This article was originally published by Chris Martenson at PeakProsperity.com

Now that the world’s central banking cartel is taking a long-overdue pause from printing money and handing it to the wealthy elite, the collection of asset price bubbles nested within the Everything Bubble are starting to burst.

The cartel (especially the ECB and the Fed) is hoping it can gently deflate these bubbles it created, but that’s a fantasy. Bubbles always burst badly; it’s their nature to do so. Economic suffering and misery always accompany their termination.

It’s said that “every bubble is in search of a pin”. History certainly shows they always manage to find one.

History also shows that after the puncturing, pundits obsess over what precise pin triggered it, as if that matters. It doesn’t, because ’cause’ of a bubble’s bursting can be anything. It can be a wayward comment by a finance minister, otherwise innocuous at any other time, that spooks a critical European bond market at exactly the right (wrong?) moment, triggering a runaway cascade.

Or it might be the routine bankruptcy of a small company that unexpectedly exposes an under-hedged counterpart, thereby setting off a chain reaction across the corporate bond market before the contagion quickly spreads into other key elements of the financial system.

Or perhaps it will be the US Justice Department arresting a Chinese technology executive on murky, over-reaching charges to bully an ally into accepting that unilateral US sanctions are to be abided by everyone, regardless of sovereignty.

How was it that the famous Tulip Bulb bubble came to a crashing end back in the 1600’s? No one knows the exact moment or trigger. But we can easily imagine that in some Dutch pub on the fateful night on the Feb 3rd 1637, a bidder on the most-coveted of all bulbs, the Semper Augustus, had an upset stomach and briefly grimaced when hit by a ripping gas pain:

Interpreting this face as distaste for the opening bid price, the assembled crowd may have suddenly realized the absurdity of paying so much (enough to clothe and feed a family for more than half a lifetime) for an ungrown flower. The bids were pulled, and the rest is history.

The point is: it doesn’t really matter what the pin actually is. The fatal trigger is often something completely unexpected and impossible to have predicted. So obsessing over what will end the Everything Bubble is a fool’s errand.

Rather than the “pin”, what’s important to focus on is the “pop” — what the aftermath will be. The duration and height of a bubble is directly correlated with the scope of the destruction its bursting will wreak, as is the number of asset classes that get caught up in the mania.

It’s much wiser to spend our time focusing on where the damage is going to occur, what path it’s most likely to take, and how bad the losses will be — so that we can position ourselves accordingly in advance for safety and, for the more adventurous, profit.

We’ve never seen anything like the current bubble we’re in. Stocks, bonds, real estate, fine art, you name it — nearly everything has been inflated to all-time highs. When this Everything Bubble pops, the pain is going to be epically calamitous.

And it’s increasingly looking like the “pop” has sounded.

Greed & Fear

Every bubble requires two essential inputs to fuel its rise:

- a compelling story

- ample credit

If either is missing, no bubble.

Price bubbles are not financial phenomenon, but rather psychological constructs born and nurtured in the human brain stem. Greed and fear — that’s what drives bubbles.

Greed on the way up and then fear on the way down. But neither has much influence without a tempting yarn and a lot of easy credit.

Attempting To Replace The Business Cycle With A Credit Cycle

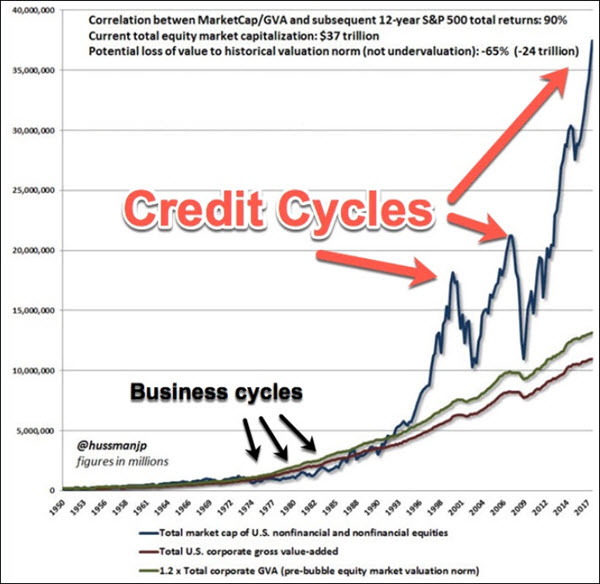

In their quest for power and glory (and accompanied by a dead-flat learning curve), the world’s central banks are now pursuing their third, largest, and most ill-considered attempt to defeat the business cycle by replacing it with a credit cycle. The fact that the prior two credit cycles blew up spectacularly doesn’t seem to be deterring them in the slightest.

A rather minor business cycle slowdown in 1994 was fought with a tidal wave of new credit under Greenspan. That ultimately resulted in the Dot Com Bubble crash of 2000, but the lesson went unlearned.

Instead the Fed concluded that the idea was sound, but was simply not taken far enough. The elite cheerleading squad, captained by Paul Krugman, fully supported a doubling down, and the media unquestioningly went along with the program.

So Greenspan and Bernanke created the Housing Bubble 1.0 by offering the world’s credit markets a price of money so low it couldn’t be refused. Housing was the story, and the Fed supplied the credit. As predicted by a scant few of us, that all blew up spectacularly in 2008. And no constructive lessons were drawn from that experience, either.

With the political aircover to “save the system” (from the problems that it created!), Bernanke, Yellen, Kuroda and Draghi then led the most aggressive, coordinated central bank bender in all of human history.

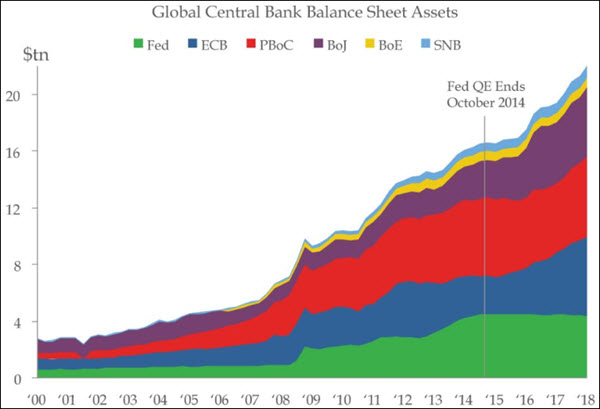

$Trillions and $trillions were printed up, and many times that amount were leveraged and loaned throughout the banking and speculative finance universes:

(Source)

If you can’t clearly see how the above chart explains the massive price inflation over the past years in stocks, bonds and real estate, you’ll have no chance of understanding what’s coming next. Best of luck to everyone choosing to avoid paying attention to this critical information; you’ll dearly need it.

Paying attention or not, here we all are; stuck together in a world awash with credit. $250 trillion in debt. 4 times that amount in unfunded liabilities. And a mind-bogglingly massive amount of tangled financial derivatives roughly the same size as both those debts and liabilities put together.

The Greed Is Now Gone

All that credit had to go somewhere. And it did.

Rare art fetched record-breaking prices. As did top-end trophy properties the world over. Rare cars and large gemstones commanded the highest prices ever seen. Stocks were bid up to ridiculous Price/Earnings multiples. And the Housing Bubble 2.0 returned to many metros around the globe — housing has never been more unaffordable to more people than it is now.

Can you feel it? How greed is now giving way to fear?

Sure, you probably know people who are hanging onto the Wall Street marketing slogans (“Buy the dips…hang on…don’t panic…successful investors don’t sell into weakness, they buy more!”). But the party atmosphere is now over.

Just ask anyone who bought a house in Seattle in June (now down 11%). Or FAANG stocks in July (down 20%+). Or cryptocurrencies in January (down 80%+).

We’ve seen more downside volatility in the financial markets this year than in all of 2012-2017.

Until and unless the central banks reverse their current tightening course, everything is headed lower.

And I mean everything.

How bad will it get? Honestly, pretty damn bad. Worse than 2000 and worse than 2008.

The credit cycle is just that much larger this time.

It’s the airgap between the economic value added (EVA) lines below and the spiked tops above that defines the amount off pain involved in the unwinding. This chart clearly shows the reckoning is going to be on a scale we’ve never experienced before.

Which is why our our advice continues to be protect your money, develop all 8 Forms of resilience (especially Emotional), and prepare to be a source of support for shell-shocked neighbors and loved ones.

The “Big One” Is Here

The recent market volatility is just the beginning of the downslide.

There will be many starts and stops along the way, but coming soon will be a shock that wakes people up and scares them badly.

Perhaps it will be another institutional failure like Lehman Brothers. Or maybe a sovereign default. Or even a central bank failure (yeah, I’m looking at you Swiss National Bank!).

Just “printing less” is causing the major stock indexes to stumble, while plunging the peripheral emerging markets into bear market territory.

What’s going to happen when the central banking cartel is in net “money withdrawal” mode? Will today’s teetering markets be able to withstand that headwind?

We won’t have to wait long to find out. We should hit that milestone in the next quarter.

For now, the Fed and ECB lack the political capital to resume printing anytime soon. The Bank of Japan hardly has the muscle to muster anything more than temporary speed bump on its wind-down. And China increasingly has less and less motivation to help the US financial elites by rescuing their markets for them. Besides, the Chinese authorities have their own massive collapsing bubbles to contend with right now.

And to add insult to injury, recession indicators are piling up faster and faster now. 2019 is looking primed to be The Year That Mass Layoffs Returned. Should that be the case, the resultant slowdown in consumer spending is certainly not going to help matters.

Against this backdrop, how far could the markets fall from their current prices? Easily 30% to 50%. And that’s if we’re lucky.

In Part 2: What To Do Now That The “The Big One” Is Here, we detail out the key indicators to watch most closely to track the great unwinding ahead, so that you can stay head of events and increase your odds of positioning for safety (and profit).

Those of us who have spent the past years watching in concern as the Everything Bubble grew, this is the moment we’ve been anticipating. Time to put your crash plans into action.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

0 Comments