This article was contributed by Portfolio Wealth Global.

A good friend of mine just liquidated 80% of his mining stocks portfolio. He wrote his broker in June 2020, when he saw the big recovery happening, that his thesis was that because of all the currency printing, global supply chain shutdowns, inflationary rebound and stimulus checks, gold would be at $3,000/ounce by the November elections.

Yesterday, he told me that if a global healthcare crisis, coupled with a supply chain breakdown, along with the most excessive currency creation scheme of all time, can’t propel gold to $3,000, then nothing ever will.

I disagree.

Gold’s best bull markets (the 1970s and 2000s) had nothing to do with calamities.

Gold’s 1970s bull market was essentially price discovery after the $35:1/ounce was revealed as bullshit, which then morphed into a speculative bubble.

Gold’s 2000s bull market was a reaction to a dramatic cut in interest rates, coupled with a sideways stock market.

Right now, people are asking themselves what will send precious metals higher and the answer is negative interest rates.

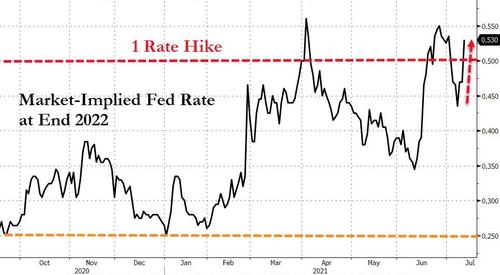

The highest Core CPI data in 30 years came out today and we do not believe the FED will do anything about it, for one.

Courtesy: Zerohedge.com, Bloomberg

The FED is quite adamant that employment must include all genders and races – a goal that’s far from being achieved – so I don’t expect them to raise rates, and my most aggressive forecast is that they might begin to taper in September.

In other words, inflation can run hot for another year, and still, all the FED would probably do is just explain why it will soon come back down by sheer gravity.

The only sector I’m truly concerned with is technology; it’s just so expensive:

Courtesy: Zerohedge.com, Bloomberg

Now we know what the inflationist camp is thinking, but I also want to point out that there are those who are not convinced that hyperinflation is next.

To them, when a person changes his diet, the body feels uncomfortable at first, but after a while, it adjusts.

It can take longer than we think, but in the end, the body finds new equilibrium. The free enterprise system tends to fix itself by way of innovation.

Those in this group believe that inflation is mostly transitory and will soon revert to its trend line.

I remember when my trainer put me on a new program and my body had to acclimate; it takes time, but eventually, it did so. In the interim, my muscles felt weird.

Closing global supply chains does that; it generates issues, chief among them inflation, but the thing to keep in mind is that the long-term trajectory is mostly deflationary.

Courtesy: Zerohedge.com

If and when things do revert back down, which is what the Federal Reserve fully expects, it could be sub-2% again, but I doubt it.

Not much can happen in the modern economy to turn the tables and, all of a sudden, usher in positive real rates.

High inflation or not, negative rates are a constant, in my opinion, and will continue to drive demand for precious metals and for Bitcoin.

0 Comments