Americans have reached the point of no return when it comes to consumer debt says that data of a large bank. The clock is ticking as the level of debt rises and the risk is increasing at a rapid pace.

“The clock is ticking,” Deutsche Bank’s chief international economist Torsten Slok told Yahoo Finance in a phone interview. “Maybe the risk here is that you’re actually in a situation where you should be paying attention to these charts and these consumers loans.” However, Slok is adamant that “the economy is doing fine — we are not about to enter a recession,” he said. The labor market is strong and so are wages, he insists.

If that’s the case, then why are so many consumers burdened by debt finding it increasingly hard to pay back the money they owe? Slok says it’s due to sub-prime loans. “When you come out of a recession, you can only get a loan if you [have a] stellar credit score,” Slok explained. However, after the 2009 slowdown, “loans were given more and more to people who had lower and lower credit scores … [and] soon deep-subprime credit scorers got loans.”

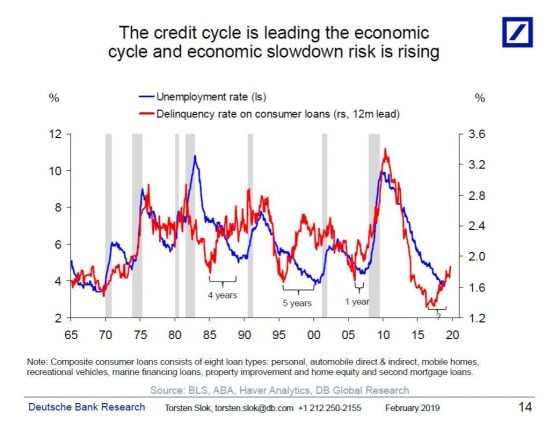

Deutsche’s own data, on the other hand, shows that the credit cycle does lead an economic slowdown. In other words, when delinquency rates on consumer loans take a big dip as they are now, there’s a likelihood that a recession could be on the horizon.

Those borrowers with lower credit scores probably shouldn’t have been given a loan, nor should they have requested one. But they are now adding to the alarming spikes in auto loans, credit card debt, and other personal loans. One of the key demographics experiencing this trouble is millennials. The New York Fed recently reported that the age cohort is leading the pack when it comes to auto loans that were more than 90 days delinquent, according to a report by Yahoo Finance.

Lenders are reacting to the delinquencies by hiking the interest rates on existing consumer loans, which in turn is increasing the burden on the consumer.

https://www.shtfplan.com/headline-news/trump-to-be-blamed-for-the-next-recession-but-americans-lack-of-responsibility-is-real-culprit_04242019

As U.S. consumers continue to balk personal responsibility and rack up a record amount in debt (a recent Federal Reserve report showed outstanding consumer debt topped a record $4 trillion) Deutsche Bank’s analysts showed that more borrowers are falling behind on a range of personal debts, like credit cards and auto loans.

Delinquencies make the potential of a recession much more likely. This is the “ticking time bomb” referenced earlier.

0 Comments