This article was contributed by James Davis of Future Money Trends.

Before the end of the year, Future Money Trends expects gold to TRADE OVER $2,100, but in the immediate-term, know that we could be IN FOR A DOOZY.

In the times of the Bible, a prophet of doom when TIMES WERE GREAT was hated, ignored, and unpopular; who wants to hear that there’s potential TROUBLE AHEAD when the immediate past is filled with glorious days?

I’m NOT prophesizing doom at all; I’m reflecting a REALISTIC SITUATION.

- Gold has just made a NOMINAL ALL-TIME HIGH.

- Silver has had its best week in 40 YEARS.

- Nearly every mining stock on the GDX and GDXJ indices has gone up VERTICALLY for weeks.

There could be just TOO MANY SELLERS that will be taking profits right now and not enough new buyers to block the correction.

The BULL MARKET is clearly just beginning for precious metals since the headlines and the sentiment are mixed between those calling this a bubble and others that are relying on data that understand gold is headed above $2,500/ounce soon.

What we’re saying is to TREAD LIGHTLY in the coming weeks; I’ll personally be using this time to BUY THE DIP.

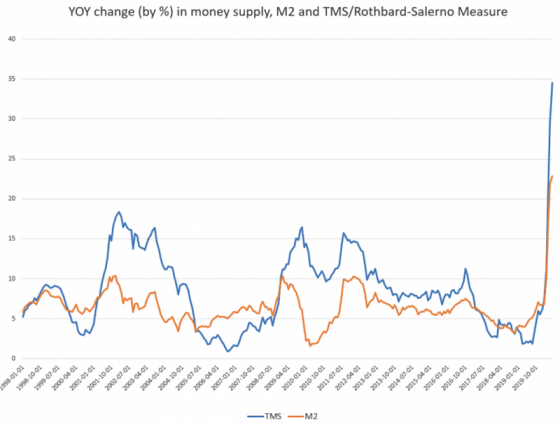

Courtesy: Zerohedge.com

This reflation is TWICE AS BIG as the ones that followed the Dotcom and 9/11 reflation and the 2008 financial crisis.

If we just see a REPEAT of those previous instances, gold and silver have more than a 100% upside potential, with silver potentially breaking its $50/ounce high from 1980.

My message is not to RUSH FOR THE EXIT, but to be disciplined in the coming weeks and look at the big picture.

Less-convicted traders will sell, allowing those that have done their homework to SCOOP UP shares at a discount.

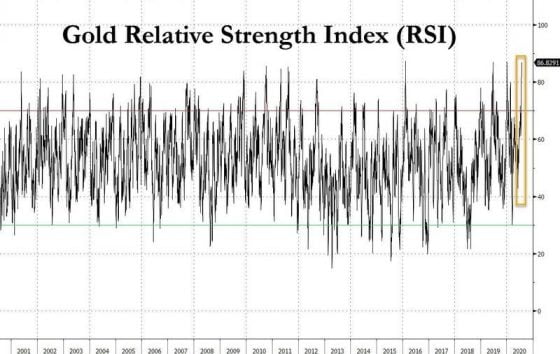

Courtesy: Zerohedge.com

It’s nearly MATHEMATICALLY IMPOSSIBLE to get more overbought from a technical analysis perspective, so don’t be surprised to see gold back down to the $1,800s and silver fall back to the $22s.

It works out perfectly, TAKING PROFITS on triple-digit gains, cashing up, and then RETURNING after a healthy pullback.

The Federal Reserve’s balance sheet is going to grow beyond $10T in the coming months. The ramifications for the dollar, especially in light of the fiscal strength exhibited by Europe, ARE AWFUL.

Our most important insight when it comes to precious metals and commodities is that many don’t understand that the dollar has TRULY ENTERED a lasting bear market.

The dollar’s relentless rise, including LEADING ALL ASSETS in 2018, is what investors remember. They can’t yet bring themselves to the point of view that the DECADE-LONG rally has come to an end.

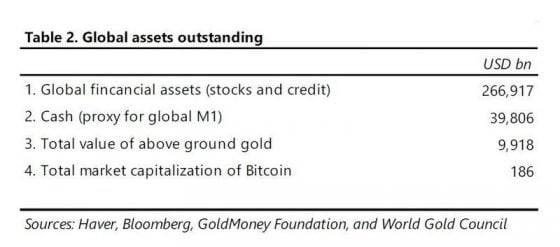

Courtesy: Zerohedge.com

Gold’s place in the asset universe is pretty unique. Its total value is nearing $10T, while stocks and bonds are more than 26x its size.

In the next 1-2 years, as an additional $1T makes its way to the gold sector, its price will SHARPLY RISE.

The LEGENDARY RETURNS, though, will come from the mining stocks.

A mini-pullback is healthy and it’s well overdue at this point.

The big picture is that this will be ONE FOR THE AGES!

In August, we will be announcing a new company that we’re going to cover for the coming years. Everything about it tells us that it has a TEN-BAGGER POTENTIAL (1,000% upside)!

You’ll be stunned.

0 Comments