This article was contributed by Future Money Trends.

One of Future Money Trends’ proudest moments in our newsletter’s history is covering the bullish case of Bitcoin when its price was $13/coin!

It’s been nearly nine years since, and Bitcoin is more relevant and important today than it ever was before.

Its technological adoption by the international community is now a thing of art.

Hype or not and government regulation or not, by this time in 2023, you’ll be seeing Bitcoin ATMs all around you and thousands of businesses accepting the cryptocurrency.

If anything can ever hope to materially change the currency ballgame and the dollar hegemony, it looks like Bitcoin would be it. Having said that, for Bitcoin to reach its reserve role will probably take 15-20 years to develop.

For now, the dollar is what we’re stuck with, unless you prefer one of the other fiat currencies…

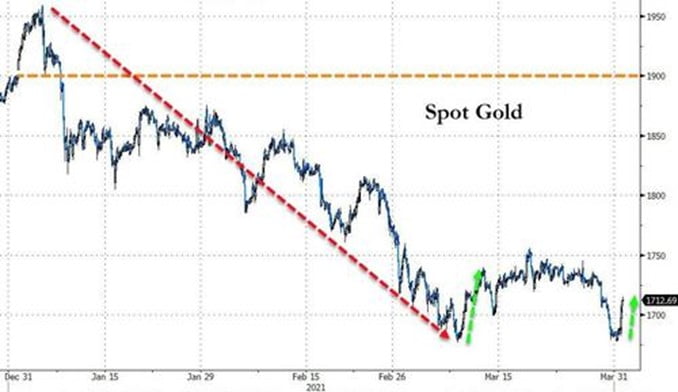

Courtesy: Zerohedge.com

The global economy had plenty of chances to reinstitute gold as some sort of foundational part of its currency strategy. It has chosen not to do so, and there does not seem to be any strong political, academic, economic, financial, or regulatory will to advance any failsafe that includes it.

If you think about it, letting gold trade freely is actually in our best interest!

I like it when gold trades on the open market since I have an exact system for when to accumulate more ounces:

- When gold comprises less than 5% of my net worth. That’s the most important rule of thumb (asset allocation balancing)

- When its price falls by 15% or more (buying the dip).

- When real interest rates are negative (a hedge against the cost of holding cash)

- When my allocation towards stocks is excessive (a hedge against expensive markets)

Courtesy: Zerohedge.com

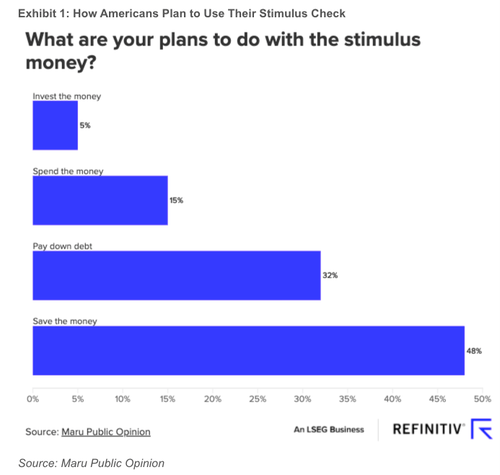

American consumerism is just not what it used to be!

The millennials saw the unfortunate problems endured by their parents in the 2008 Great Financial Crisis and they’re much more conservative in general.

They are even minimalists.

This fear of an overheated economy is really laughable.

The FED is not going to raise rates with unemployment rates for Asians at 6%, Hispanics at 7.9%, blacks at 9.6%, and whites at 5.4%!

Secondly, there are an estimated 1.6M job seekers who are actively looking and aren’t counted in the official numbers because of the way they are reported.

As you can see from the survey above, most Americans plan on saving their stimulus checks or paying down debt (80% of participants).

Courtesy: Zerohedge

Now, with the euphoria stage out of the way and options traders vanishing from the scene, if the CPI data doesn’t confirm a real threat of inflation (data comes out mid-April), we expect tech to continue leading for years to come.

Don’t be surprised to see rates continue to climb, but as we see it, the 85% rally in yields since the beginning of 2021 is overdone.

Gold has greatly suffered from this bond bear market in 2021. We believe that April might be the best time since June 2019 and March 2020 to own mining equities!

We’ll update on our highest-conviction ideas imminently!

We live in the era of ZIRP – Zero Interest Rate Policy. It’s designed to stimulate economic activity by making it cheap to borrow. Negative rates exist in Japan and Europe, and will be coming to the US. The fairly high unemployment rate and that the economy is sluggish are the officially stated reasons why interest rates are not going up, but these are not the main factors. One main purpose is that the federal debt is so immense that financing it with even almost nonexistent rates is still costing at least a budget wrecking 500 billion a year. Low interest rates allows gov’t (fed. & state) to help finance their titanic debts. If interest rates were to increase even only a percent or two the debt would really swamp the financial state of the nation, there literally would not be enough money in the US to finance an economy without massive Weimar type inflationary printing (which will be occurring anyway). Another reason is that low interest rates favor Wall Street, corporations, banks, and hyper wealthy investors to move around and use money at almost no expense (even as this hurts middle class savers and investors). All we really have to show for it all is a perennially struggling economy, incomprehensible debt, the ever widening wealth gap, and a dollar rapidly declining in value. In effect, State and central bank policies of today are mainly concerned for that which helps ensure (inflated) stock values on Wall Street, and to help protect the hyper wealth concentration of major investors and institutions.

Bitcoin and the blockchain seem to be pilot tests, using state infrastructure, state cooperation, and no literal promises of privacy, since there is a permanent data trail. They are, in all likelihood, going to become standardized.

Gold is worth whatever the local authorities say, whenever they say, or I defy you to find a higher price. Thirdworlders peg the value, artificially low, for their civilians, so the govt can sell on an open market.

I can’t help but think of Boomer memes…

“Your gold and silver is cankered; and the rust of them shall be a witness against you, and shall eat your flesh as it were fire. Ye have heaped treasure together for the last days. Behold, the hire of the labourers who have reaped down your fields, which is of you kept back by fraud, crieth: and the cries of them which have reaped are entered into the ears of the Lord of sabaoth. Ye have lived in pleasure on the earth, and been wanton; ye have nourished your hearts, as in a day of slaughter. Ye have condemned and killed the just; and he doth not resist you.”

— from James 5

“They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the LORD: they shall not satisfy their souls, neither fill their bowels: because it is the stumblingblock of their iniquity.”

— from Ezekiel 7

I might act the same way, using the same justifications, depending on which social contract I was born-under.