If you’ve been watching the gold mining sector lately then you may have noticed a recent dip in prices. While this may normally be a sign of problems in the space, as Eric Sprott points out in his latest interview with SGT Report, the reason behind the down-move is actually the opposite of what you may think. As Sprott explains, the popularity of one of the world’s largest gold related Exchange Traded Funds (ETF), the VanEck GDXJ, which is designed specifically to track junior gold mining companies, has led to massive inflows of cash from investors. That, of course, is a good thing for the precious metals sector as whole. The short-term downside is that the ETF grew in popularity so quickly, that it has too much cash and not enough places to put it. The reason for this is that regulatory rules limit how much the GDXJ ETF can invest in any single company – currently at 20%.

What this means is that by June 17, the GDXJ ETF must re-balance its entire portfolio by way of selling junior mining company shares before it can re-invest those funds into new holdings. And as you may have guessed, that has put serious selling pressure on some mining companies that are currently being held by the fund. But the selling pressure, says Sprott, will be short-lived and has actually created a unique and potentially very profitable scenario for precious metals investors:

The problem that VanEck found with the GDXJ was that there was too much interest in it… their standard was they didn’t want to own companies with a market cap in excess of $1.8 Billion… In order invest as many funds as were flowing into it they ended up owning large concentrations of ownership in the companies… Things became very complicated for the GDXJ… The premise is that the buying interest in junior gold stocks is causing the change…

The stocks that exist in the fund up to June 17… Most of them, their weightings will fall to about 50%… Which means that the ETF has to sell… So you’re getting this rebalancing… People are acting in the market to sell ahead of the trade on June 17… It’s putting pressure on the stocks… and ultimately when all this is over these stocks are going to go back to where they were.

The interview, which also features First Mining Finance Chairman Keith Neumeyer, is a must watch for those struggling to understand how record interest in the GDXJ is actually about to cause the prices of some junior mining companies to drop, as well as how to identify profit opportunities over the next month while the effects of the sell-off play out:

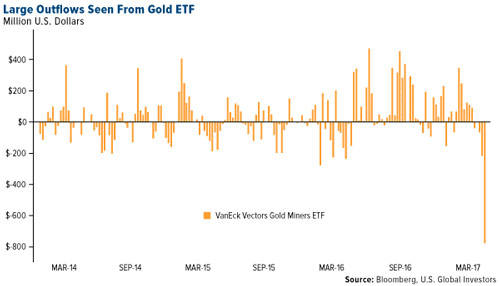

A simple chart via Wealth Research Group shows how significant the change has been in the last couple of months as GDXJ offloads up to 50% of some of its junior mining company holdings:

Keith Neumeyer, who joined Eric Sprott in the interview, is the CEO of the world’s top primary silver producer, First Majestic Silver, and the Chairman of First Mining Finance, which is directly affected by the coming change in GDXJ:

The fact that they got up to 15% of total outstanding shares of First Mining Finance is an enormous position for one passive investor that doesn’t really care what happens to price, because it’s just simply an ETF and there’s no real decision making going on… they add you to the portfolio and they subtract you from the portfolio…

I’ve seen First Majestic added to the GDXJ twice… and taken out of the GDXJ twice…

Now a similar situation is occuring in First Mining Finance where they have to reduce their holdings from around 15% to somewhere around 8%, which is about half their current holdings… and they’re doing it in a period of about six weeks. The market for mining stocks isn’t exactly rip-roaring right now… so they’re selling into a relatively weak environment and it’s really putting a lot of extra pressure on the stock which wouldn’t exist otherwise.

It does create an opportunity… but it sure does create a lot of concern for a lot of our shareholder base, who, quite honestly, doesn’t really understand this ETF world.

Though stock prices dipping could cause concern and even panic for some investors, those who understand the mechanics behind the recent technical challenges faced by the GDXJ stand to profit handsomely, according to Neumeyer:

A lot of the analysts point to the GDXJ and say ‘it’s due to success.’

The GDXJ has gone from $1.5 billion to around a $5 billion value… and that’s a lot of funds that have been going into that ETF… the junior mining space is quite small… so that $3.5 billion extra that has been invested into the junior mining space in the last 12 to 18 months has been a huge underpinning to a lot of these stocks…

…

It takes very little money for these stocks to move and for this sector to move… You can fit the entire gold mining sector into the market cap of Apple… It gives you an idea of how small the gold and silver mining sector are.

The Dow continually hits new highs… and the NASDAQ continues to hit new highs… so that’s where the money is going [right now]…

But those smart investors out there… they have to look at the other side of the investment world… because there will be a point in time when the money is going to start coming back to the mining sector… You have to be ahead of the game…

In short, as Neumeyer notes, investment inflows of $3.5 billion to just the GDXJ ETF show that investor interest has grown significantly over the last two years, and with prices for some junior mining companies set to temporarily drop, now may be a perfect opportunity for money on the sidelines to make its way into the precious metals sector.

Because in addition to the drop in prices going into June 17, there will be continued interest in precious metals due to uncertainty across the globe, which could, as Eric Sprott highlights, see a very meaningful resurgence in price:

I think the most important thing that you pointed out is that the weighting of gold investments in the world of investments is like one-half of one percent… In 1980 the weighting of gold investments was 8%… Imagine what happened from 2002 to 2011 when went up by 1700%… that sort of thing can happen again…

We have not just the printing of money… but we have the whole geopolitical thing…

Anything could sort of tip this thing over… we’ve seen so many of the smart investors mentioning gold that weren’t mentioning gold two years ago… I see generalist technical analysts who are pounding the table on gold investments…

So when these come to manifest themselves it’s going to be a pretty small door for everyone to come through… and the smallest door of all will be the Junior mining door, so it could be quite exciting.

Keith Neumeyer is the President and CEO of First Majestic Silver and the Chairman of Mineral Bank First Mining Finance.

Eric Sprott is the founder of Sprott Global Resource Investments and Chairman of Kirkland Lake Gold

Visit SGT Report for more interviews, market news and commentary.

0 Comments