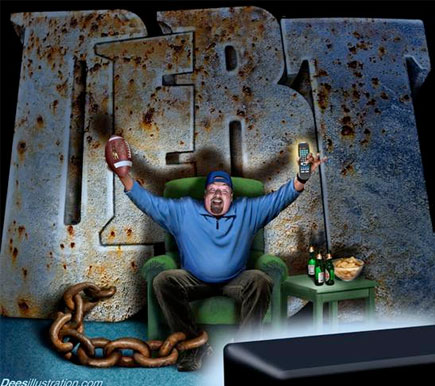

Illustration by David Dees. http://www.deesillustration.com/

The people of the United States, misled by its politicians, and plundered by its financial institutions, are swimming in so much debt that no one will probably ever grasp the truly staggering amount — if indeed it can ever be fully calculated.

Forget paying it all back; the Federal Reserve isn’t even apparently aware of how deep the crisis goes.

Officially, the U.S. was already $59 trillion in debt in 2015, but now the number is significantly higher.

When the Fed is changed its method of tracking and reporting debt numbers, and replaced a single Credit Market Instruments chart with two separate charts for “debt securities” and “loans,” it suddenly reported an additional $2.7 trillion.

That’s quite an accounting error! Zero Hedge reports:

Everyone has seen the chart of “Total Credit Market Instruments“, which as of its most recent update on March 31, 2015, was just over $59 trillion, or 330% of US GDP.

For those who have not seen it, as well as for those who are familiar with this chart, take a long look, because this is the last update of this particular data series, pulled straight from the Fed’s Z.1 Flow of Funds (section L.1), you will ever see.

[…]

We can only assume that the vocal outcry that emerged in the aftermath of the Fed’s release of its Q2 Flow of Funds statement missing this most critical of data sets on September 18, was so loud that three weeks later, this past Friday on October 9, the Fed released an official follow up explanation what exactly happened.

According to the Federal Reserve’s official statement,

With the September 18, 2015 Z.1 release, the classic presentation of the instrument category “credit market instruments” has been discontinued and replaced with two new instrument categories, “debt securities” and “loans”.

[…]

While the underlying instrument categories that make up the sum of debt securities and loans are the same as those in old “credit market instruments” concept, changes to a few of these categories make the new sum of debt securities and loans larger than in previous publications.

Of course, the acknowledgement of this additional sum of debt — piled on top of the already massive $59 trillion — was only made on a technical page for the Z.1 statistical report.

In other words, it wasn’t considered news that the national debt jumped, suddenly, to an official $62.1 trillion. There was no press statement, it was just a quiet footnote.

Like the $2.3 “missing” trillions (announced just the day before 9/11), these enormous sums are reported to the public with little explanation and a barely-audible voice:

Even trying to read the Fed’s dizzying statement is enough to make anyone not trained in financial dribble become sick or fall asleep.

Moreover, the change in Fed reporting makes it even more difficult than before to follow its actions, and focus on the significant and worsening problems the country faces. As Zero Hedge notes:

And so the Fed has managed to kill two birds with one stone: it no longer provides a simple, one-stop-shop way to reconcile the total US credit stock, and it quietly boosted total US consolidated credit by $2.7 trillion to $62.1 trillion as of June 30, 2015.

The details of how and why are less important than the fact that the U.S. debt is soaring above the clouds, leading the dangerous path of global debt.

Back in February of this year, a report showed that global debt rose sharply in the wake of the 2008 financial crisis, growing at a faster pace than ever before, by a stunning $57 trillion — that’s the increase, not the total.

Personal debt ain’t pretty either, and many foreign countries, U.S. states and local governments and other entities are at or near a breaking point, unable to pay back their debts, or even service the interest. When they default, as Puerto Rico has nearly done, it threatens to tank entire markets with it.

Quite clearly, no one is paying attention, and perhaps no one is even in charge of the rampant, out of control spending that ensures that Americans now, and for generations to come, will be slaves to debt, and to the institutions that hold those debts.

0 Comments