This report was originally published by Brandon Smith at Alt-Market.com

There are a few important rules you have to follow if you want to join the consortium of mainstream economic con-men/analysts. Take special note if you plan on becoming one of these very “special” people:

1) Never discuss the reality that government fiscal statistics are not the true picture of the health of the economy. Just present the stats at face value to the public and quickly move on.

2) Almost always focus on false positives. Give the masses a delusional sense of recovery by pointing desperately at the few indicators that paint a rosier picture. Always mention a higher stock market as a symbol of an improving economy even though the stock market is irrelevant to the fundamentals of the economy. In fact, pretend the stock market is the ONLY thing that matters. Period.

3) Never talk about falling demand. Avoid mention of this at all costs. Instead, bring up “rising supply” and pretend as if demand is not a factor even worth considering.

4) Call any article that discusses the numerous and substantial negatives in the economy “doom porn.” Ask “where is the collapse?” a lot, when the collapse in fundamentals is right in front of your face.

5) Avoid debate on the health of the economy when you can, but if cornered, misrepresent the data whenever possible. Muddle the discussion with minutia and circular logic.

6) When a crash occurs, act like you had been the one warning about the danger all along. For good measure, make sure alternative economic analysts do not get credit for correct examinations of the fiscal system.

7) Argue that there was nothing special about their warnings and predictions and that “everyone else saw it coming too;” otherwise you might be out of a job.

Now, if you follow these rules most of the time, or religiously, then you have a good shot at becoming the next Paul Krugman or one of the many hucksters at Forbes, Bloomberg or Reuters. A cushy job and comfortable salary await you. Good luck and Godspeed!

However, say you are one of those weird people cursed with a conscience; becoming a vapid mouthpiece for the establishment may not sound very appealing. Or, maybe you just have OCD and you can’t stand the idea of “creative math” when it comes to economic data. Whatever the case may be, you want to outline the deeper facts of the economy because the economy is life — it is the structure which holds together our civilization, and if we lie about it in the short term, then we only set ourselves up for catastrophe in the long run. Welcome to another dimension. Welcome to the world of alternative economics.

Every aspect of the U.S. economy or the global economy can be presented two very different ways depending on whether you “interpret” the data to fit a preconceived conclusion, or simply relay it to the public as it really is. Let’s use oil and the petrodollar as an example…

To illustrate the mainstream establishment reaction to legitimate economic concerns on oil, I highly suggest going back and reading an article by Foreign Policy, the official magazine of the Council On Foreign Relations, titled “Debunking The Dumping-The-Dollar Conspiracy,” published in 2009. The idiocy of this article was truly bewildering at the time it was released, but even more so now in retrospect.

First, it is important to note that Foreign Policy refused to even acknowledge the issue of the dollar losing petro-currency status until Robert Fisk of The Independent, someone closer to mainstream exposure, dared to broach the topic, warning that a trend was in play to dump the dollar as the petro-currency by 2018. The alternative economic community had been warning about the world moving away from U.S. oil dominance for some time beforehand.

Second, the CFR uses a typical circular fallacy when confronting the potential end of the dollar’s world reserve status; the fallacy that the dollar is the world reserve currency because “the U.S. is the preeminent world economic power.” Actually, the reverse is true — the U.S. is the world’s preeminent economic power only because the dollar has world reserve status. It was also once an industrial powerhouse after WWII, but this was ONLY because the U.S. was one of the few manufacturing hubs in the world that wasn’t demolished by years of kinetic destruction. When you are the only game in town, of course you reap huge economic benefits including massive international investment, but not forever.

Today, obviously, the U.S. is far surpassed by other nations in the area of manufacturing and production, and has also been surpassed as the largest global importer and exporter. The “preeminence” argument is unmitigated garbage.

Third, almost every danger Foreign Policy dismissed as “conspiracy” back in 2009 is now coming true. Just as Robert Fisk warned, and just as the alternative economic community warned long before him, numerous shifts in the world of oil as well as geopolitical relationships have created a spiraling nexus of anti-dollar sentiment. Is it possible that the dollar will lose petro-status by 2018? Absolutely, and here is why…

While the U.S. remains the world’s largest oil consumer according to the Energy Information Administration (EIA), American consumption of petroleum products has greatly diminished over the past few years; falling demand by increasingly destitute U.S. consumers has left oil producers searching for buyers elsewhere. The World Economic Forum noted in 2015 the drastic fall in U.S. demand since the 2008 debt crisis, but this admission went largely unnoticed in the mainstream media. Interestingly, while demand was crashing, the price per barrel continued to skyrocket because of the Federal Reserve’s inflationary QE policies. Almost immediately after the Fed began tapering QE, oil prices drastically declined in line with the lack of existing demand.

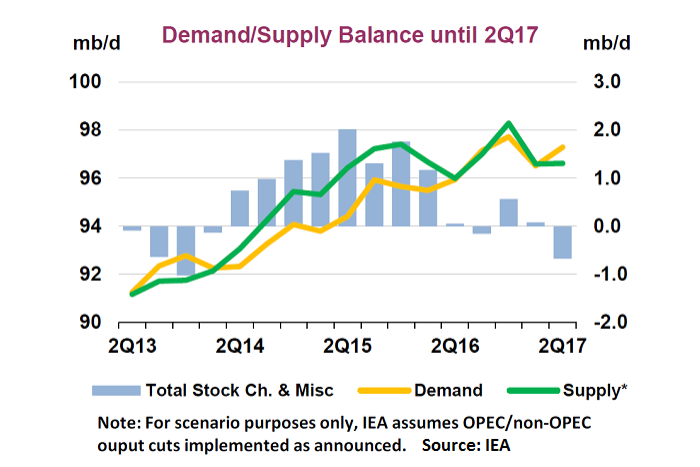

In 2017, the EIA claims there has been a rise in global demand since the second quarter. And has “projected” increasing demand including higher U.S. demand going into 2018, outpacing supply.

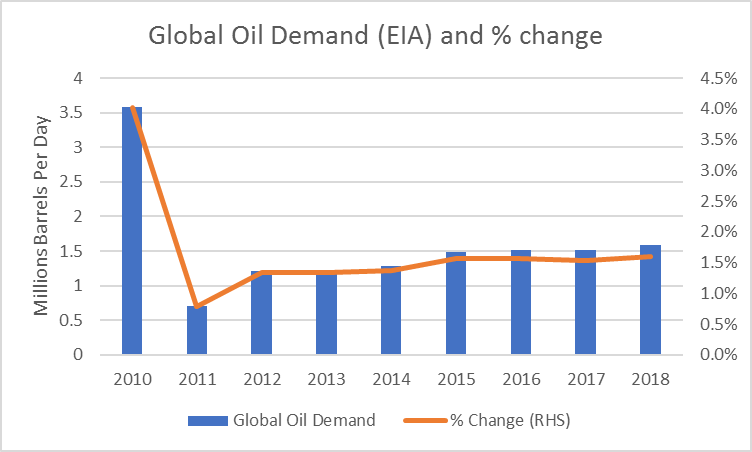

Yet, at the same time the EIA admits a frustrating stagnation in global oil demand, with the U.S. being the primary drag on consumption since 2010.

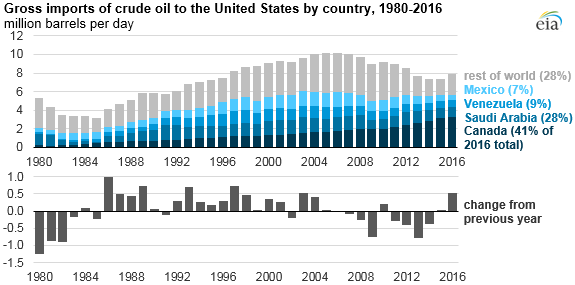

So, which trend are we supposed to believe? The one that is right in front of us, or the one that is optimistically projected? It is clear, even according to “official” statistics on crude oil imports, that the U.S. market began sinking in 2009 to levels not seen since the 1990’s and has not recovered since. Everyone knows that each new year is supposed to bring exponential demand, like clockwork. But this has not been the case at all in the U.S.

Meanwhile, China has recently surpassed the U.S. as the world’s largest oil importer, even though the EIA lists the U.S. as the world’s largest oil “consumer.”

The argument mainstream analysts would probably make here is that imports of oil are diminishing because U.S. shale oil is filling demand domestically. This argument overlooks the overall process of declining demand, though. The US is the largest consumer of oil NOW, but will that pace continue? According to the data, the answer is no. Americans are buying less petroleum products since the 2008 credit crisis, regardless of where they come from, and oil producers are seeking to diversify into other markets, and other currencies.

On top of that, even if it were true that imported oil is crumbling because US domestic oil is filling rising demand, this still begs the question – Why would oil producing nations stick with the dollar as the petrocurrency when the US has decided to take its ball and go home? The US has now become a COMPETITOR in the oil market with shale, so why would OPEC nations and others also continue to give the US the enormous advantage of owning petrocurrency status?

In the meantime, the geopolitical situation grows more unstable. I believe the Iranian sanctions issue has gone ignored far too long, and this has direct repercussions on the dollar’s petro-status. How? Well, consider this — Europe continues its appetite for Iranian oil, with 40 percent of Iran’s oil exports going to the EU. With the very oddly timed U.S.-led effort by the Trump administration to renew sanctions, Europe has been caught in a catch-22; either defy sanctions and upset relations with the U.S. or lose a significant source of petroleum imports. For now it appears that the EU will support sanctions, but this time solidarity on the issue is nowhere near as strong as it was back in 2012.

With Iran as a major supplier for Europe as well as China, and overtaking Saudi Arabia as the top oil supplier for India, Trump’s latest call to put economic pressure on the nation may add more fuel to the accelerating rationale against the dollar as the primary trade mechanism for oil. The question becomes, who benefits from American influence in oil, and who suffers? The more countries that suffer because of a world reserve dollar, the more likely they will be to look for an alternative.

China has deepened ties to Russia for this exact reason. With Russia supplanting Saudi Arabia as China’s largest petroleum source, and bilateral trade between Russia and China cutting out the dollar as world reserve, this is just the beginning of the shift. In the past week it has been hinted that China will be shifting in the next two months into using its OWN currency, the Yuan, to price oil instead of using the dollar.

Saudi Arabia, America’s longtime partner in the oil dominance chain, is now moving away from the old relationship. Tensions between the Saudis and the U.S. State Department over the rather surreal Qatar embargo are just part of a series of divisions. With China’s influence in the region increasing, the mainstream has finally begun to acknowledge that Saudi Arabia may be “compelled” to trade oil in currencies other than the dollar.

Why is oil so important? Because energy, along with currency, is the key to understanding the state of the economy. When demand for energy goes stagnant, this usually means the economy is stagnant. When a nation has maintained a monopoly on global energy trade by coupling its currency to oil, an addiction can be formed and its financial structure becomes dependent in that addiction being continuously satiated.

Foreign Policy argued in 2009 that oil trade in dollars is “nothing more than a convention.” I would actually agree with that in part; it is indeed a convention that can change dramatically at any given moment. But, Foreign Policy asserts that there would be no consequences for the U.S. if and when the change takes place and the dollar loses petrostatus. This is absurd. Trillions in dollars are held overseas and the singular function of those dollars is to fulfill international trade based on the “convention” of the dollar’s world reserve status. What purpose do those dollars serve if world reserve status is abandoned? The answer is none.

All of those dollars would come flooding back into the U.S. through various channels. Market psychology would immediately trigger a massive loss in the dollar’s international value, not to mention incredible inflation would be spiking here at home. This process has already begun, and it is looking more and more like the next couple of years will bring a vast “reset” (as the IMF likes to call it) in the hegemony of certain currencies.

Some people believe this will be a wellspring, a change for the better. They think the death of the dollar will lead to “decentralization” of the global economy and a “multipolar world,” but the situation is far more complex than it seems. I will go into greater detail in my next article as to why the dollar and the U.S. economy in general has actually been slated for deliberate demolition and how this will likely come about. As far as oil and petro-status are concerned, the mainstream media is perfectly willing to report on the developments I have mentioned here in a fleeting manner, but at the same time they are completely unwilling to account for the effects that will result or the deeper meaning behind these events. They will report on the smaller stories, but refuse to acknowledge the bigger story. It is quite a contradiction, but a contradiction with a purpose.

If you would like to support the publishing of articles like the one you have just read, visit our donations page here. We greatly appreciate your patronage.

You can contact Brandon Smith at: br*****@********et.com

After 8 long years of ultra-loose monetary policy from the Federal Reserve, it’s no secret that inflation is primed to soar. If your IRA or 401(k) is exposed to this threat, it’s critical to act now! That’s why thousands of Americans are moving their retirement into a Gold IRA. Learn how you can too with a free info kit on gold from Birch Gold Group. It reveals the little-known IRS Tax Law to move your IRA or 401(k) into gold. Click here to get your free Info Kit on Gold.

0 Comments