This article was contributed by Future Money Trends.

Silver’s price is tied with inflation much more than gold’s is. In the 1970s, as inflation raged in the United States, silver rose to $50/ounce, having started the decade at under $2. It was a sensational decade for the white metal.

However, in the 1980s and 1990s, as deflationary forces brought interest rates down rapidly, the metal’s price languished. Today, its price is HALF of what it was in 1980!

Obviously, investing in silver is NOT similar to investing in gold, which does enjoy a long-term appreciation under both deflationary and inflationary environments.

The question, then, is whether or not there’s a potentially interesting trade setting up in silver now that it has doubled from its March lows.

The answer depends on inflationary pressures and inflationary expectations.

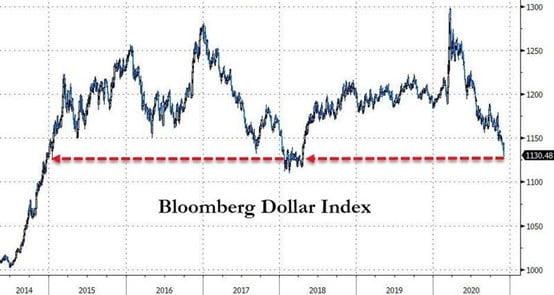

- We are seeing that the dollar is dramatically weakening, which is the first sign that silver is likely to enjoy the momentum.

Here’s the dollar chart as it stands today:

Courtesy: Zerohedge.com

It doesn’t feel like the trend is swinging, either. This seems to be a long-term structural decline. Even the price of oil is back over $50/barrel.

- Silver’s price has already tested $30 this year and has shown that in the first stages of a recovery, however weak it may be, it can surge by triple-digits.

In 2009, for instance, it appreciated from $9 to $49 in two short years.

Again, this is a trade that could be capitalized upon, not a buy-and-hold idea.

- The price of silver has directly correlated with the price of oil over the years. With oil surging, this could be a critical bullish catalyst for silver.

In the end, silver is an ideal way of betting on inflation.

The Federal Reserve has done the heavy lifting for us. It arbitrarily mandated 2% inflation as some magical number. This means that the street will be bracing for inflation if the FED measures it as such.

Therefore, the smartest move is to watch that 2% gauge from Powell and his buddies.

Courtesy: Zerohedge.com

In our world, we’re reaching a point that we call the DEBT LIMIT, which is the moment when deflating the currency supply by simply adding more debt is not productive.

This moment will change how investors view inflation.

Be prepared for it and study the topic thoroughly in the meantime.

Seriously? Is this the best shit you can come up with? I can write articles WAYYY better than this and a lot more relevant too! You have my email, all you have to do is ask…

Future Money Trends founder here Dan Amenduri is one of the kings of PUMP and DUMP stock picks that he , his cousin Ken and his friends Lior and Tom send out in mass emailings to get you to buy and then sell after you buy them up. Stay far away from Future Money Trends, Wealth Research Group, Portfolio Wealth Global, and Crush the Street. You have been warned !!!

you people (authors) are aware there are other investments outside of pm’s and digital … right?

A .223 in the hand ,is worth two .999 in the bush. errrr

I predict trillion dollar silver. Right before the dollar disappears entirely.

Silver hitting $50 an oz, it happened in the mid 90’s when the Koch / Kock Bros tried to corner the market on silver. How do I know, well, for one, it was all over the news and for another, guys, people that I worked with in the packing house were buying silver like no tomorrow. I was asked if I wanted in and I refused, because I didn’t anything about it.Short story, they lost their rear end when the price of silver dropped to 10 or 15 dollars an oz.So yes, silver can and has hit $50 an oz. Will it go higher, good guess

Together with every little thing which appears to be building inside this particular area, your viewpoints are very exciting. Having said that, I am sorry, but I can not subscribe to your whole plan, all be it exciting none the less. It looks to me that your remarks are generally not totally justified and in fact you are yourself not fully certain of the assertion. In any case I did take pleasure in reading it.