (8.75%), that $200,000 loan goes from a payment of $890 to $1450 per month, an increase of 60%!

Even in the event that the max rate is not hit on the initial reset, and the rate jumps from the 3.75% teaser to a 5.75% rate, the payment on the loan now goes to $1080 per month, an increase of 21%!

With homeowners already struggling with wage deflation and job losses, a 21% increase in a house payment may not seem like much, but across millions of homeowners, there is sure to be a significant bounce in delinquencies and foreclosures. Since many will choose to pay their home loans, they will have to sacrifice spending elsewhere – perhaps in retail goods consumption or payment of other, non-essential debt like credit cards. The effects of this second wave will be felt not just in housing, but across the entire economy.

As interest rates continue to rise on government debt, so too will home mortgage rates, so even if some homeowners do not see the max rate hit now, Option ARM mortgages may adjust every 6 months or every year after the initial 3 year teaser period, so it is safe to say that at some point in the next several years, that rate is going to max out.

This very basic example provides some clues as to how the individual homeowner will be affected once the mortgage resets start cranking. And notice, again, that this wave is actually more like a Tsunami that will continue for several years, as depicted by this chart from Agora Financial:

Mr. York of Wells Fargo may foresee rising home prices for the next couple of months, but what about the next couple of years? As more inventory hits the market from this next wave of meltdown, plus the shadow inventory of millions of foreclosed/delinquent homes that have yet to be put on the books, there is only one direction for real estate to go in real terms — down.

0 Comments