This article was contributed by James Davis with Future Money Trends.

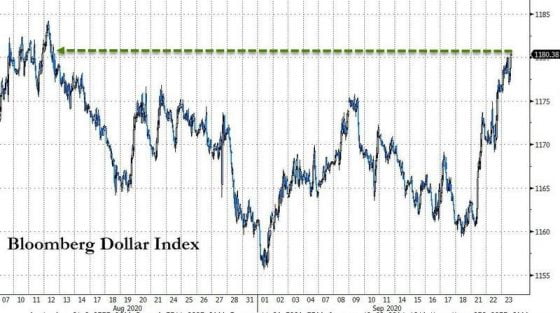

The dollar is punishing traders; throughout July and August, the dollar was HEAVILY SHORTED, as we pointed out and warned about. So far in 2020, we’ve called EACH MAJOR move of the dollar and precious metals ahead of time – this is a big correction for stocks, gold, and silver, but we’re forecasting that the MAJORITY OF IT is behind us.

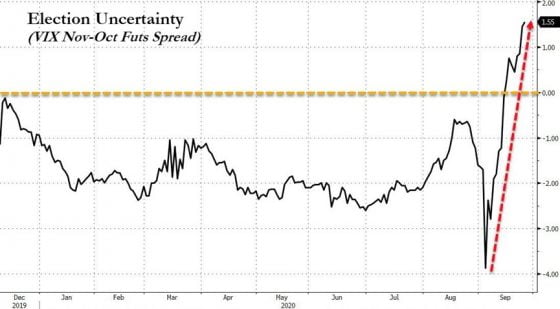

The main reason for the SELL-OFF in gold and silver is the rise in REAL RATES, whereas the reason stocks have entered a correction is because of ELECTION UNCERTAINTY and healthy de-leveraging after August was SUPER-EUPHORIC.

Courtesy: Zerohedge.com

So far, in 2020, each breakdown below the 200-DMA has been a HUGE OPPORTUNITY to buy mining stocks and physical gold.

You can also observe that each time has been QUICK, lasting two or three weeks AT THE MOST; gold has massive support.

My point is that if one is UNDER-INVESTED in precious metals, this is a potential discount window before we resume the uptrend.

This coming week, markets will receive SOME CLARITY, as the presidential debate will be a PIVOTAL MOMENT in American history!

It’s a big week; please don’t STAY INDIFFERENT to the gravity of the debate because much is riding ON IT!

Courtesy: Zerohedge.com

This uncertainty is what’s REALLY DRIVING the huge surge in dollar demand; the wait and see approach is manifesting in the dash for cash and there could be MORE OF IT as we enter October, but Friday’s action towards the end of the session might signal the end of the correction, so STAY TUNED.

It now becomes a question of what’s next to come after the huge gains we’ve ALREADY EXPERIENCED in 2020 and the answer is, as it ALWAYS IS, that no one knows.

What we know is that the NASDAQ 100 is 13% cheaper than it was at the end of August and that the S&P 500 is 10% cheaper than it was just three weeks ago.

Everyone is selling and cashing out; are you doing THE EXACT opposite?

Courtesy: Zerohedge.com

There are ELECTION JITTERS, but ask yourself this: will interest rates be different if a Republican or Democrat is in office?

Ask yourself the same question about stocks: are companies going to be worth less because of who’s in the WHITE HOUSE? Here, the answer is YES; higher corporate taxes make stocks less attractive.

COVID-19 has made many companies face DIRE CONDITIONS, so my thought is that as the mining companies report earnings GOING INTO OCTOBER, the dramatic results will bring back investors like Warren Buffett and the sector will GO NUTS.

0 Comments