This article was contributed by Tom Beck with Portfolio Wealth Global.

The retail public is feeling PRETTY DARN good at the moment. Anything they bought in April and May is up big!

What the retail public, especially 30-40-year-olds have been taught since 2009, is that DIPS are to be BOUGHT, because Mother Goose will make sure those prices FLY OFF THE CHARTS.

The lesson they’ve been experiencing for 12 years is that the Federal Reserve will make everything better, so unlike the baby boomers, who are retired and HATE VOLATILITY, the younger generations are buying.

What are they buying, though? When the S&P 500 companies are trading at a forward multiple of 20 or more, it means that they’re buying an asset that is yielding about 5%, nearly 60% BELOW its historical value proposition.

My feeling is that with the same speed they CAME IN, they will LEAVE with the first shakeout of confidence.

Just so I’m clear, buying the dips is NOT A MISTAKE, but buying without an exit strategy is!

That’s what I think is happening; the retail public bought companies, which may or may not come back stronger and it overpaid for many stocks. FUNDAMENTALLY SPEAKING, the truth is that if rates were just a bit higher, the basket of viable companies would DROP BY HALF!

When I own a company, I want to know that it can function in tougher environments as well, and December 2018 proved that most can’t.

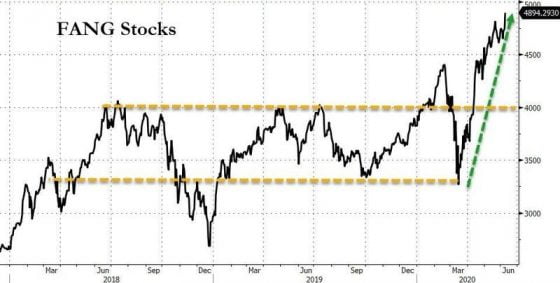

Courtesy: Zerohedge.com

What this chart is telling us, though, is that the MARCH PANIC wasn’t a real bear market, the reason being that bear markets CHANGE BEHAVIOR and nothing has changed for the FANG stocks.

They’re still in favor and, as long as this continues, the trend will remain the same.

We have to accept that the business world is becoming CONCENTRATED.

These companies are not monopolies, but they amount to the same thing: EVERYONE uses their products and they’re extremely innovative and competitive. Therefore, unlike in previous historic rallies, the leaders this time are basically blue-chip tech stocks.

To me, this means that we haven’t seen the end of this cyclical dominance of tech companies.

This doesn’t mean that they’ll be INDEX-CRUSHERS in the next 2-3 years. In my opinion, after doing tremendous research, the REAL MONEY is in buying the most beaten-down household names, which are in the hotel, casino, cruise line, air travel and oil businesses – and the same goes with retail malls.

These WILL NOT be long-term holdings, but within 2-3 years some of them will be worth JUST AS MUCH as they were before the crisis, so if they’re down by 50%, we can make a 100% gain WITH LOW RISK.

In the months ahead, as people go back to normal, the critical thing to watch for is how fast unemployment numbers go down. If Americans can’t resume pre-crisis jobs, the real crisis will BE AHEAD OF US, not behind us.

0 Comments