This article was originally published by Lior Gantz of The Wealth Research Group.

Buffett is famous for saying that he missed out on Amazon, Google, Facebook, Netflix, and others because “You can’t teach an old dog new tricks,” but it seems that this opportunity IS JUST TOO GOOD even for old dogs to stand idly by and watch.

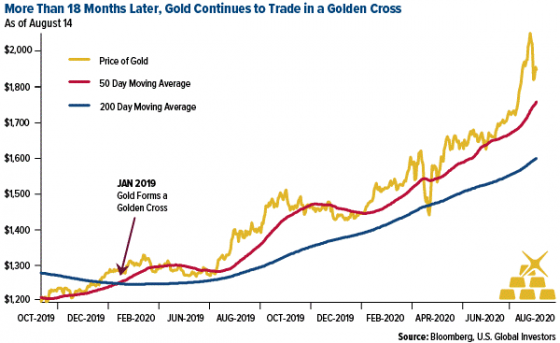

Gold has had a CRAZY WEEK, with wild swings, but the big picture remains as ROSY AS EVER. Even after falling by close to 4.6% in the past week, and CLOSING BELOW $2,000/ounce, and even after both gold and silver had their WORST DAY in years this week (silver went down by 13.5%!), the technical analysis is VERY CLEAR: the bull market LIVES ON!

Courtesy: U.S. Global Investors

The 50-DMA is above the 200-DMA and the spot price is above both of those. It is a beautiful sight to see – a GLORIOUS WORK OF ART.

While gold, which normally trades inversely to stocks, is RUNNING HARD, the S&P 500 just underwent its best 100-day STRETCH IN HISTORY.

Truly, if one WASN’T SHAKEN OUT in March, and especially if he had THE STAMINA to go long in the MOST OBVIOUS time in human history when buyers were considered to be MAD LUNATICS, one had unreal returns.

So, what now?

- People that we would not HAVE DREAMED would be interested in gold, let alone mining it, are now buying into the sector. Berkshire’s 13F filings show a $564mn position in Barrick Gold, the powerhouse of the industry. Others will FOLLOW SUIT!

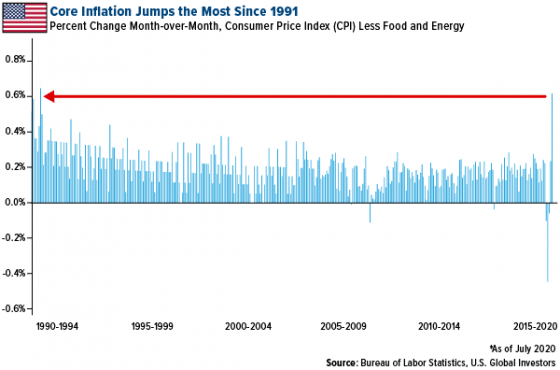

- Inflationary expectations ARE RISING FAST, but the central banks have stated that they’re not even CONSIDERING raising rates. They’re not even considering if they should consider it.

Courtesy: U.S. Global Investors

Not since 1991 has there been SUCH A SPIKE in inflationary expectations.

In the past 100 days, the S&P 500 is up just over 50%. In 2009, it was 45%, when in July the market finished a stunning recovery.

The STARK CONTRAST, though, is that the market wasn’t trading at all-time highs back then.

Markets move SO FAST these days that they price in events that are 2-3 years INTO THE FUTURE – they’ll continue to do so. Prices reflect 2022 and even 2023, at this point.

We’re not in the business of crystal balls; our objective is to look at the world around us and FIND OPPORTUNITIES, not guess where they’ll be next.

If what President Trump is planning GOES THROUGH, an additional $3,400 PPP injection is coming to each family of four.

It’s a tremendous stimulus measure with political ramifications. Sending money to families so close to the elections is a tactic that is meant to MAKE ONE feel indebted and obligated to the person who sent it.

With eighty days to go until the ballots, the President will do WHATEVER HE CAN to make sure his powers help him tilt the odds in his favor.

Prepare for another incredible week!

0 Comments